Classmates.com 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

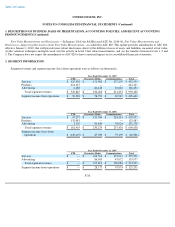

7. FAIR VALUE MEASUREMENTS

The provisions of ASC 820 related to nonfinancial assets and liabilities became effective for the Company on January 1, 2009, and did not

have a material impact on the Company's consolidated financial statements.

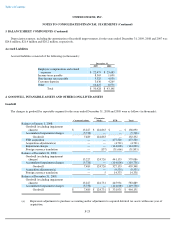

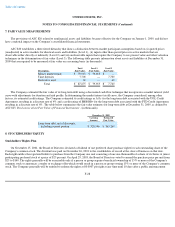

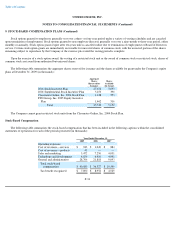

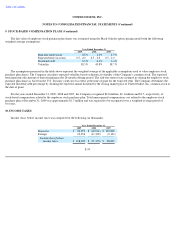

ASC 820 establishes a three-tiered hierarchy that draws a distinction between market participant assumptions based on (i) quoted prices

(unadjusted) in active markets for identical assets and liabilities (Level 1), (ii) inputs other than quoted prices in active markets that are

observable either directly or indirectly (Level 2) and (iii) unobservable inputs that require the Company to use present value and other valuation

techniques in the determination of fair value (Level 3). The following table presents information about assets and liabilities at December 31,

2009 that are required to be measured at fair value on a recurring basis (in thousands):

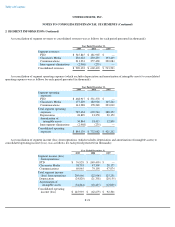

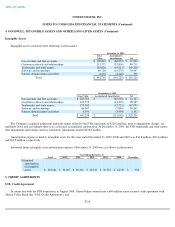

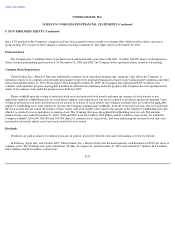

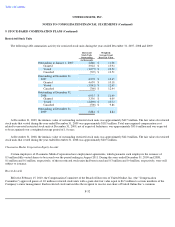

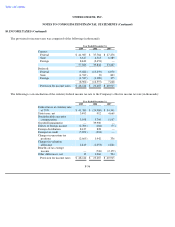

The Company estimated the fair value of its long-term debt using a discounted cash flow technique that incorporates a market interest yield

curve with adjustments for duration and risk profile. In determining the market interest yield curve, the Company considered, among other

factors, its estimated credit ratings. The Company estimated its credit ratings as A/A- for the long-term debt associated with the UOL Credit

Agreement, resulting in a discount rate of 4% and a credit rating of BBB/BB+ for the long-

term debt associated with the FTD Credit Agreement,

resulting in a discount rate of 6%. The table below summarizes the fair value estimates for long-term debt at December 31, 2009, as defined by

ASC 825, Disclosures about Fair Value of Financial Instruments , (in thousands):

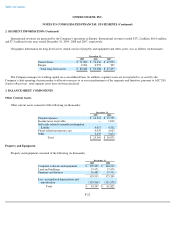

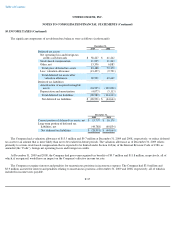

8. STOCKHOLDERS' EQUITY

Stockholders' Rights Plan

On November 15, 2001, the Board of Directors declared a dividend of one preferred share purchase right for each outstanding share of the

Company's common stock. The dividend was paid on November 26, 2001 to the stockholders of record at the close of business on that date.

Each right entitles the registered holder to purchase from the Company one unit consisting of one one-

thousandth of a share of its Series A junior

participating preferred stock at a price of $25 per unit. On April 29, 2003, the Board of Directors voted to amend the purchase price per unit from

$25 to $140. The rights generally will be exercisable only if a person or group acquires beneficial ownership of 15% or more of the Company's

common stock or announces a tender or exchange offer which would result in a person or group owning 15% or more of the Company's common

stock. The Company generally will be entitled to redeem the rights at $0.0007 per right at any time until 10 days after a public announcement

F-28

Description

Total

Fair Value Level 1

Fair Value Level 2

Fair Value

Money market funds

$

79,915

$

79,915

$

—

Time deposits

7,700

—

7,700

Derivative asset

60

—

60

Total

$

87,675

$

79,915

$

7,760

December 31, 2009

Carrying

Amount

Estimated

Fair Value

Long

-

term debt, net of discounts,

including current portion

$

328,946

$

365,260