Classmates.com 2009 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

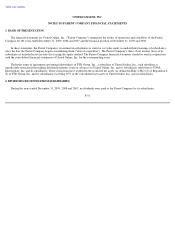

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

15. COMMITMENTS AND CONTINGENCIES (Continued)

those investors material portions of the restricted number of NetZero shares issued in connection with the offering; and (ii) the underwriters had

entered into agreements with customers whereby the underwriters agreed to allocate NetZero shares to those customers in the offering in

exchange for which the customers agreed to purchase additional NetZero shares in the aftermarket at pre-determined prices. Plaintiffs are

seeking injunctive relief and damages. The case against NetZero was coordinated with approximately 300 other suits filed against more than 300

issuers that conducted their initial public offerings between 1998 and 2000, their underwriters and an unspecified number of their individual

corporate officers and directors. The parties in the approximately 300 coordinated class actions, including NetZero, the underwriter defendants in

the NetZero class action, and the plaintiff class in the NetZero action, have reached an agreement in principle under which the insurers for the

issuer defendants in the coordinated cases will make a settlement payment on behalf of the issuers, including NetZero. On October 5, 2009, the

district court issued an order granting final approval of the settlement and certifying the settlement class. Certain individuals have appealed the

October 5, 2009 order.

In 2009, a committee of the U.S. Senate commenced an investigation of post-transaction sales practices and the companies that have

engaged in such practices. As part of such investigation, the Company received a request for information from the committee, and it has

cooperated with such request. In addition, the Company has received a civil investigative demand from the Attorney General of the State of

Washington and subpoenas from the Attorney General of the State of New York regarding their respective investigations into such practices and

the companies that have engaged in them, including the Company. The Company has been cooperating with the investigations, but it cannot

predict their outcome or their potential implications for the Company's business. There are no assurances that additional governmental

investigations or other legal actions will not be instituted in connection with the Company's former post-transaction sales practices or other

current or former business practices.

Lawsuits and investigations involve complex questions of fact and law and may require the expenditure of significant funds and the

diversion of other resources to defend. Although the Company does not believe the outcome of its outstanding legal proceedings, investigations,

claims, and litigation will have a material adverse effect on its business, financial condition, results of operations, or cash flows, the results of

legal proceedings, investigations, claims, and litigation are inherently uncertain and the Company cannot provide assurance that it will not be

materially and adversely impacted by the results of such proceedings or investigations. At December 31, 2009, the Company had not established

any reserves for legal proceedings and investigations except for a $2.2 million reserve for a pending lawsuit.

The Company is subject to various legal proceedings, claims and litigation that arise in the ordinary course of business. Based on

information at this time, the Company believes the amount, and ultimate liability, if any, with respect to these actions will not materially affect

its business, financial condition, results of operations, or cash flows. There can be no assurance, however, that such actions will not materially

and adversely affect the Company's business, financial condition, results of operations, or cash flows.

F-46