Classmates.com 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

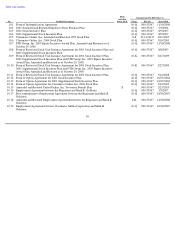

Table of Contents

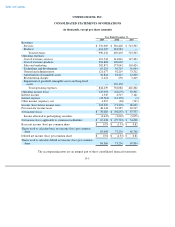

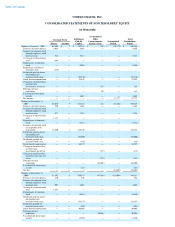

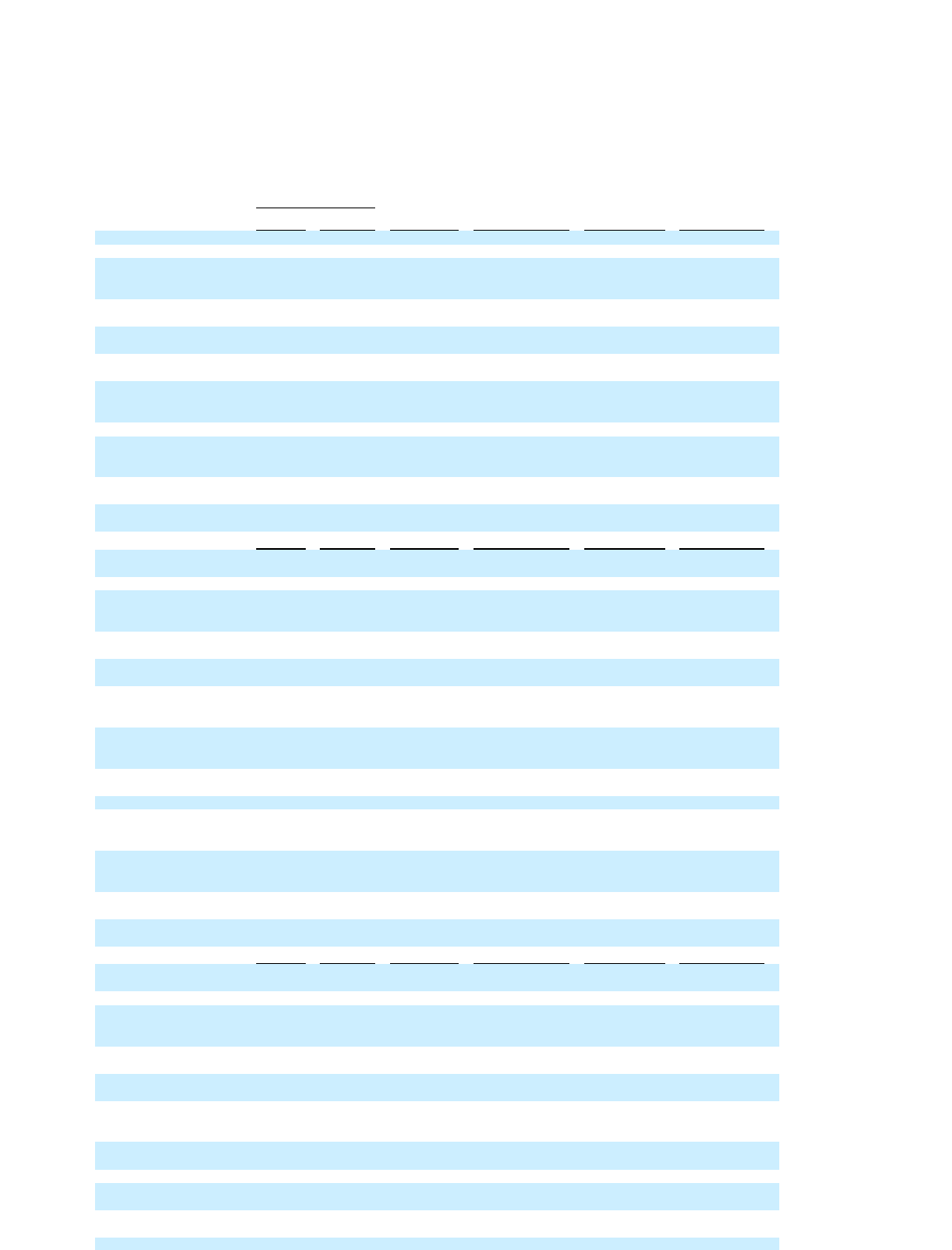

UNITED ONLINE, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(in thousands)

Common Stock

Accumulated

Other

Comprehensive

Income (Loss)

Additional

Paid-In

Capital

Accumulated

Deficit

Total

Stockholders'

Equity

Shares

Amount

Balance at January 1, 2007

65,805

$

7

$

439,383

$

(245

)

$

(92,179

)

$

346,966

Exercises of stock options

1,068

—

8,605

—

—

8,605

Issuance of common stock

through employee stock

purchase plan

583

—

5,413

—

—

5,413

Vesting of restricted stock

units

688

—

—

—

—

—

Repurchases of common

stock

—

—

(

5,601

)

—

—

(

5,601

)

Repurchase of forfeited

restricted stock

(125

)

—

—

—

—

—

Dividends paid on shares

outstanding and

restricted stock units

—

—

(

57,130

)

—

—

(

57,130

)

Stock

-

based compensation

—

—

19,549

—

—

19,549

Change in unrealized gain

on short-term

investments, net of tax

—

—

—

285

—

285

Foreign currency

translation

—

—

—

142

—

142

Tax benefits from equity

awards

—

—

4,622

—

—

4,622

Net income

—

—

—

—

57,777

57,777

Balance at December 31,

2007

68,019

7

414,841

182

(34,402

)

380,628

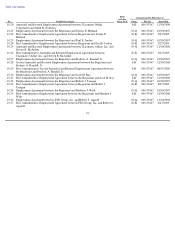

Exercises of stock options

220

—

1,668

—

—

1,668

Issuance of common stock

through employee stock

purchase plan

471

—

3,754

—

—

3,754

Vesting of restricted stock

units

1,137

—

—

—

—

—

Repurchases of common

stock

—

—

(

8,841

)

—

—

(

8,841

)

Issuance of common stock

in connection with

acquisition

12,260

1

126,150

—

—

126,151

Dividends paid on shares

outstanding and

restricted stock units

—

—

(

53,060

)

—

—

(

53,060

)

Dividends payable on

restricted stock units

—

—

(

385

)

—

—

(

385

)

Stock

-

based compensation

—

—

36,527

—

—

36,527

Change in unrealized loss

on short-term

investments, net of tax

—

—

—

(

157

)

—

(

157

)

Change in unrealized loss

on interest rate cap, net

of tax

—

—

—

(

242

)

—

(

242

)

Foreign currency

translation

—

—

—

(

46,802

)

—

(

46,802

)

Tax shortfalls from equity

awards

—

—

(

467

)

—

—

(

467

)

Net loss

—

—

—

—

(

94,657

)

(94,657

)

Balance at December 31,

2008

82,107

8

520,187

(47,019

)

(129,059

)

344,117

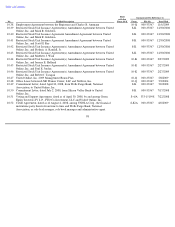

Exercises of stock options

120

—

546

—

—

546

Issuance of common stock

through employee stock

purchase plan

907

—

4,069

—

—

4,069

Vesting of restricted stock

units

1,824

—

—

—

—

—

Repurchases of common

stock

—

—

(

6,842

)

—

—

(

6,842

)

Dividends paid on shares

outstanding and

restricted stock units

—

—

(

36,257

)

—

—

(

36,257

)

Dividends payable on

restricted stock units

—

—

(

207

)

—

—

(

207

)

Stock

-

based compensation

—

—

40,080

—

—

40,080

Foreign currency

translation

—

—

—

20,056

—

20,056

Tax shortfalls from equity

awards

—

—

(

2,996

)

—

—

(

2,996

)