Classmates.com 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

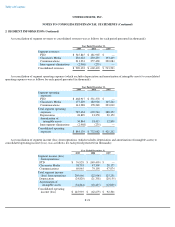

management or other personnel, significant negative industry or economic trends, changes in the Company's operating model or strategy, and

competitive forces. In determining if an impairment exists, the Company estimates the undiscounted cash flows to be generated from the use and

ultimate disposition of these assets. If an impairment is indicated based on a comparison of the assets' carrying values and the undiscounted cash

flows, the impairment loss is measured as the amount by which the carrying amount of the assets exceeds the fair market value of the assets.

Definite-lived intangible assets are amortized on either a straight-

line basis or an accelerated basis over their estimated useful lives, ranging from

two to ten years.

The process of evaluating the potential impairment of long-

lived intangible assets is subjective and requires significant judgment on matters

such as, but not limited to, the asset group to be tested for recoverability. The Company is also required to make estimates that may significantly

impact the outcome of the analyses. Such estimates include, but are not limited to, future operating performance and cash flows, cost of capital,

terminal values, and remaining economic lives of assets.

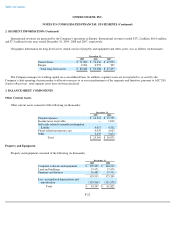

Member Redemption Liability —Member redemption liability for online loyalty marketing points represents the estimated costs associated

with the obligation of MyPoints to redeem outstanding points accumulated by its online loyalty marketing members as well as those points

purchased by its advertisers for use in such advertisers' promotion campaigns as they have been earned by MyPoints' members, less an allowance

for points expected to expire prior to redemption. The estimated cost of points is primarily presented in cost of revenues, except for the portion

related to member acquisition activities, internal marketing surveys and other non-revenue generating activities which are presented in sales and

marketing expenses. The member redemption liability is recognized when members earn points, less an allowance for points expected to expire,

and is reduced when members redeem accumulated points upon reaching required redemption thresholds or when points expire prior to

redemption.

MyPoints members may redeem points for third-party gift cards and other rewards. Members earn points when they respond to direct

marketing offers delivered by MyPoints, purchase goods or services from advertisers, engage in certain promotional campaigns of advertisers, or

engage in other specified activities.

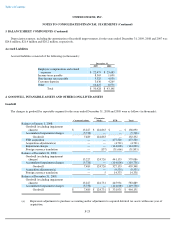

The member redemption liability is estimated based upon the weighted-average cost and number of points that may be redeemed in the

future. On a monthly basis, the weighted-average cost of points is calculated by taking the total cost of items fulfilled divided by total points

redeemed. MyPoints purchases gift cards and other awards from merchants at a discount and sets redemption levels for its members. The

discounts and points needed to redeem awards vary by merchant and award denomination. MyPoints has the ability to adjust the number of

points required to redeem awards to reflect changes in the cost of awards.

On a monthly basis, MyPoints accounts for and reduces the gross points issued by an estimate of points that will never be redeemed by its

members. This reduction is calculated based on an analysis of historical point-earning trends, redemption activities and individual member

account activity. MyPoints' historical analysis takes into consideration the total points in members' accounts that have been inactive for six

months or longer, less an estimated reactivation rate, plus an estimate of future inactive points.

F-14