Classmates.com 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

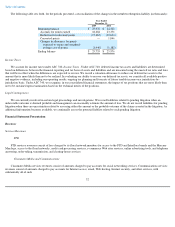

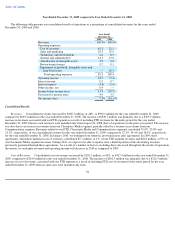

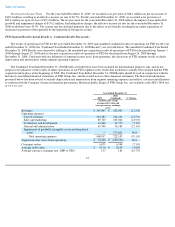

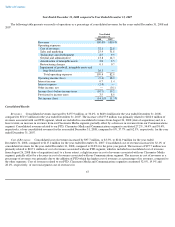

Year Ended December 31, 2009 compared to Year Ended December 31, 2008

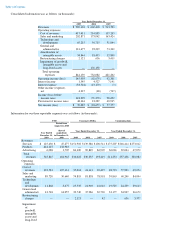

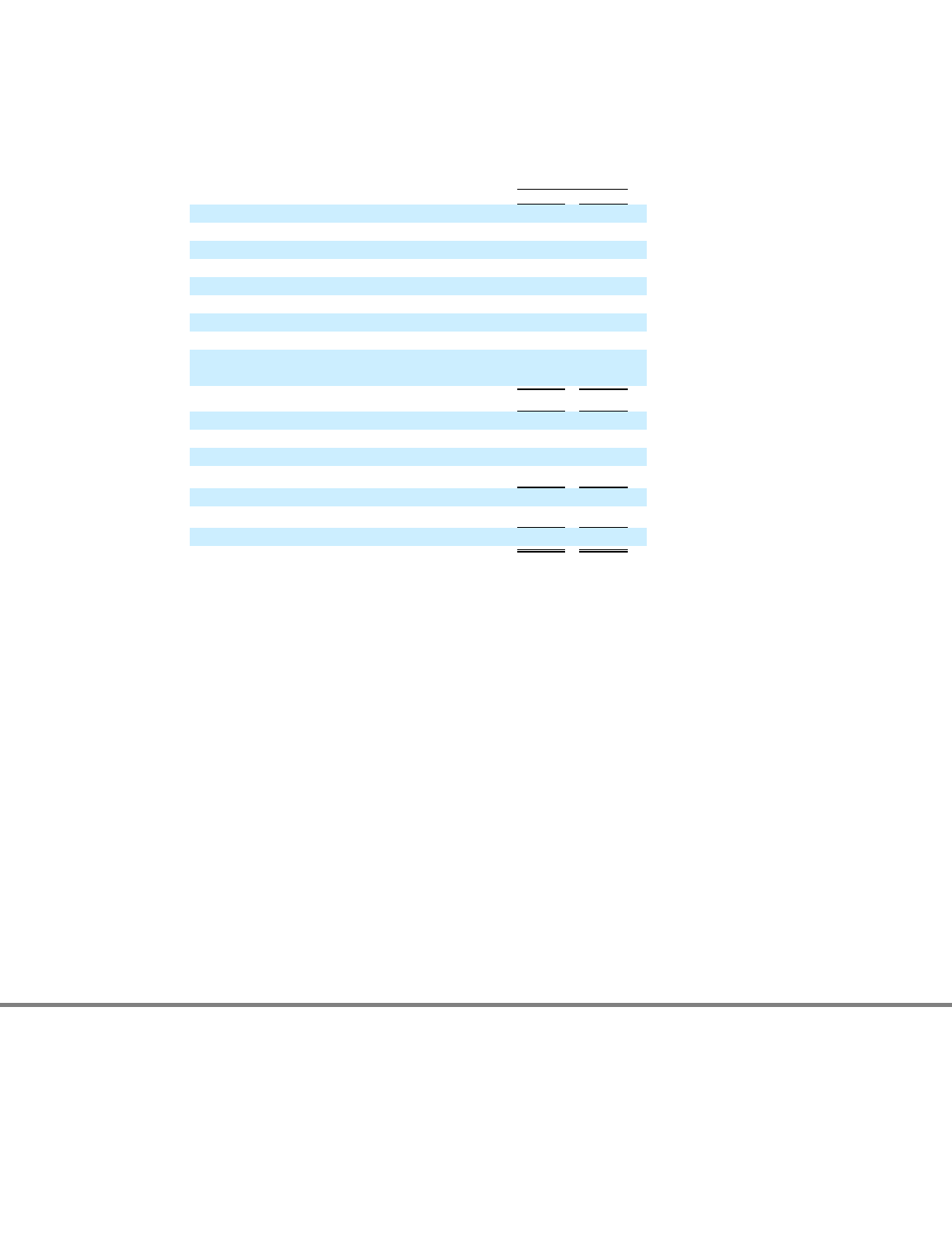

The following table presents our consolidated results of operations as a percentage of consolidated revenues for the years ended

December 31, 2009 and 2008.

Consolidated Results

Revenues. Consolidated revenues increased by $320.7 million, or 48%, to $990.1 million for the year ended December 31, 2009,

compared to $669.4 million for the year ended December 31, 2008. The increase of $320.7 million was primarily due to a $363.9 million

increase in revenues associated with our FTD segment as a result of including FTD revenues for the entire period for the year ended

December 31, 2009 whereas such revenues were included only from August 26, 2008 (date of acquisition) in the prior-year period. The increase

was also due to an increase in revenues from our Classmates Media segment, partially offset by a decrease in revenues from our

Communications segment. Revenues related to our FTD, Classmates Media and Communications segments constituted 55.0%, 23.8% and

21.3%, respectively, of our consolidated revenues for the year ended December 31, 2009, compared to 27.2%, 34.4% and 38.4%, respectively,

for the year ended December 31, 2008. In January 2010, we terminated our domestic post-transaction sales agreements. In 2009, these

agreements, which have minimal costs of revenues, contributed $5.7 million, or 1%, of our FTD segment revenues and $20.8 million, or 9%, of

our Classmates Media segment revenues. During 2010, we expect to be able to replace only a limited portion of the advertising revenues

previously generated through these agreements. As a result of a number of factors, including those discussed throughout the results of operations

discussion, we anticipate revenues and operating income will decrease in 2010 as compared to 2009.

Cost of Revenues.

Consolidated cost of revenues increased by $202.5 million, or 94%, to $417.4 million for the year ended December 31,

2009, compared to $214.9 million for the year ended December 31, 2008. The increase of $202.5 million was primarily due to a $216.5 million

increase in cost of revenues associated with our FTD segment as a result of including FTD cost of revenues for the entire period for the year

ended December 31, 2009 whereas such costs were included only from

58

Year Ended

December 31,

2009

2008

Revenues

100.0

%

100.0

%

Operating expenses:

Cost of revenues

42.2

32.1

Sales and marketing

20.5

25.9

Technology and development

6.6

8.5

General and administrative

12.3

13.8

Amortization of intangible assets

3.5

2.8

Restructuring charges

0.2

0.1

Impairment of goodwill, intangible assets and

long

-

lived assets

—

26.3

Total operating expenses

85.3

109.4

Operating income

14.7

(9.4

)

Interest income

0.2

0.7

Interest expense

(3.4

)

(2.0

)

Other income, net

0.4

—

Income before income taxes

11.9

(10.7

)

Provision for income taxes

4.9

3.5

Net income (loss)

7.1

%

(14.1

)%