Classmates.com 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

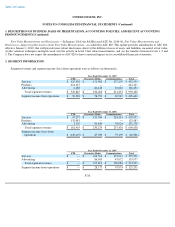

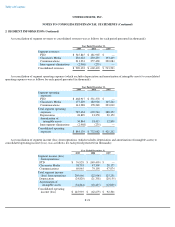

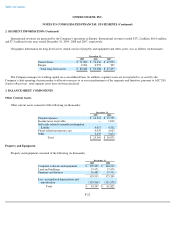

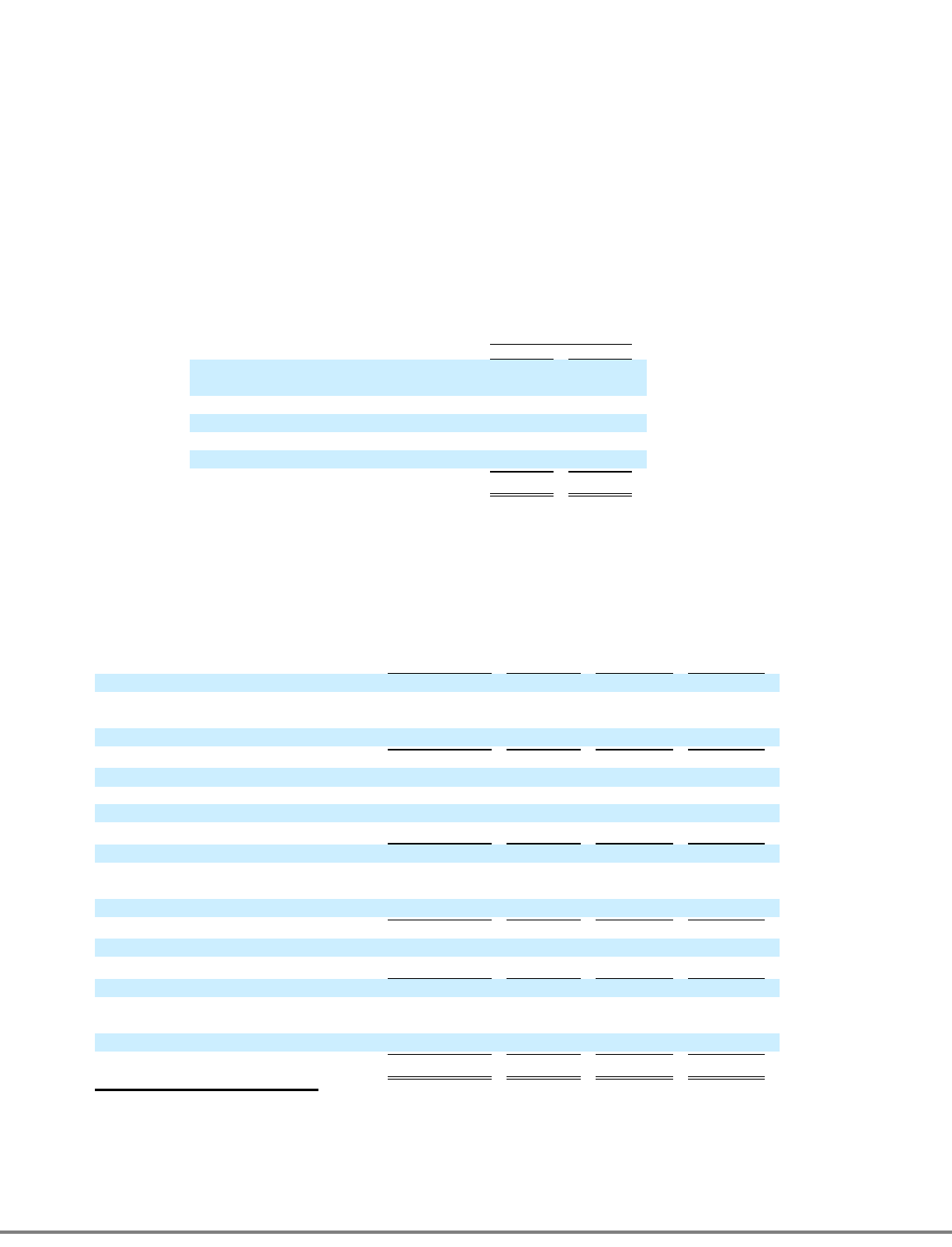

3. BALANCE SHEET COMPONENTS (Continued)

Depreciation expense, including the amortization of leasehold improvements, for the years ended December 31, 2009, 2008 and 2007 was

$24.8 million, $21.4 million and $20.2 million, respectively.

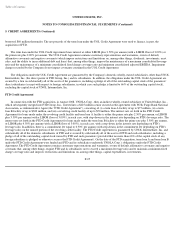

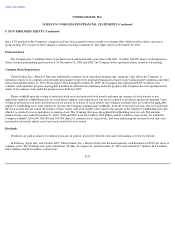

Accrued Liabilities

Accrued liabilities consisted of the following (in thousands):

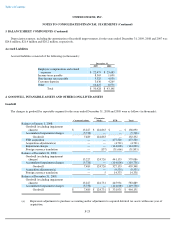

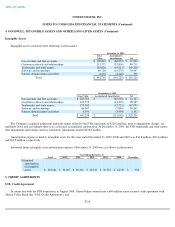

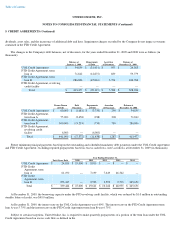

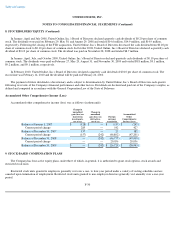

4. GOODWILL, INTANGIBLE ASSETS AND OTHER LONG-LIVED ASSETS

Goodwill

The changes in goodwill by reportable segment for the years ended December 31, 2008 and 2009 were as follows (in thousands):

F-23

December 31,

2009

2008

Employee compensation and related

expenses

$

22,475

$

23,683

Income taxes payable

8,565

1,690

Non

-

income taxes payable

5,325

4,930

Customer deposits

3,636

4,269

Other

10,427

8,576

Total

$

50,428

$

43,148

Communications

Classmates

Media

FTD

Total

Balance at January 1, 2008:

Goodwill (excluding impairment

charges)

$

13,227

$

124,863

$

—

$

138,090

Accumulated impairment charges

(5,738

)

—

—

(

5,738

)

Goodwill

7,489

124,863

—

132,352

FTD acquisition

—

—

477,520

477,520

Acquisition adjustments(a)

—

—

(

4,721

)

(4,721

)

Impairment charges

—

—

(

114,000

)

(114,000

)

Foreign currency translation

—

(

137

)

(31,666

)

(31,803

)

Balance at December 31, 2008:

Goodwill (excluding impairment

charges)

13,227

124,726

441,133

579,086

Accumulated impairment charges

(5,738

)

—

(

114,000

)

(119,738

)

Goodwill

7,489

124,726

327,133

459,348

Acquisition adjustments(a)

—

—

(

9,535

)

(9,535

)

Foreign currency translation

—

5

14,333

14,338

Balance at December 31, 2009:

Goodwill (excluding impairment

charges)

13,227

124,731

445,931

583,889

Accumulated impairment charges

(5,738

)

—

(

114,000

)

(119,738

)

Goodwill

$

7,489

$

124,731

$

331,931

$

464,151

(a) Represents adjustments to purchase accounting and/or adjustments to acquired deferred tax assets within one year of

acquisition.