Classmates.com 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

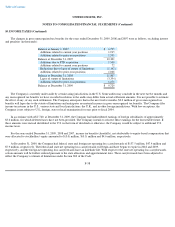

12. RESTRUCTURING CHARGES (Continued)

quarter. In addition, the Company recognized restructuring charges totaling $0.4 million for termination benefits paid to certain employees

associated with its Web hosting and photo sharing businesses.

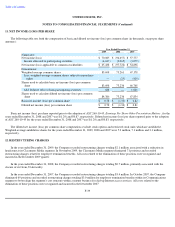

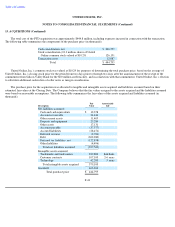

13. ACQUISITIONS

FTD Group, Inc.

On August 26, 2008 (the "Closing Date"), the Company completed the acquisition of FTD. Since the acquisition occurred prior to the

effective date of ASC 805, it was accounted for under the purchase method in accordance with SFAS No. 141. The primary reasons for the

acquisition were as follows:

•

Significant Increase in Scale,

resulting in significantly higher consolidated and diversified revenues and consolidated operating

income and expanded business opportunities.

•

Diversification of Revenue and Cash Flow Streams

, resulting in the Company's mature Communications segment representing

a smaller percentage of consolidated revenues and cash flows. FTD would provide additional revenue and cash flow streams in

addition to the existing Communications and Classmates Media businesses.

•

Expansion into an Attractive Market Segment and FTD's Market Position

, enabling the Company to participate in a large

domestic and international floral market experiencing growth in the Internet sector.

•

Expanded Marketing Opportunities and Efficiencies,

resulting from the Company's marketing expertise to attract consumers

to FTD's Web sites and thousands of floral network members while cross-selling FTD products and services to the Company's

then-existing member base of over 50 million registered domestic consumer accounts having similar demographic characteristics

as FTD's customer base.

The Company believed that certain of these primary factors supported the amount of goodwill recorded as a result of the purchase price

paid for FTD, in relation to other acquired tangible and intangible assets. In the fourth quarter of 2008, the Company determined that significant

adverse changes in the business climate had occurred and subsequently determined that an impairment charge was necessary (see Note 14).

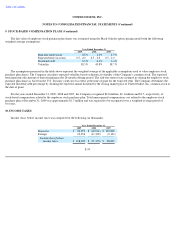

Each share of common stock of FTD Group, Inc., par value $0.01 per share, issued and outstanding immediately prior to the effective time

of the FTD acquisition was canceled and converted into the right to receive $10.15 in cash and 0.4087 of a share of United Online, Inc. common

stock, subject to the payment of cash in lieu of fractional shares of United Online, Inc. common stock. The total merger consideration was

approximately $307 million in cash, net, and approximately 12.3 million shares of United Online, Inc. common stock.

The FTD acquisition was financed in part with the net proceeds of term loan borrowings under a $425 million credit facility, which includes

up to $50 million in a revolving credit facility that was undrawn at the closing of the transaction, with Wells Fargo Bank, National Association,

as lead arranger, and a $60 million credit facility with Silicon Valley Bank. The remaining cash consideration in the transaction was paid from

the Company's and FTD's existing cash on hand.

F-40