Blackberry 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

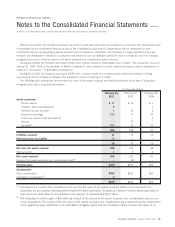

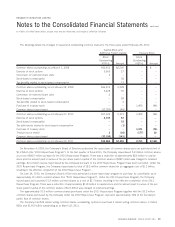

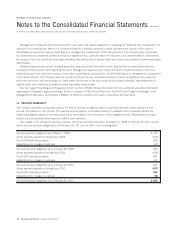

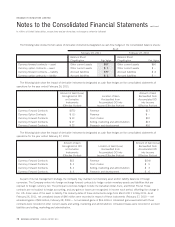

12. EARNINGS PER SHARE

The following table sets forth the computation of basic and diluted earnings per share:

February 26,

2011

February 27,

2010

February 28,

2009

For the year ended

Net income for basic and diluted earnings per share available to common

shareholders $ 3,411 $ 2,457 $ 1,893

Weighted-average number of shares outstanding (000’s) — basic 535,986 564,492 565,059

Effect of dilutive securities (000’s) — stock-based compensation 2,344 5,267 9,097

Weighted-average number of shares and assumed conversions (000’s) — diluted 538,330 569,759 574,156

Earnings per share — reported

Basic $ 6.36 $ 4.35 $ 3.35

Diluted $ 6.34 $ 4.31 $ 3.30

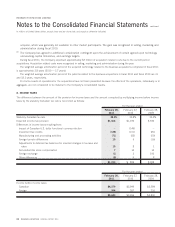

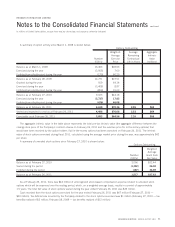

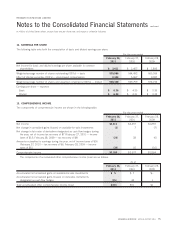

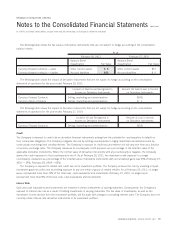

13. COMPREHENSIVE INCOME

The components of comprehensive income are shown in the following table:

February 26,

2011

February 27,

2010

February 28,

2009

For the year ended

Net income $3,411 $2,457 $1,893

Net change in unrealized gains (losses) on available-for-sale investments (2) 7(7)

Net change in fair value of derivatives designated as cash flow hedges during

the year, net of income tax recovery of $7 (February 27, 2010 — income

taxes of $13; February 28, 2009 — tax recovery of $9) (20) 28 (6)

Amounts reclassified to earnings during the year, net of income taxes of $16

(February 27, 2010 — tax recovery of $6; February 28, 2009 — income

taxes of $5) (39) 15 (16)

Comprehensive income $3,350 $2,507 $1,864

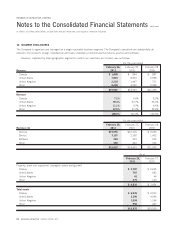

The components of accumulated other comprehensive income (loss) are as follows:

February 26,

2011

February 27,

2010

February 28,

2009

As at

Accumulated net unrealized gains on available-for-sale investments $5 $7 $–

Accumulated net unrealized gains (losses) on derivative instruments

designated as cash flow hedges (15) 44 1

Total accumulated other comprehensive income (loss) $(10) $51 $1

RESEARCH IN MOTION ANNUAL REPORT 2011 75

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated