Blackberry 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accounting standards published by the International Accounting Standards Board (“IASB”). On February 24, 2010, the SEC issued a

statement describing its position regarding global accounting standards. Among other things, the SEC stated that it has directed its

staff to execute a work plan which will include consideration of IFRS as it exists today and after completion of various “convergence”

projects currently underway between U.S. and international accounting standards setters. On October 29, 2010, the SEC issued a

progress report for its work plan considering the impact of incorporating IFRS on the U.S. financial reporting system. The SEC staff is

currently using a sample of global jurisdictions to analyze how IFRS is being incorporated in other jurisdictions and to assess its

potential impact on a variety of stakeholders including investors, regulators, and issuers. The Financial Accounting Standards Board, in

conjunction with the IASB, have prioritized the completion of certain convergence projects, while certain other projects have been

deferred beyond the original June 2011 target completion date. In 2011, assuming completion of certain projects and the SEC staff’s

work plan, the SEC is expected to decide whether to incorporate IFRS into the U.S. financial reporting system.

Independent Governance Review

As discussed under “Restatement of Previously Issued Financial Statements — OSC Settlement” in the Company’s MD&A for the fiscal

year ended February 28, 2009, on February 5, 2009, a panel of Commissioners of the Ontario Securities Commission (“OSC”) approved

a settlement agreement (the “OSC Settlement Agreement”) with the Company and certain of its officers and directors, including its

Co-Chief Executive Officers (“Co-CEOs”), relating to the previously disclosed OSC investigation of the Company’s historical stock option

granting practices.

As discussed under “Restatement of Previously Issued Financial Statements — SEC Settlements” in the Company’s MD&A for the fiscal

year ended February 28, 2009, on February 17, 2009, the Company and certain of its officers, including its Co-CEOs, entered into

settlements with the SEC that resolved the previously disclosed SEC investigation of the Company’s historical stock option granting practices.

As part of the OSC Settlement Agreement, the Company agreed to enter into an agreement with an independent consultant to

conduct a comprehensive examination and review of the Company and report to the Company’s board of directors and the staff of the

OSC on the Company’s governance practices and procedures and its internal control over financial reporting. The Company retained

Protiviti Co. (“Protiviti”) to carry out this engagement. See “Independent Governance Assessment” and Appendix A in the Company’s

MD&A for the fiscal year ended February 27, 2010 for a further description of Protiviti’s engagement, its recommendations and the

Company’s responses to such recommendations. A copy of Protiviti’s recommendations is also available on the website of the OSC.

Under the terms of the OSC Settlement Agreement, Protiviti was to review the implementation of its recommendations in its final

report to the Company that the Company agreed to implement and provide a report to the Board of Directors, the Audit and Risk

Management Committee and to staff of the OSC concerning the progress of the implementation. That report has been completed and

Protiviti and staff of the OSC have advised the Company that all recommendations of Protiviti have been addressed by the Company in

a manner satisfactory to them. As a result, Protiviti’s independent governance review has now been completed.

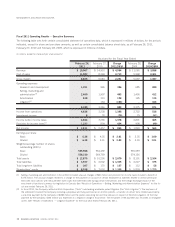

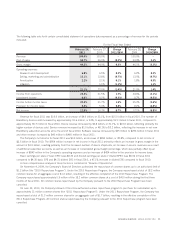

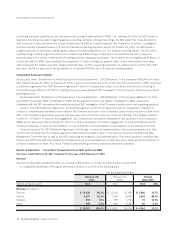

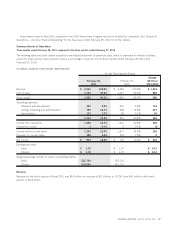

Results of Operations — Fiscal 2011 Compared to Fiscal 2010 and Fiscal 2009

Fiscal year ended February 26, 2011 compared to fiscal year ended February 27, 2010

Revenue

Revenue for fiscal 2011 was $19.9 billion, an increase of $4.9 billion, or 33.1%, from $15.0 billion in fiscal 2010.

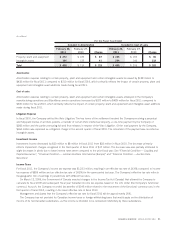

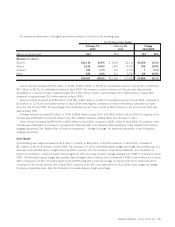

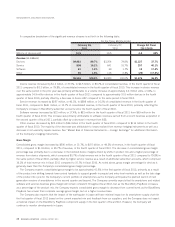

A comparative breakdown of the significant revenue streams is set forth in the following table:

February 26,

2011

February 27,

2010

Change

2011/2010

For the Fiscal Year Ended

Millions of devices sold 52.3 36.7 15.6 43%

Revenue (in millions)

Devices $ 15,956 80.2% $ 12,116 81.0% $ 3,840 31.7%

Service 3,197 16.1% 2,158 14.4% 1,039 48.1%

Software 294 1.5% 259 1.7% 35 13.5%

Other 460 2.2% 420 2.9% 40 9.5%

$ 19,907 100.0% $ 14,953 100.0% $ 4,954 33.1%

18 RESEARCH IN MOTION ANNUAL REPORT 2011

MANAGEMENT’S DISCUSSION AND ANALYSIS