Blackberry 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

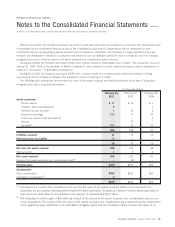

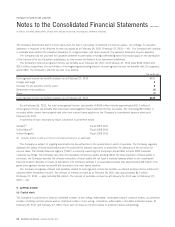

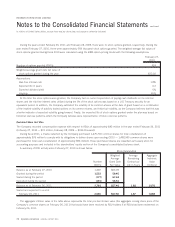

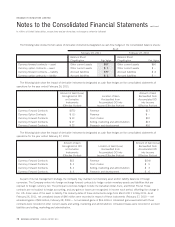

As of February 26, 2011, there was $95 million of unrecognized compensation expense related to RSUs which will be expensed

over the vesting period, which, on a weighted-average basis, results in a period of approximately 1.6 years.

Deferred Share Unit Plan

The Company issued 16,699 DSUs in the year ended February 26, 2011. There are 51,500 DSUs outstanding as at February 26,

2011 (February 27, 2010 — 34,801). The Company had a liability of $3 million in relation to the DSU plan as at February 26, 2011

(February 27, 2010 — $3 million).

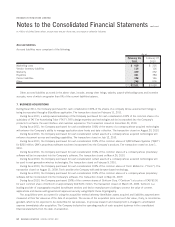

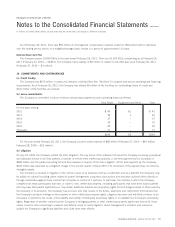

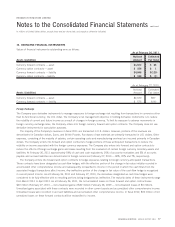

10. COMMITMENTS AND CONTINGENCIES

(a) Credit Facility

The Company has $150 million in unsecured demand credit facilities (the “Facilities”) to support and secure operating and financing

requirements. As at February 26, 2011, the Company has utilized $9 million of the Facilities for outstanding letters of credit and

$141 million of the Facilities are unused.

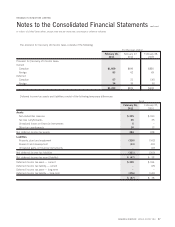

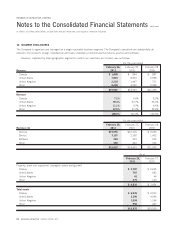

(b) Lease commitments

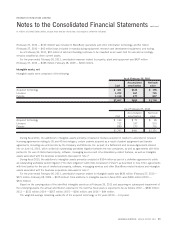

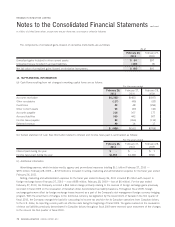

The Company is committed to future minimum annual lease payments under operating leases as follows:

Real Estate Equipment and Other Total

For the years ending

2012 $40 $1 $41

2013 39 1 40

2014 37 – 37

2015 30 – 30

2016 25 – 25

Thereafter 71 – 71

$242 $2 $244

For the year ended February 26, 2011, the Company incurred rental expense of $68 million (February 27, 2010 — $40 million;

February 28, 2009 — $23 million).

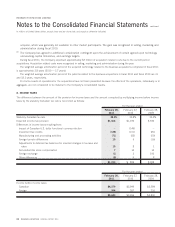

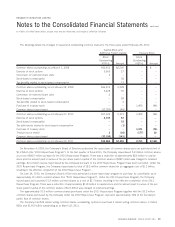

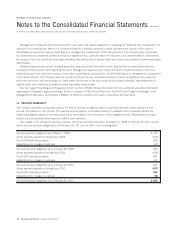

(b) Litigation

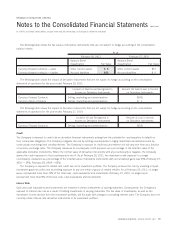

On July 23, 2009, the Company settled the Visto Litigation. The key terms of the settlement involved the Company receiving a perpetual

and fully-paid license on all Visto patents, a transfer of certain Visto intellectual property, a one-time payment by the Company of

$268 million and the parties executing full and final releases in respect of the Visto Litigation. Of the total payment by the Company,

$164 million was expensed as a litigation charge in the second quarter of fiscal 2010. The remainder of the payment was recorded as

intangible assets.

The Company is involved in litigation in the normal course of its business, both as a defendant and as a plaintiff. The Company may

be subject to claims (including claims related to patent infringement, purported class actions and derivative actions) either directly or

through indemnities against these claims that it provides to certain of it partners. In particular, the industry in which the Company

competes has many participants that own, or claim to own, intellectual property, including participants that have been issued patents

and may have filed patent applications or may obtain additional patents and proprietary rights for technologies similar to those used by

the Company in its products. The Company has received, and may receive in the future, assertions and claims from third parties that

the Company’s products infringe on their patents or other intellectual property rights. Litigation has been and will likely continue to be

necessary to determine the scope, enforceability and validity of third-party proprietary rights or to establish the Company’s proprietary

rights. Regardless of whether claims that the Company is infringing patents or other intellectual property rights have any merit, those

claims could be time-consuming to evaluate and defend, result in costly litigation, divert management’s attention and resources,

subject the Company to significant liabilities and could have other effects.

RESEARCH IN MOTION ANNUAL REPORT 2011 73

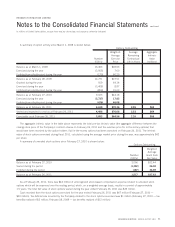

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated