Blackberry 2011 Annual Report Download - page 66

Download and view the complete annual report

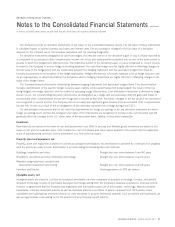

Please find page 66 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenue recognition

The Company recognizes revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable

and earned when it has persuasive evidence of an arrangement, the product has been delivered or the services have been provided to

the customer, the sales price is fixed or determinable and collection is reasonably assured. In addition to this general policy, the

following paragraphs describe the specific revenue recognition policies for each of the Company’s major categories of revenue.

Hardware

Revenue from the sale of BlackBerry wireless devices is recognized when title has transferred to the customer and all significant

contractual obligations that affect the customer’s final acceptance have been fulfilled. For hardware products for which the software is

deemed essential to the functionality of the hardware, the Company recognizes revenue in accordance with general revenue recognition

accounting guidance. The Company records reductions to revenue for estimated commitments related to price protection and for

customer incentive programs. The estimated cost of the incentive programs is accrued as a reduction to revenue based on historical

experience, and is recognized at the later of the date at which the Company has sold the product or the date at which the program is

offered. Price protection is accrued as a reduction to revenue based on estimates of future price reductions, provided the price

reduction can be reliably estimated and all other revenue recognition criteria have been met.

Service

Revenue from service is recognized rateably on a monthly basis when the service is provided. In instances where the Company bills the

customer prior to performing the service, the prebilling is recorded as deferred revenue.

Software

Revenue from licensed software is recognized at the inception of the license term and in accordance with industry-specific software

revenue recognition accounting guidance. When the fair value of a delivered element has not been established, the Company uses the

residual method to recognize revenue if the fair value of undelivered elements is determinable. Revenue from software maintenance,

unspecified upgrades and technical support contracts is recognized over the period that such items are delivered or those services are

provided.

Other

Revenue from the sale of accessories is recognized when title has transferred to the customer and all significant contractual obligations

that affect the customer’s final acceptance have been fulfilled. Revenue from repair and maintenance programs is recognized when the

service is delivered, which is when the title is transferred to the customer and all significant contractual obligations that affect the

customer’s final acceptance have been fulfilled. Revenue for non-recurring engineering contracts is recognized as specific contract

milestones are met. The attainment of milestones approximates actual performance.

Shipping and handling costs

Amounts billed to customers related to shipping and handling are classified as revenue, and the Company’s shipping and handling

costs are included in cost of sales. Shipping and handling costs that can’t be reasonably attributed to certain customers are included in

selling, marketing and administration.

Multiple-element arrangements

The Company enters into revenue arrangements that may consist of multiple deliverables of its product and service offerings. The

Company’s typical multiple-element arrangements involve: (i) handheld devices with services and (ii) software with technical support

services.

For the Company’s arrangements involving multiple deliverables of handheld devices with services, the consideration from the

arrangement is allocated to each respective element based on its relative selling price, using vendor-specific objective evidence of

selling price (“VSOE”). In certain limited instances when the Company is unable to establish the selling price using VSOE, the Company

attempts to establish selling price of each element based on acceptable third party evidence of selling price (“TPE”); however, the

RESEARCH IN MOTION ANNUAL REPORT 2011 53

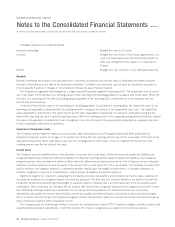

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated