Blackberry 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

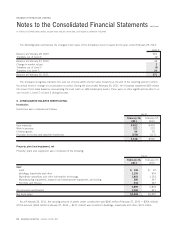

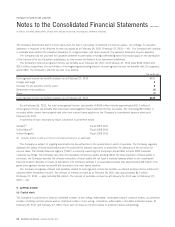

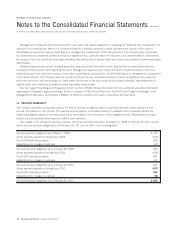

acquiree, which was generally not available to other market participants. The gain was recognized in selling, marketing and

administration during fiscal 2010.

(3)

The Company has agreed to additional consideration contingent upon the achievement of certain agreed upon technology

and working capital milestones, and earnings targets.

During fiscal 2011, the Company expensed approximately $3 million of acquisition related costs due to the current period

acquisitions. Acquisition related costs were recognized in selling, marketing and administration during the year.

The weighted average amortization period of the acquired technology related to the business acquisitions completed in fiscal 2011

is approximately 3.8 years (2010 — 3.7 years).

The weighted average amortization period of the patents related to the business acquisitions in fiscal 2011 and fiscal 2010 are nil

and 18.1 years, respectively.

Pro forma results of operations for the acquisitions have not been presented because the effects of the operations, individually or in

aggregate, are not considered to be material to the Company’s consolidated results.

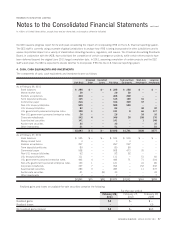

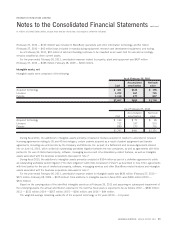

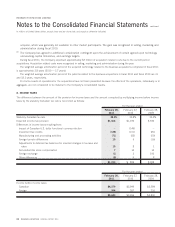

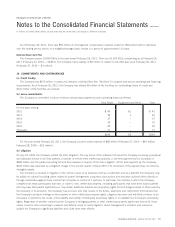

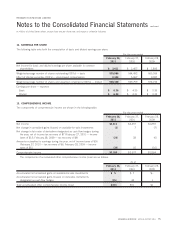

8. INCOME TAXES

The difference between the amount of the provision for income taxes and the amount computed by multiplying income before income

taxes by the statutory Canadian tax rate is reconciled as follows:

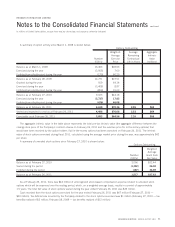

February 26,

2011

February 27,

2010

February 28,

2009

For the year ended

Statutory Canadian tax rate 30.5% 32.8% 33.4%

Expected income tax provision $1,414 $1,072 $ 936

Differences in income taxes resulting from:

Impact of Canadian U.S. dollar functional currency election –(145) –

Investment tax credits (138) (101) (81)

Manufacturing and processing activities (71) (52) (50)

Foreign tax rate differences 15 5 (16)

Adjustments to deferred tax balances for enacted changes in tax laws and

rates 15 81

Non-deductible stock compensation 710 10

Foreign exchange (1) 3 100

Other differences (8) 98

$1,233 $ 809 $ 908

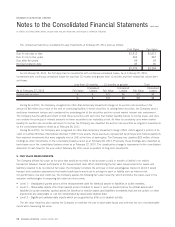

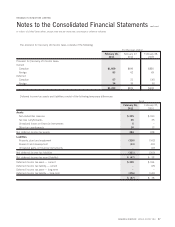

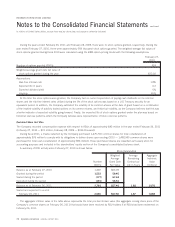

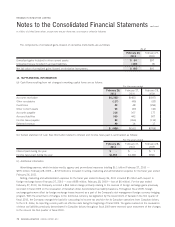

February 26,

2011

February 27,

2010

February 28,

2009

For the year ended

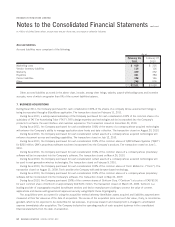

Income before income taxes:

Canadian $4,279 $2,999 $2,584

Foreign 364 267 216

$4,643 $3,266 $2,800

66 RESEARCH IN MOTION ANNUAL REPORT 2011

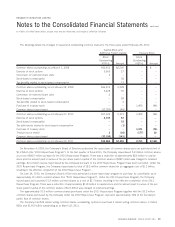

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated