Blackberry 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

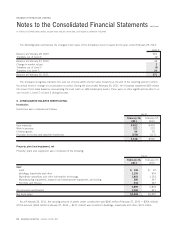

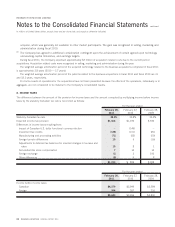

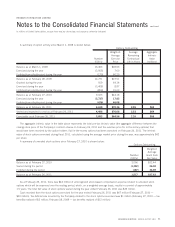

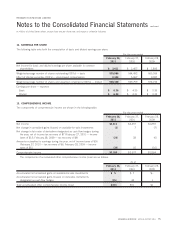

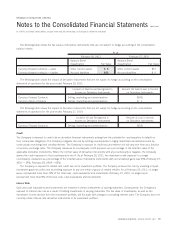

During the years ended February 26, 2011 and February 28, 2009, there were no stock options granted, respectively. During the

year ended February 27, 2010, there were approximately 559 thousand stock options granted. The weighted-average fair values of

stock options granted during fiscal 2010 were calculated using the BSM option-pricing model with the following assumptions:

February 27,

2010

Number of options granted (000’s) 559

Weighted-average grant date fair value of

stock options granted during the year $33.02

Assumptions:

Risk-free interest rate 1.8%

Expected life in years 4.2

Expected dividend yield 0%

Volatility 65%

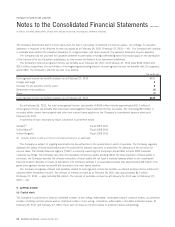

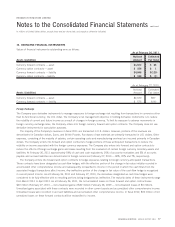

At the time the stock options were granted, the Company had no current expectation of paying cash dividends on its common

shares and the risk-free interest rates utilized during the life of the stock options was based on a U.S. Treasury security for an

equivalent period. In addition, the Company estimated the volatility of its common shares at the date of grant based on a combination

of the implied volatility of publicly traded options on its common shares, and historical volatility, as the Company believes that this was

a better indicator of expected volatility going forward. Finally, the expected life of stock options granted under the plan was based on

historical exercise patterns, which the Company believes were representative of future exercise patterns.

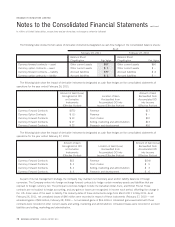

Restricted Share Unit Plan

The Company recorded compensation expense with respect to RSUs of approximately $42 million in the year ended February 26, 2011

(February 27, 2010 — $21 million; February 28, 2009 — $196 thousand).

During fiscal 2011, a trustee selected by the Company purchased 1,470,703 common shares for total consideration of

approximately $76 million to comply with its obligations to deliver shares upon vesting (2010 — 1,458,950 common shares were

purchased for total cash consideration of approximately $94 million). These purchased shares are classified as treasury stock for

accounting purposes and included in the shareholders’ equity section of the Company’s consolidated balance sheet.

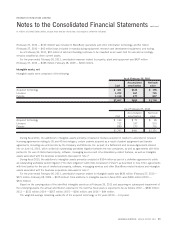

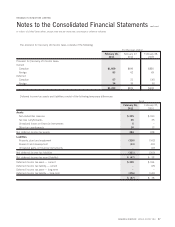

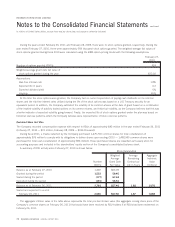

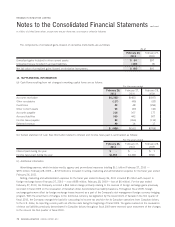

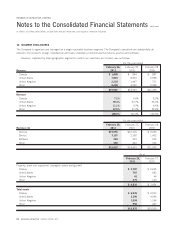

A summary of RSU activity since February 27, 2010 is shown below:

Number

(000’s)

Weighted

Average

Grant Date

Fair Value

Average

Remaining

Contractual

Life in Years

Aggregate

Instrinsic

Value

(millions)

RSUs Outstanding

Balance as at February 27, 2010 1,449 $66.09

Granted during the period 1,532 50.45

Vested during the period (177) 67.64

Cancelled during the period (101) 58.34

Balance as at February 26, 2011 2,703 $57.40 1.88 $178

Vested and expected to vest at

February 26, 2011 2,543 $57.50 1.87 $168

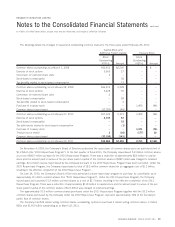

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the aggregate closing share price of the

Company’s common shares on February 26, 2011) that would have been received by RSU holders if all RSUs had been redeemed on

February 26, 2011.

72 RESEARCH IN MOTION ANNUAL REPORT 2011

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated