Blackberry 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

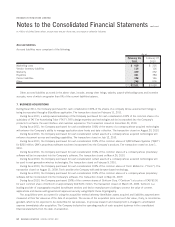

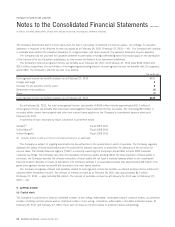

Effective fiscal 2010, the Company expenses: (a) all direct costs associated with the acquisitions as incurred; (b) compensation paid

to employees for pre-combination services as part of the consideration paid; and (c) compensation paid to employees for post-

combination services as operating expenses separate from the business combination. The Company no longer expenses in-process

research and development; instead it is capitalized and amortized over its estimated useful life once it is ready for use. The Company

recognizes the excess of the fair value of net assets acquired over consideration paid in income.

During fiscal 2009, the Company purchased 100% of the common shares of Chalk Media Corp (“Chalk”). The transaction closed on

January 30, 2009. Chalk is the developer of Mobile chalkboard

TM

, which enables the rapid creation and secure, tracked deployment of

media-rich “Pushcasts”

TM

to BlackBerry smartphones.

During fiscal 2009, the Company purchased 100% of the common shares of a company whose proprietary software is being

incorporated into the Company’s software. The transaction closed on February 13, 2009.

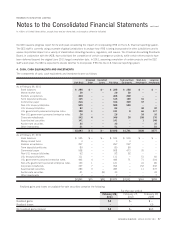

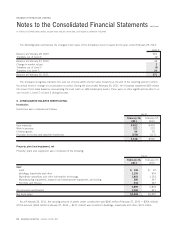

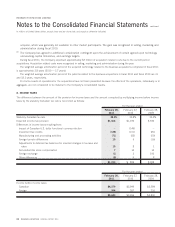

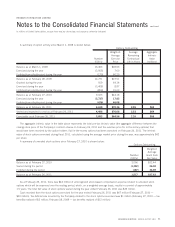

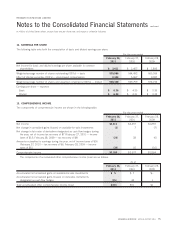

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of acquisition

along with prior year’s acquisition allocations:

February 26,

2011

February 27,

2010

February 28,

2009

For the year ended

Assets purchased

Current assets $11 $19 $1

Property, plant and equipment 5–1

Deferred income tax asset 126 3

Acquired technology 152 73 31

In-process research and development ––2

Patents –37 –

Goodwill

(1)

357 13 23

526 168 61

Liabilities assumed 11 15 13

Deferred income tax liability 17 1–

28 16 13

Net non-cash assets acquired 498 152 48

Cash acquired 192

Net assets acquired 499 161 50

Excess of net assets acquired over consideration paid

(2)

–(9) –

Purchase price $499 $152 $50

Consideration

Cash consideration $494 $152 $50

Contingent consideration

(3)

5––

$499 $152 $50

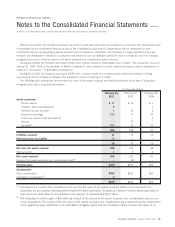

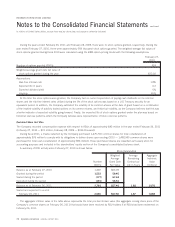

(1)

Represents the excess of the acquisition price over the fair value of net assets acquired, which is not expected to be

deductible for tax purposes when goodwill results from share purchases. Goodwill as a result of certain assets purchased is

expected to be deductible for tax purposes in the amount of approximately $20 million.

(2)

The Company recorded a gain of $9 million as a result of the excess of net assets acquired over consideration paid on one

of the acquisitions. The excess of the fair value of net assets acquired over consideration paid resulted from the combination

of the significant value attributed to the identifiable intangible assets and the Company’s ability to utilize tax losses of an

RESEARCH IN MOTION ANNUAL REPORT 2011 65

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated