Blackberry 2011 Annual Report Download - page 46

Download and view the complete annual report

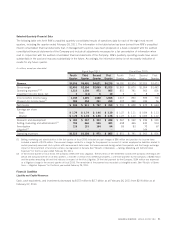

Please find page 46 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$83 million when compared to the same period in the prior year due to the Company’s increased profitability as well as the timing of

income tax installment payments.

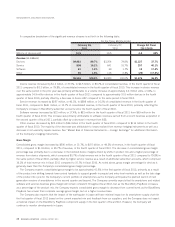

Investing Activities

During the fiscal year ended February 26, 2011, cash flows used in investing activities were $1.7 billion and included property, plant

and equipment additions of $1.0 billion, intangible asset additions of $557 million and business acquisitions of $494 million, offset by

cash flows provided by transactions involving the proceeds on sale or maturity of short-term investments and long-term investments,

net of the costs of acquisitions, in the amount of $392 million. For the same period of the prior fiscal year, cash flows used in investing

activities were $1.5 billion and included property, plant and equipment additions of $1.0 billion, intangible asset additions of

$421 million, and business acquisitions of $143 million, offset by cash flows provided by transactions involving the proceeds on sale or

maturity of short-term investments and long-term investments, net of the costs of acquisitions, in the amount of $103 million.

Property, plant and equipment additions for the fiscal year ended February 26, 2011 were comparable to the fiscal year ended

February 27, 2010 as the level of investment in building expansion, renovations to existing facilities, and manufacturing equipment

continued. During the fiscal year ended February 26, 2011, the additions to intangible assets primary consisted of licenses acquired in

relation to amended or renewed licensing agreements relating to 3G and 4G technologies, certain patents acquired as a result of

patent assignment and transfer agreements, including one entered into by the Company and Motorola, Inc. as part of a Settlement and

License Agreement entered into on June 10, 2010, which settled all outstanding worldwide litigation between the two companies, as

well as agreements with third parties for the use of intellectual property, software, messaging services and other BlackBerry related

features, as well as intangible assets associated with business acquisitions. Business acquisitions during fiscal 2011 related to the

purchase of a company whose acquired technology is being incorporated through a BlackBerry application, a subsidiary of TAT The

Astonishing Tribe, QNX Software Systems, as well as the purchase of a company whose proprietary software will be incorporated into

the Company’s software, the purchase of a company whose acquired technologies will enhance document access and handling

capacities, and the purchase of a company whose acquired technologies will enhance the Company’s ability to manage application

store fronts and data collection. Investments in intangible assets during fiscal 2010 were primarily associated with the settlement of the

Visto Litigation, agreements with third parties for use of intellectual property and business acquisitions. All acquired patents were

recorded as intangible assets and are being amortized over their estimated useful lives. Business acquisitions during fiscal 2010 related

to the purchase of Certicom Corp., Torch Mobile Inc. and the purchase of a company whose proprietary software will be incorporated

into the Company’s software.

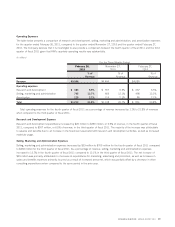

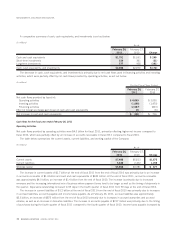

Financing Activities

Cash flows used in financing activities were $2.1 billion for fiscal 2011 and were primarily attributable to the common share repurchase

programs described above in the amount of $2.1 billion, as well as the purchases of common shares on the open market by a trustee

selected by the Company in connection with its Restricted Share Unit Plan, which are classified on the balance sheet for accounting

purposes as treasury stock, in the amount of $76 million, partially offset by proceeds from the issuance of common shares in the

amount of $67 million. Cash flows used in financing activities were $843 million for fiscal 2010 and were primarily attributable to the

2010 Repurchase Program described above in the amount of $775 million, purchases of common shares on the open market by a

trustee selected by the Company in connection with its Restricted Share Unit Plan, which were classified on the consolidated balance

sheet for accounting purposes as treasury stock in the amount of $94 million, the repayment of debt acquired through acquisitions in

the amount of $6 million, offset partially by the proceeds from the exercise of stock options in the amount of $30 million and tax

benefits from the exercise of stock options.

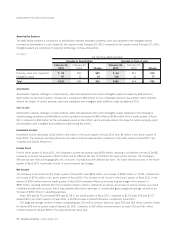

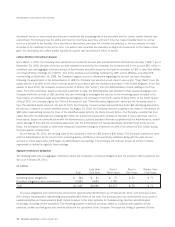

Auction Rate Securities

Auction rate securities are debt instruments with long-term nominal maturity dates for which the interest rates are reset through a

dutch auction process, typically every 7, 28 or 35 days. Interest is paid at the end of each auction period, and the auction normally

serves as the mechanism for securities holders to sell their existing positions to interested buyers. As at February 26, 2011, the

Company held $41 million in face value of investment grade auction rate securities for which auctions are not taking place. The interest

rate for these securities has been set at the maximum rate specified in the program documents and interest continues to be paid every

28 days as scheduled. As a result of the continuing lack of liquidity in these securities, the Company recognized through investment

income, in the third quarter of fiscal 2011, an other-than-temporary impairment charge of $6 million. The Company used a multi-year

RESEARCH IN MOTION ANNUAL REPORT 2011 33