Blackberry 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

denominated tax liability balances. Throughout fiscal 2009, foreign exchange gains were offset by foreign exchange losses incurred as a

part of the Company’s foreign currency hedging program. See “Income Taxes” for the fiscal year ended February 27, 2010 for further

details on the changes to the functional currency tax legislation in Canada, and “Market Risk of Financial Instruments — Foreign

Exchange” for additional information on the Company’s hedging instruments.

Selling, marketing and administration expenses for fiscal 2010 also included a charge of $42 million for the payment on account of

certain employee tax liabilities related to certain previously-exercised stock options with measurement date issues that were exercised

during certain time periods. The Company’s Board of Directors approved the payment on account of certain incremental personal tax

liabilities of certain employees, excluding RIM’s Co-CEOs, related to the exercise of certain stock options issued by the Company.

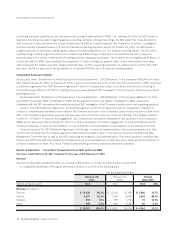

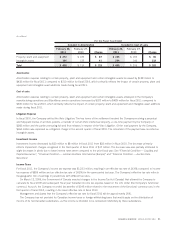

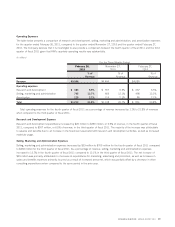

Amortization Expense

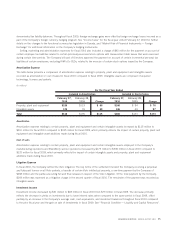

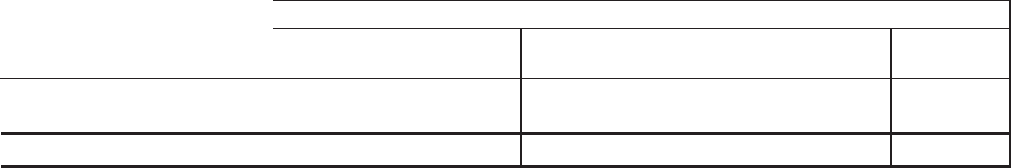

The table below presents a comparison of amortization expense relating to property, plant and equipment and intangible assets

recorded as amortization or cost of sales for fiscal 2010 compared to fiscal 2009. Intangible assets are comprised of acquired

technology, licenses and patents.

(in millions)

February 27,

2010

February 28,

2009 Change

February 27,

2010

February 28,

2009 Change

Included in Amortization Included in Cost of sales

For the Fiscal Year Ended

Property, plant and equipment $185 $119 $ 66 $160 $84 $76

Intangible assets 125 76 49 146 49 97

Total $310 $195 $115 $306 $133 $173

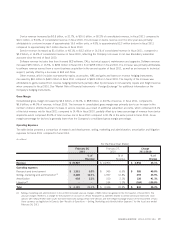

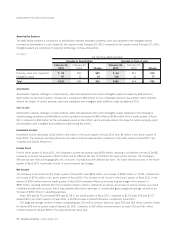

Amortization

Amortization expense relating to certain property, plant and equipment and certain intangible assets increased by $115 million to

$310 million for fiscal 2010 compared to $195 million for fiscal 2009, which primarily reflects the impact of certain property, plant and

equipment and intangible asset additions made during fiscal 2010.

Cost of sales

Amortization expense relating to certain property, plant and equipment and certain intangible assets employed in the Company’s

manufacturing operations and BlackBerry service operations increased by $173 million to $306 million in fiscal 2010 compared to

$133 million for fiscal 2009, which primarily reflects the impact of certain intangible assets and property, plant and equipment

additions made during fiscal 2010.

Litigation Expense

In fiscal 2010, the Company settled the Visto Litigation. The key terms of the settlement involved the Company receiving a perpetual

and fully-paid license on all Visto patents, a transfer of certain Visto intellectual property, a one-time payment by the Company of

$268 million and the parties executing full and final releases in respect of the Visto Litigation. Of the total payment by the Company,

$164 million was expensed as a litigation charge in the second quarter of fiscal 2010. The remainder of the payment was recorded as

intangible assets.

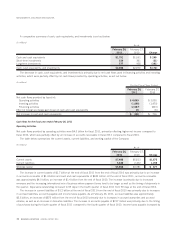

Investment Income

Investment income decreased by $51 million to $28 million in fiscal 2010 from $79 million in fiscal 2009. The decrease primarily

reflects the decrease in yields on investments due to lower interest rates when compared to the same period in fiscal 2009, offset

partially by an increase in the Company’s average cash, cash equivalents, and investment balances throughout fiscal 2010 compared

to the prior fiscal year and the gain on sale of investments in fiscal 2009. See “Financial Condition — Liquidity and Capital Resources”.

RESEARCH IN MOTION ANNUAL REPORT 2011 25