Blackberry 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

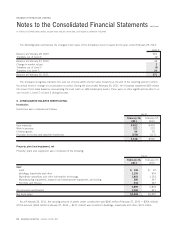

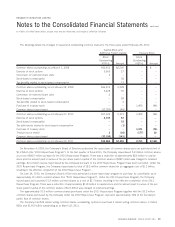

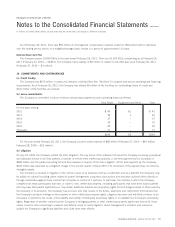

(February 27, 2010 — $103 million) was included in BlackBerry operations and other information technology; and $1 million

(February 27, 2010 — $41 million) was included in manufacturing equipment, research and development equipment, and tooling.

As at February 26, 2011, $32 million of land and building continues to be classified as an asset held for sale and accordingly

remains classified as other current assets.

For the year ended February 26, 2011, amortization expense related to property, plant and equipment was $497 million

(February 27, 2010 — $345 million; February 28, 2009 — $203 million).

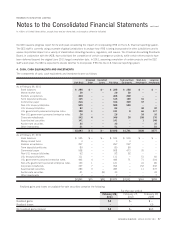

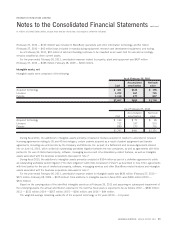

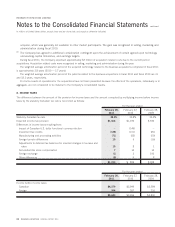

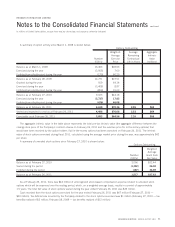

Intangible assets, net

Intangible assets were comprised of the following:

Cost

Accumulated

amortization

Net book

value

As at February 26, 2011

Acquired technology $ 321 $125 $ 196

Licenses 1,232 467 765

Patents 1,114 277 837

$2,667 $869 $1,798

Cost

Accumulated

amortization

Net book

value

As at February 27, 2010

Acquired technology $ 166 $ 71 $ 95

Licenses 712 197 515

Patents 889 173 716

$1,767 $441 $1,326

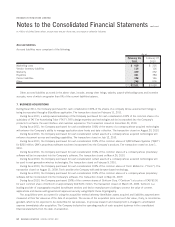

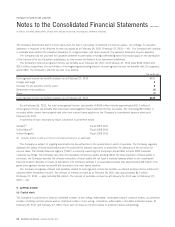

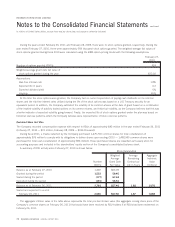

During fiscal 2011, the additions to intangible assets primarily consisted of licenses acquired in relation to amended or renewed

licensing agreements relating to 3G and 4G technologies, certain patents acquired as a result of patent assignment and transfer

agreements, including one entered into by the Company and Motorola, Inc. as part of a Settlement and License Agreement entered

into on June 10, 2010, which settled all outstanding worldwide litigation between the two companies, as well as agreements with third

parties for the use of intellectual property, software, messaging services and other BlackBerry related features, as well as intangible

assets associated with the business acquisitions discussed in note 7.

During fiscal 2010, the additions to intangible assets primarily consisted of $104 million as part of a definitive agreement to settle

all outstanding worldwide patent litigation (“the Visto Litigation”) with Visto Corporation (“Visto”) as described in note 10(c), agreements

with third parties for the use of intellectual property, software, messaging services and other BlackBerry related features and intangible

assets associated with the business acquisitions discussed in note 7.

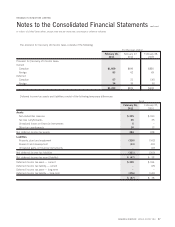

For the year ended February 26, 2011, amortization expense related to intangible assets was $430 million (February 27, 2010 —

$271 million; February 28, 2009 — $125 million). Total additions to intangible assets in fiscal 2011 were $906 million (2010 —

$531 million).

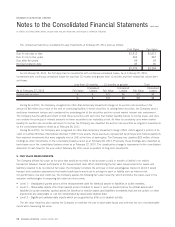

Based on the carrying value of the identified intangible assets as at February 26, 2011 and assuming no subsequent impairment of

the underlying assets, the annual amortization expense for the next five fiscal years is expected to be as follows: 2012 — $646 million;

2013 — $331 million; 2014 — $257 million; 2015 — $150 million; and 2016 — $94 million.

The weighted-average remaining useful life of the acquired technology is 3.5 years (2010 — 3.4 years).

RESEARCH IN MOTION ANNUAL REPORT 2011 63

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated