Blackberry 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

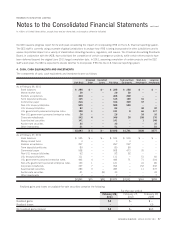

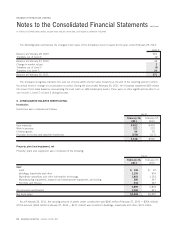

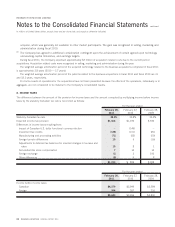

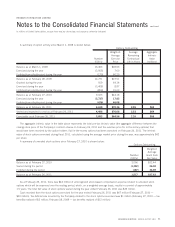

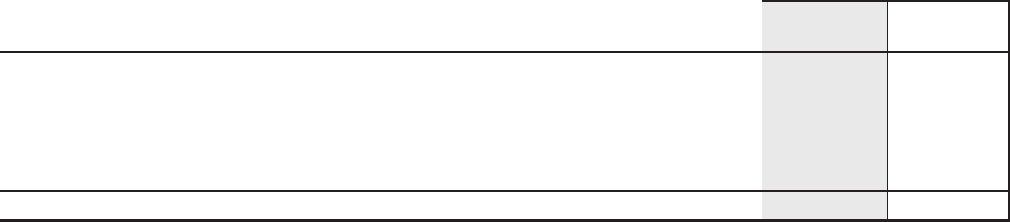

Accrued liabilities

Accrued liabilities were comprised of the following:

February 26,

2011

February 27,

2010

As at

Marketing costs $419 $ 225

Vendor inventory liabilities 116 126

Warranty 459 252

Royalties 461 384

Carrier liabilities 308 146

Other 748 505

$2,511 $1,638

Other accrued liabilities as noted in the above chart, include, among other things, salaries, payroll withholding taxes and incentive

accruals, none of which are greater than 5% of the current liabilities balance.

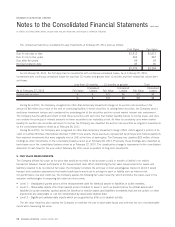

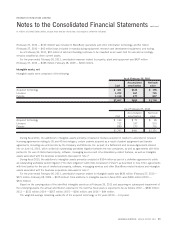

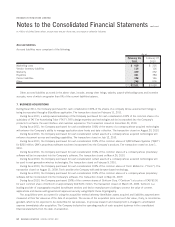

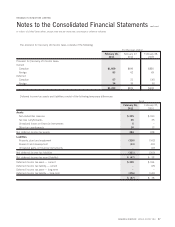

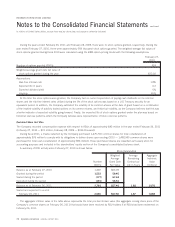

7. BUSINESS ACQUISITIONS

During fiscal 2011, the Company purchased for cash consideration 100% of the shares of a company whose acquired technology is

being incorporated through a BlackBerry application. The transaction closed on February 11, 2011.

During fiscal 2011, a wholly-owned subsidiary of the Company purchased for cash consideration 100% of the common shares of a

subsidiary of TAT The Astonishing Tribe (“TAT”). TAT’s design expertise and technologies will be incorporated into the Company’s

products to enhance the user interface and customer experience. The transaction closed on December 23, 2010.

During fiscal 2011, the Company purchased for cash consideration 100% of the shares of a company whose acquired technologies

will enhance the Company’s ability to manage application store fronts and data collection. The transaction closed on August 20, 2010.

During fiscal 2011, the Company purchased for cash consideration certain assets of a company whose acquired technologies will

enhance document access and handling capabilities. The transaction closed on July 12, 2010.

During fiscal 2011, the Company purchased for cash consideration 100% of the common shares of QNX Software Systems (“QNX”)

for $200 million. QNX’s proprietary software has been incorporated into the Company’s products. The transaction closed on June 1,

2010.

During fiscal 2011, the Company purchased for cash consideration 100% of the common shares of a company whose proprietary

software will be incorporated into the Company’s software. The transaction closed on March 26, 2010.

During fiscal 2010, the Company purchased for cash consideration certain assets of a company whose acquired technologies will

be used in next generation wireless technologies. The transaction closed on February 9, 2010.

During fiscal 2010, the Company purchased for cash consideration 100% of the common shares of Torch Mobile Inc. (“Torch”). The

transaction closed on August 21, 2009. Torch provides the Company with web browser based technology.

During fiscal 2010, the Company purchased for cash consideration 100% of the common shares of a company whose proprietary

software will be incorporated into the Company’s software. The transaction closed on May 22, 2009.

During fiscal 2010, the Company purchased 100% of the common shares of Certicom Corp. (“Certicom”) at a price of CAD $3.00

for each common share of Certicom or approximately CAD $131 million. The transaction closed on March 23, 2009. Certicom is a

leading provider of cryptography required by software vendors and device manufacturers looking to protect the value of content,

applications and devices with government approved security using Elliptic Curve Cryptography.

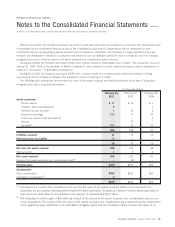

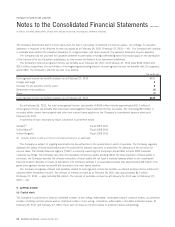

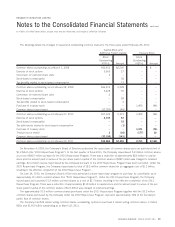

The acquisitions were accounted for using the acquisition method whereby identifiable assets acquired and liabilities assumed were

measured at their fair values as of the date of acquisition. The excess of the acquisition price over such fair value, if any, is recorded as

goodwill, which is not expected to be deductible for tax purposes. In-process research and development is charged to amortization

expense immediately after acquisition. The Company includes the operating results of each acquired business in the consolidated

financial statements from the date of acquisition.

64 RESEARCH IN MOTION ANNUAL REPORT 2011

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated