Blackberry 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

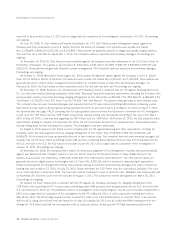

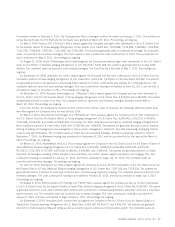

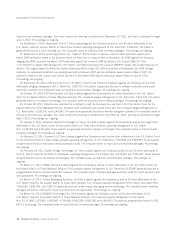

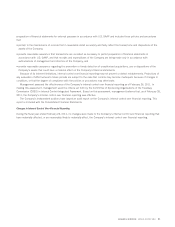

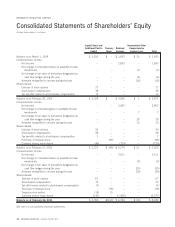

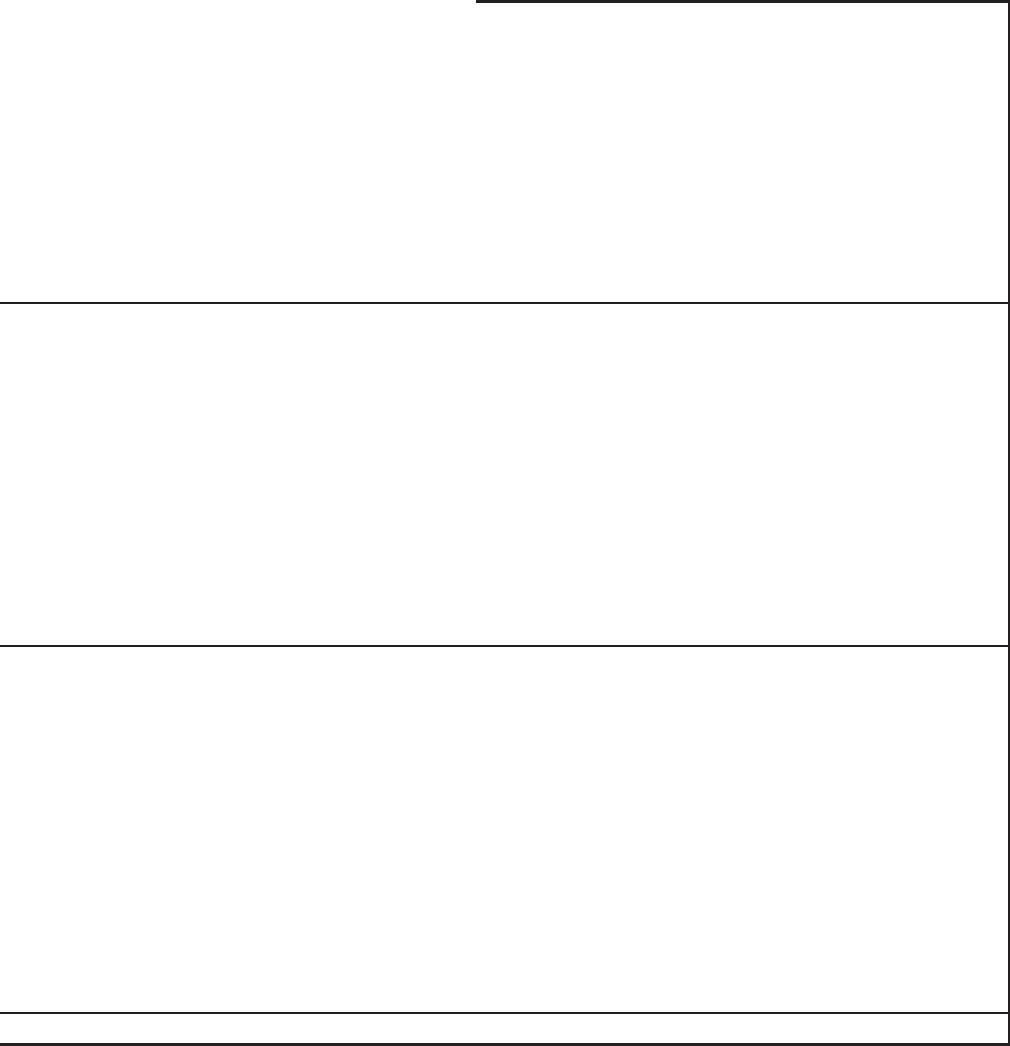

RESEARCH IN MOTION LIMITED

Consolidated Statements of Shareholders’ Equity

(United States dollars, in millions)

Capital Stock and

Additional Paid-In

Capital

Treasury

Stock

Retained

Earnings

Accumulated Other

Comprehensive

Income (Loss) Total

Balance as at March 1, 2008 $ 2,250 $ – $ 1,653 $ 30 $ 3,933

Comprehensive income:

Net income – – 1,893 – 1,893

Net change in unrealized losses on available-for-sale

investments – – – (7) (7)

Net change in fair value of derivatives designated as

cash flow hedges during the year – – – (6) (6)

Amounts reclassified to income during the year – – – (16) (16)

Shares issued:

Exercise of stock options 27 – – – 27

Stock-based compensation 38 – – – 38

Tax benefits related to stock-based compensation 13 – – – 13

Balance as at February 28, 2009 $ 2,328 $ – $ 3,546 $ 1 $ 5,875

Comprehensive income:

Net income – – 2,457 – 2,457

Net change in unrealized gains on available-for-sale

investments – – – 7 7

Net change in fair value of derivatives designated as

cash flow hedges during the year – – – 28 28

Amounts reclassified to income during the year – – – 15 15

Shares issued:

Exercise of stock options 30 – – – 30

Stock-based compensation 58 – – – 58

Tax benefits related to stock-based compensation 2 – – – 2

Purchase of treasury stock – (94) – – (94)

Common shares repurchased (46) – (729) – (775)

Balance as at February 27, 2010 $ 2,372 $ (94) $ 5,274 $ 51 $ 7,603

Comprehensive income:

Net income – – 3,411 – 3,411

Net change in unrealized losses on available-for-sale

investments – – – (2) (2)

Net change in fair value of derivatives designated as

cash flow hedges during the year – – – (20) (20)

Amounts reclassified to income during the year – – – (39) (39)

Shares issued:

Exercise of stock options 67 – – – 67

Stock-based compensation 72 – – – 72

Tax deficiencies related to stock-based compensation (1) – – – (1)

Purchase of treasury stock – (76) – – (76)

Treasury stock vested (10) 10 – – -

Common shares repurchased (141) – (1,936) – (2,077)

Balance as at February 26, 2011 $ 2,359 $(160) $ 6,749 $ (10) $ 8,938

See notes to consolidated financial statements.

46 RESEARCH IN MOTION ANNUAL REPORT 2011