Blackberry 2011 Annual Report Download - page 69

Download and view the complete annual report

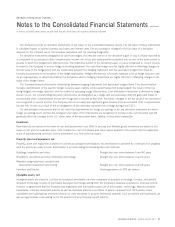

Please find page 69 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Level 2 or Level 3. The new authoritative guidance is effective for interim and annual periods beginning after December 15, 2009,

except for the requirement to separately disclose purchases, sales, issuances, and settlements in the Level 3 reconciliation which is

effective for interim and annual periods beginning after December 15, 2010. The Company adopted this authoritative guidance in the

first quarter of fiscal 2011, with the exception of the requirement to separately disclose purchases, sales, issuances, and settlements,

which the Company will adopt in the first quarter of fiscal 2012. The adoption did not have a material impact on the Company’s results

of operations, financial condition and the Company’s disclosures. The adoption of the remaining guidance in the first quarter of fiscal

2012 is not expected to have a material impact on the Company’s results of operations, financial condition and the Company’s

disclosures.

In October 2009, the FASB issued authoritative guidance on certain revenue arrangements that include software elements. The

guidance amends previous literature to provide that software revenue recognition guidance should not be applied to tangible products

containing software components and non-software components that function together to deliver the product’s essential functionality. As

a result of this guidance, revenue from most of the Company’s devices and services, including its BlackBerry wireless devices, is no

longer recognized using the industry-specific software revenue recognition guidance.

In October 2009, the FASB also issued authoritative guidance on revenue recognition for arrangements with multiple deliverables.

The guidance amends previous literature to require an entity to use an estimated selling price when VSOE or TPE does not exist for

products or services included in a multiple element arrangement. The arrangement consideration should be allocated among the

products and services based upon their relative selling prices, thus eliminating the use of the residual method of allocation. The

guidance also requires expanded qualitative and quantitative disclosures regarding significant judgments made and changes in applying

the guidance.

The new authoritative guidance described above is effective for revenue arrangements entered into or materially modified in fiscal

years beginning on or after June 15, 2010, with early adoption permitted. The Company adopted this authoritative guidance in the first

quarter of fiscal 2011 on a prospective basis for applicable transactions entered into or materially modified after February 27, 2010.

The adoption did not have a material impact on the Company’s results of operations and financial condition for the fiscal year ended

February 26, 2011, and the Company does not expect the adoption to have a material effect on financial statements in future periods.

The Company has not significantly changed its view on units of accounting, allocation of arrangement consideration to the units of

accounting or the timing of revenue recognition. Due to the new authoritative guidance implemented in the first quarter of fiscal 2011,

the Company modified its revenue recognition accounting policy, which is described above.

In June 2009, the FASB issued authoritative guidance to amend the manner in which an enterprise performs an analysis to

determine whether the enterprise’s variable interest gives it a controlling interest in the variable interest entity (“VIE”). The guidance

uses a qualitative risks and rewards approach by focusing on which enterprise has the power to direct the activities of the VIE, the

obligation to absorb the entity’s losses and rights to receive benefits from the entity. The guidance also requires enhanced disclosures

related to the VIE. The Company adopted this authoritative guidance in the first quarter of fiscal 2011 and the adoption did not have

material impact on the Company’s results of operations and financial condition.

In June 2009, the FASB issued authoritative guidance amending the accounting for transfers of financial assets. The guidance,

among other things, eliminates the exceptions for qualifying special-purpose entities from the consolidation guidance, clarifies the

requirements for transferred financial assets that are eligible for sale accounting and requires enhanced disclosures about a transferor’s

continuing involvement with transferred financial assets. The Company adopted this authoritative guidance in the first quarter of fiscal

2011 and the adoption did not have a material impact on the Company’s results of operations and financial condition.

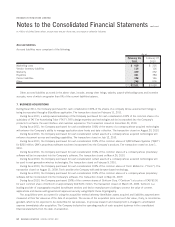

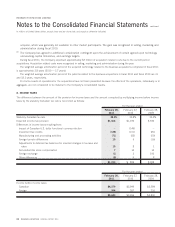

3. RECENTLY ISSUED PRONOUNCEMENTS

In November 2008, the Securities Exchange Commission (“SEC”) announced a proposed roadmap for comment regarding the potential

use by U.S. issuers of financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”). IFRS is a

comprehensive series of accounting standards published by the International Accounting Standards Board (“IASB”). On February 24,

2010, the SEC issued a statement describing its position regarding global accounting standards. Among other things, the SEC stated

that it has directed its staff to execute a work plan which will include consideration of IFRS as it exists today and after completion of

various “convergence” projects currently underway between U.S. and international accounting standards setters. On October 29, 2010,

56 RESEARCH IN MOTION ANNUAL REPORT 2011

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated