Blackberry 2011 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

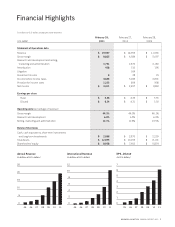

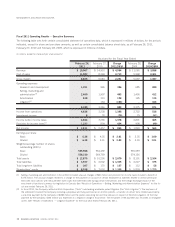

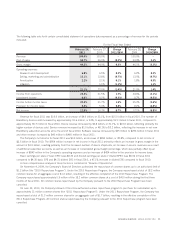

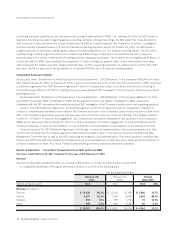

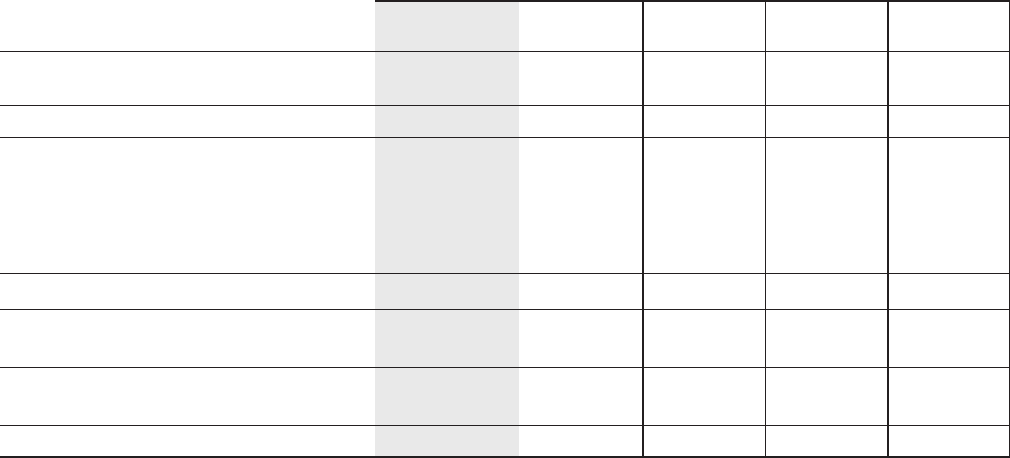

The following table sets forth certain consolidated statement of operations data expressed as a percentage of revenue for the periods

indicated:

February 26,

2011

February 27,

2010

Change

2011/2010

February 28,

2009

Change

2010/2009

For the Fiscal Year Ended

Revenue 100.0% 100.0% –100.0% –

Cost of sales 55.7% 56.0% (0.3%) 53.9% 2.1%

Gross margin 44.3% 44.0% 0.3% 46.1% (2.1%)

Operating expenses

Research and development 6.8% 6.5% 0.3% 6.2% 0.3%

Selling, marketing and administration 12.1% 12.8% (0.7%) 13.5% (0.7%)

Amortization 2.2% 2.1% 0.1% 1.8% 0.3%

Litigation –1.1% (1.1%) –1.1%

21.1% 22.5% (1.4%) 21.5% 1.0%

Income from operations 23.2% 21.5% 1.7% 24.6% (3.1%)

Investment income 0.0% 0.2% (0.2%) 0.7% (0.5%)

Income before income taxes 23.2% 21.7% 1.5% 25.3% (3.6%)

Provision for income taxes 6.2% 5.4% 0.8% 8.2% (2.8%)

Net income 17.0% 16.3% 0.7% 17.1% (0.8%)

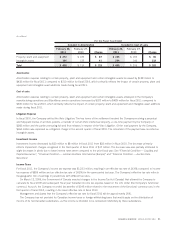

Revenue for fiscal 2011 was $19.9 billion, an increase of $4.9 billion, or 33.1%, from $15.0 billion in fiscal 2010. The number of

BlackBerry devices sold increased by approximately 15.6 million, or 43%, to approximately 52.3 million in fiscal 2011, compared to

approximately 36.7 million in fiscal 2010. Device revenue increased by $3.8 billion, or 31.7%, to $16.0 billion, reflecting primarily the

higher number of devices sold. Service revenue increased by $1.0 billion, or 48.1% to $3.2 billion, reflecting the increase in net new

BlackBerry subscriber accounts since the end of fiscal 2010. Software revenue increased by $35 million to $294 million in fiscal 2011

and other revenue increased by $40 million to $460 million in fiscal 2011.

The Company’s net income for fiscal 2011 was $3.4 billion, an increase of $954 million, or 38.8%, compared to net income of

$2.5 billion in fiscal 2010. The $954 million increase in net income in fiscal 2011 primarily reflects an increase in gross margin in the

amount of $2.2 billion, resulting primarily from the increased number of device shipments, an increase in service revenues as a result

of additional subscriber accounts, as well as an increase of consolidated gross margin percentage, which was partially offset by an

increase of $843 million in the Company’s operating expenses and an increase of $424 million in the provision for income taxes.

Basic earnings per share (“basic EPS”) was $6.36 and diluted earnings per share (“diluted EPS”) was $6.34 in fiscal 2011

compared to $4.35 basic EPS and $4.31 diluted EPS in fiscal 2010, a 47.1% increase in diluted EPS compared to fiscal 2010.

A more comprehensive analysis of these factors is contained in “Results of Operations”.

On November 4, 2009, the Company’s Board of Directors authorized the repurchase of common shares up to an authorized limit of

$1.2 billion (the “2010 Repurchase Program”). Under the 2010 Repurchase Program, the Company repurchased a total of 18.2 million

common shares for an aggregate cost of $1.2 billion, resulting in the effective completion of the 2010 Repurchase Program. The

Company repurchased approximately 5.9 million of the 18.2 million common shares at a cost of $410 million during the first three

months of fiscal 2011. All common shares repurchased by the Company pursuant to the 2010 Repurchase Program have been

cancelled.

On June 24, 2010, the Company’s Board of Directors authorized a share repurchase program to purchase for cancellation up to

approximately 31 million common shares (the “2011 Repurchase Program”). Under the 2011 Repurchase Program, the Company has

repurchased a total of 31.3 million common shares for an aggregate cost of $1.7 billion, resulting in the effective completion of the

2011 Repurchase Program. All common shares repurchased by the Company pursuant to the 2011 Repurchase program have been

cancelled.

RESEARCH IN MOTION ANNUAL REPORT 2011 11