Blackberry 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

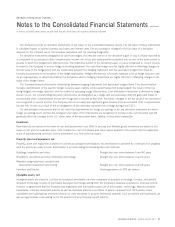

the SEC issued a progress report for its work plan considering the impact of incorporating IFRS on the U.S. financial reporting system.

The SEC staff is currently using a sample of global jurisdictions to analyze how IFRS is being incorporated in other jurisdictions and to

assess its potential impact on a variety of stakeholders including investors, regulators, and issuers. The Financial Accounting Standards

Board, in conjunction with the IASB, have prioritized the completion of certain convergence projects, while certain other projects have

been deferred beyond the original June 2011 target completion date. In 2011, assuming completion of certain projects and the SEC

staff’s work plan, the SEC is expected to decide whether to incorporate IFRS into the U.S. financial reporting system.

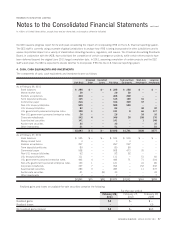

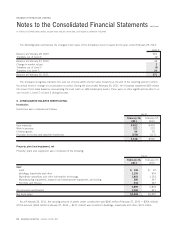

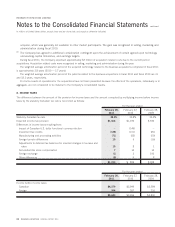

4. CASH, CASH EQUIVALENTS AND INVESTMENTS

The components of cash, cash equivalents and investments were as follows:

Cost Basis

Unrealized

Gains

Unrealized

Losses Fair Value

Cash and Cash

Equivalents

Short-term

Investments

Long-term

Investments

As at February 26, 2011

Bank balances $ 288 $ – $ – $ 288 $ 288 $ – $ –

Money market fund 20 – – 20 20 – –

Bankers acceptances 468 – – 468 468 – –

Term deposits/certificates 125 – – 125 109 16 –

Commercial paper 416 – – 416 369 47 –

Non-U.S. treasury bills/notes 509 – – 509 509 – –

U.S. treasury bills/notes 82 – – 82 – 40 42

U.S. government sponsored enterprise notes 190 1 – 191 8 66 117

Non-U.S. government sponsored enterprise notes 26 – – 26 – 10 16

Corporate notes/bonds 342 4 – 346 20 150 176

Asset-backed securities 141 – – 141 – 1 140

Auction-rate securities 35 – – 35 – – 35

Other investments 51 – – 51 – – 51

$2,693 $ 5 $ – $2,698 $1,791 $330 $577

As at February 27, 2010

Bank balances $ 535 $ – $ – $ 535 $ 535 $ – $ –

Money market fund 3 – – 3 3 – –

Bankers acceptances 297 – – 297 297 – –

Term deposits/certificates 80 – – 80 80 – –

Commercial paper 508 – – 508 473 35 –

Non-U.S. treasury bills/notes 92 – – 92 92 – –

U.S. treasury bills/notes 111 – – 111 – 51 60

U.S. government sponsored enterprise notes 442 4 – 446 71 71 304

Non-U.S. government sponsored enterprise notes 120 1 – 121 – 41 80

Corporate notes/bonds 347 7 – 354 – 152 202

Asset-backed securities 280 3 – 283 – 11 272

Auction-rate securities 41 – (8) 33 – – 33

Other investments 7 – – 7 – – 7

$2,863 $15 $(8) $2,870 $1,551 $361 $958

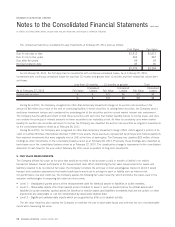

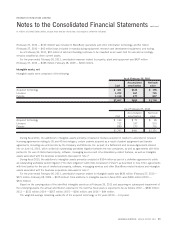

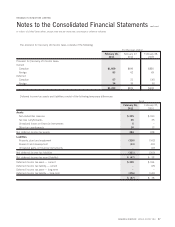

Realized gains and losses on available-for-sale securities comprise the following:

February 26,

2011

February 27,

2010

February 28,

2009

For the year ended

Realized gains $2 $– $ –

Realized losses ––(2)

Net realized gains (losses) $2 $– $(2)

RESEARCH IN MOTION ANNUAL REPORT 2011 57

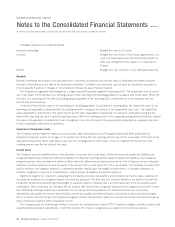

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated