Blackberry 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

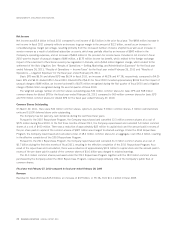

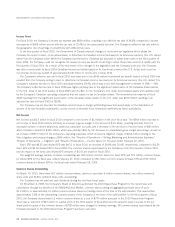

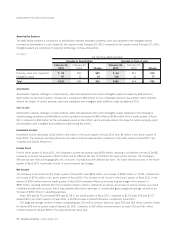

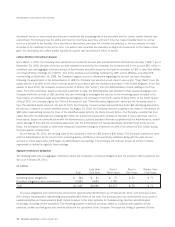

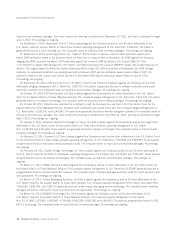

A comparative summary of cash, cash equivalents, and investments is set out below:

(in millions)

February 26,

2011

February 27,

2010 Change

As at

Cash and cash equivalents $1,791 $1,551 $240

Short-term investments 330 361 (31)

Long-term investments 577 958 (381)

Cash, cash equivalents, and investments $2,698 $2,870 $(172)

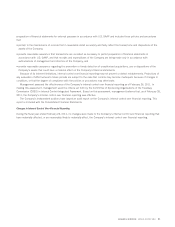

The decrease in cash, cash equivalents, and investments is primarily due to net cash flows used in financing activities and investing

activities, which were partially offset by net cash flows provided by operating activities, as set out below:

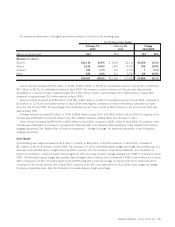

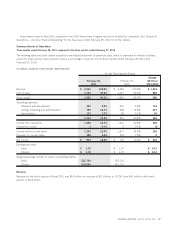

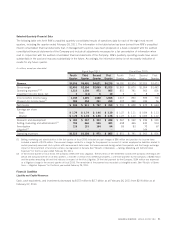

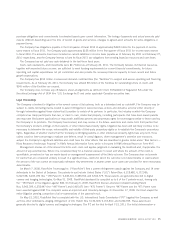

(in millions)

February 26,

2011

February 27,

2010

For the Fiscal Year Ended

Net cash flows provided by (used in):

Operating activities $ 4,009 $ 3,035

Investing activities (1,698) (1,470)

Financing activities (2,087) (843)

Effect of foreign exchange gain (loss) on cash and cash equivalents 16 (6)

Net increase in cash and cash equivalents $ 240 $716

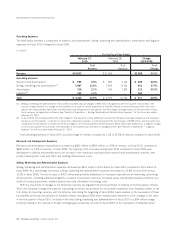

Cash flows for the fiscal year ended February 26, 2011

Operating Activities

Net cash flows provided by operating activities were $4.0 billion for fiscal 2011, primarily reflecting higher net income compared to

fiscal 2010, which was partially offset by an increase in accounts receivable in fiscal 2011 compared to fiscal 2010.

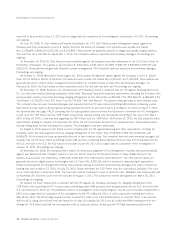

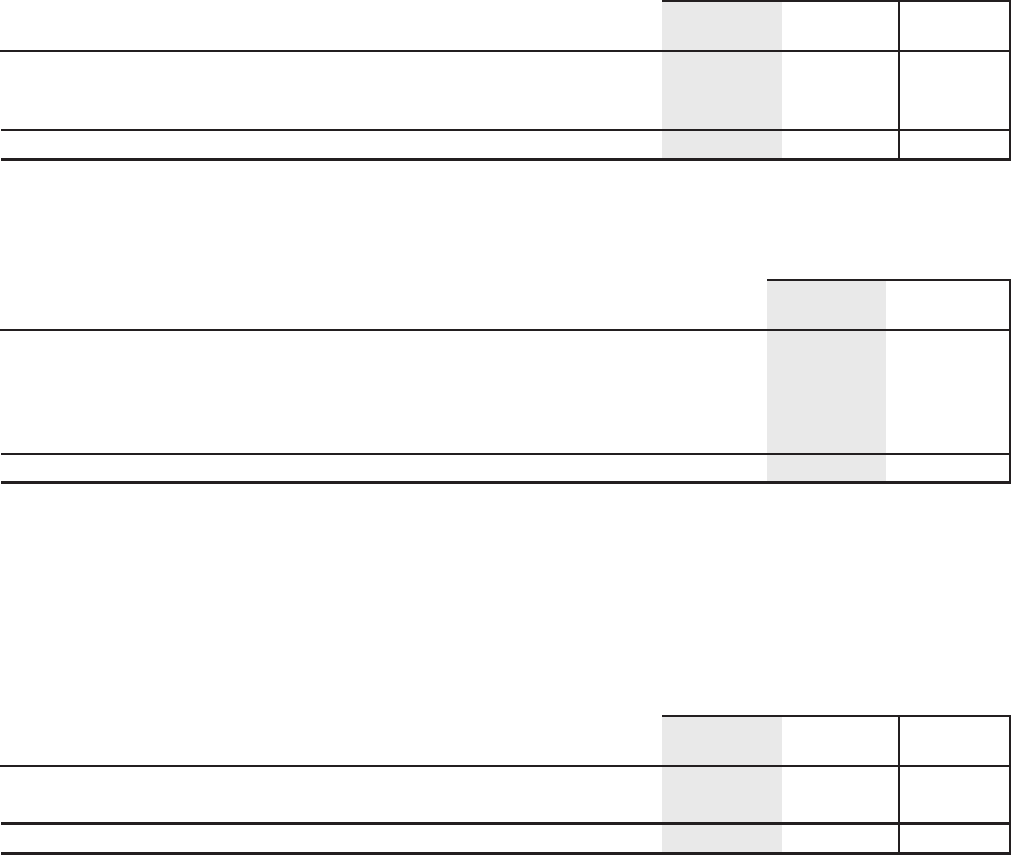

The table below summarizes the current assets, current liabilities, and working capital of the Company:

(in millions)

February 26,

2011

February 27,

2010 Change

As at

Current assets $7,488 $5,813 $1,675

Current liabilities 3,630 2,432 1,198

Working capital $3,858 $3,381 $477

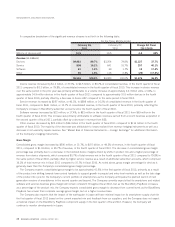

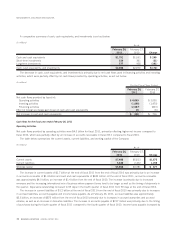

The increase in current assets of $1.7 billion at the end of fiscal 2011 from the end of fiscal 2010 was primarily due to an increase

in accounts receivable of $1.4 billion and cash and cash equivalents of $240 million. At the end of fiscal 2011, accounts receivable

was approximately $4.0 billion, an increase of $1.4 billion from the end of fiscal 2010. The increase is primarily due to increased

revenues and the increasing international mix of business where payment terms tend to be longer as well as the timing of shipments in

the quarter. Days sales outstanding increased to 65 days in the fourth quarter of fiscal 2011 from 58 days at the end of fiscal 2010.

The increase in current liabilities of $1.2 billion at the end of fiscal 2011 from the end of fiscal 2010 was primarily due to increases

in accrued liabilities, accounts payable and income taxes payable. As at February 26, 2011, accrued liabilities was approximately

$2.5 billion, an increase of $873 million from the end of fiscal 2010 primarily due to increases in accrued warranties and accrued

rebates, as well as an increase in derivative liabilities. The increase in accounts payable of $217 million was primarily due to the timing

of purchases during the fourth quarter of fiscal 2011 compared to the fourth quarter of fiscal 2010. Income taxes payable increased by

32 RESEARCH IN MOTION ANNUAL REPORT 2011

MANAGEMENT’S DISCUSSION AND ANALYSIS