Blackberry 2011 Annual Report Download - page 67

Download and view the complete annual report

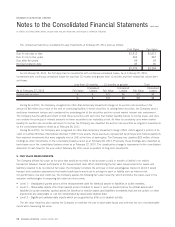

Please find page 67 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company is generally unable to reliably determine the selling prices of similar competitor products and services on a stand-alone basis.

In these instances, the Company uses best estimated selling price (“BESP”) in its allocation of arrangement consideration. The

objective of BESP is to determine the price at which the Company would transact a sale if the product or service was sold on a stand-

alone basis.

The Company determines BESP for a product or service by considering multiple factors including, but not limited to, market

conditions, competitive landscape, internal costs, gross margin objectives and pricing practices. The determination of BESP is made

through consultation with, and formal approval by, the Company’s management, taking into consideration the Company’s marketing

strategy.

For arrangements involving multiple deliverables of software with technical support services, the revenue is recognized based on the

industry-specific software revenue recognition accounting guidance. If the Company is not able to determine VSOE for all of the

deliverables of the arrangement, but is able to obtain VSOE for all undelivered elements, revenue is allocated using the residual

method. Under the residual method, the amount of revenue allocated to delivered elements equals the total arrangement consideration

less the aggregate fair value of any undelivered elements. If VSOE of any undelivered software items does not exist, revenue from the

entire arrangement is initially deferred and recognized at the earlier of: (i) delivery of those elements for which VSOE did not exist; or

(ii) when VSOE can be established.

The Company regularly reviews VSOE, TPE and BESP, and maintains internal controls over the establishment and updates of these

estimates. There were no material impacts to the amount of revenue recognized during the year, nor does the Company expect a

material impact in the near term, from changes in VSOE, TPE or BESP.

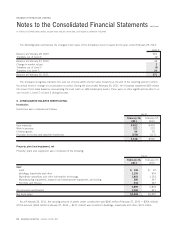

Research and development

Research costs are expensed as incurred. Development costs for BlackBerry devices and licensed software to be sold, leased or

otherwise marketed are subject to capitalization beginning when a product’s technological feasibility has been established and ending

when a product is available for general release to customers. The Company’s products are generally released soon after technological

feasibility has been established and therefore costs incurred subsequent to achievement of technological feasibility are not significant

and have been expensed as incurred.

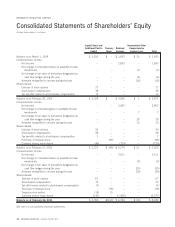

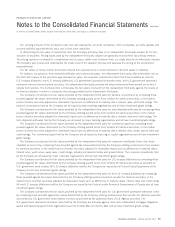

Comprehensive income

Comprehensive income is defined as the change in net assets of a business enterprise during a period from transactions and other

events and circumstances from non-owner sources and includes all changes in equity during a period except those resulting from

investments by owners and distributions to owners. The Company’s reportable items of comprehensive income are cash flow hedges as

described in note 15 and changes in the fair value of available-for-sale investments as described in note 5. Realized gains or losses on

available-for-sale investments are reclassified into investment income using the specific identification basis.

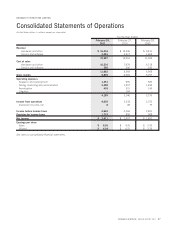

Earnings per share

Earnings per share is calculated based on the weighted-average number of shares outstanding during the year. The treasury stock

method is used for the calculation of the dilutive effect of stock options.

Stock-based compensation plans

The Company has stock-based compensation plans, which are described in note 9(b).

The Company has an incentive stock option plan for officers and employees of the Company or its subsidiaries. Under the terms of

the plan, as revised in fiscal 2008, no stock options may be granted to independent directors. The Company measures stock-based

compensation expense at the grant date based on the award’s fair value as calculated by the Black-Scholes-Merton (“BSM”) option-

pricing model and is recognized rateably over the vesting period. The BSM model requires various judgmental assumptions including

volatility and expected option life. In addition, judgment is also applied in estimating the amount of stock-based awards that are

expected to be forfeited, and if actual results differ significantly from these estimates, stock-based compensation expense and our

results of operations would be impacted.

Any consideration paid by employees on exercise of stock options plus any recorded stock-based compensation within additional

paid-in capital related to that stock option is credited to capital stock.

54 RESEARCH IN MOTION ANNUAL REPORT 2011

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements

continued

In millions of United States dollars, except share and per share data, and except as otherwise indicated