Blackberry 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.outcome. The Company does not provide for claims that are considered unlikely to result in a significant loss, claims for which the

outcome is not determinable or claims where the amount of the loss cannot be reasonably estimated. Any settlements or awards under

such claims are provided for when reasonably determinable. For further details on legal matters, see “Legal Proceedings” and see

“Results of Operations — Litigation Expense” below.

Royalties

The Company recognizes its liability for royalties in accordance with the terms of existing license agreements. Where license

agreements are not yet finalized, RIM recognizes its current estimates of the obligation in accrued liabilities in the Consolidated

Financial Statements. When the license agreements are subsequently finalized, the estimate is revised accordingly. Management’s

estimates of royalty rates are based on the Company’s historical licensing activities, royalty payment experience and forward-looking

expectations.

Warranty

The Company provides for the estimated costs of product warranties at the time revenue is recognized. BlackBerry devices are

generally covered by a time-limited warranty for varying periods of time. The Company’s warranty obligation is affected by product

failure rates, differences in warranty periods, regulatory developments with respect to warranty obligations in the countries in which the

Company carries on business, freight expense, and material usage and other related repair costs.

The Company’s estimates of costs are based upon historical experience and expectations of future return rates and unit warranty

repair cost. To the extent that the Company experiences changes in warranty activity, or changes to costs associated with servicing

those obligations, revisions to the estimated warranty liability would be required. For further details on the Company’s warranty expense

experience and estimates for fiscal 2011, refer to Note 11 to the Consolidated Financial Statements.

Income Sensitivity

The Company estimates that a 10% change to either the current average unit warranty repair cost or the current average warranty

return rate, measured against the device sales volumes currently under warranty as at February 26, 2011, would have resulted in

adjustments to warranty expense and pre-tax income of approximately $46 million, or 1.3% of consolidated annual net income.

Investments

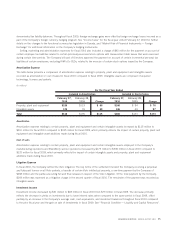

The Company’s cash equivalents and investments, other than cost method investments of $15 million and equity method investments

of $11 million, consist of money market and other debt securities, and are classified as available-for-sale for accounting purposes and

are carried at fair value with unrealized gains and losses recorded in accumulated other comprehensive income until such investments

mature or are sold. The Company uses the specific identification method of determining the cost basis in computing realized gains or

losses on available-for-sale investments which are recorded in investment income. In the event of a decline in value which is other than

temporary, the investment is written down to fair value with a charge to income.

The Company defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. When determining the fair value measurements for assets and

liabilities required to be recorded at fair value, the Company considers the principal or most advantageous market in which it would

transact and considers assumptions that market participants would use in pricing the asset or liability, such as inherent risk,

non-performance risk and credit risk. The Company applies the following fair value hierarchy, which prioritizes the inputs used in the

valuation methodologies in measuring fair value into three levels:

• Level 1 – Unadjusted quoted prices at the measurement date for identical assets or liabilities in active markets.

• Level 2 – Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and liabilities in

active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or other inputs that are

observable or can be corroborated by observable market data.

• Level 3 – Significant unobservable inputs which are supported by little or no market activity.

The fair value hierarchy also requires the Company to maximize the use of observable inputs and minimize the use of unobservable

inputs when measuring fair value.

RESEARCH IN MOTION ANNUAL REPORT 2011 15