Blackberry 2011 Annual Report Download - page 48

Download and view the complete annual report

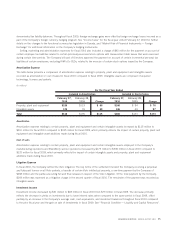

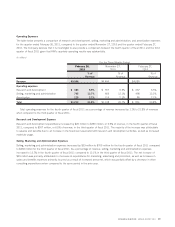

Please find page 48 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.purchase obligations and commitments is estimated based upon current information. The timing of payments and actual amounts paid

may be different depending upon the time of receipt of goods and services, changes to agreed-upon amounts for some obligations or

payment terms.

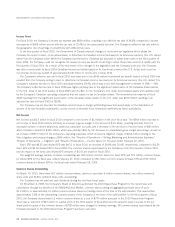

The Company has obligations payable in the first quarter of fiscal 2012 of approximately $224 million for the payment of income

taxes related to fiscal 2011. The Company paid approximately $135 million in the first quarter of fiscal 2011 for income taxes related

to fiscal 2010. The amounts have been included as current liabilities in income taxes payable as of February 26, 2011 and February 27,

2010 respectively, and the Company intends to fund its fiscal 2011 tax obligations from existing financial resources and cash flows.

The Company has not paid any cash dividends in the last three fiscal years.

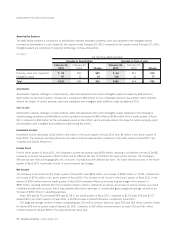

Cash, cash equivalents, and investments were $2.7 billion as at February 26, 2011. The Company believes its financial resources,

together with expected future income, are sufficient to meet funding requirements for current financial commitments, for future

operating and capital expenditures not yet committed, and also provide the necessary financial capacity to meet current and future

growth expectations.

The Company has $150 million in unsecured demand credit facilities (the “Facilities”) to support and secure operating and financing

requirements. As at February 26, 2011, the Company has utilized $9 million of the Facilities for outstanding letters of credit, and

$141 million of the Facilities are unused.

The Company does not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of Regulation S-K under the

Securities Exchange Act of 1934 (the “U.S. Exchange Act”) and under applicable Canadian securities laws.

Legal Proceedings

The Company is involved in litigation in the normal course of its business, both as a defendant and as a plaintiff. The Company may be

subject to claims (including claims related to patent infringement, purported class actions and derivative actions) either directly or

through indemnities against these claims that it provides to certain of its partners. In particular, the industry in which the Company

competes has many participants that own, or claim to own, intellectual property, including participants that have been issued patents

and may have filed patent applications or may obtain additional patents and proprietary rights for technologies similar to those used by

the Company in its products. The Company has received, and may receive in the future, assertions and claims from third parties that

the Company’s products infringe on their patents or other intellectual property rights. Litigation has been and will likely continue to be

necessary to determine the scope, enforceability and validity of third-party proprietary rights or to establish the Company’s proprietary

rights. Regardless of whether claims that the Company is infringing patents or other intellectual property rights have any merit, those

claims could be time-consuming to evaluate and defend, result in costly litigation, divert management’s attention and resources,

subject the Company to significant liabilities and could have the other effects that are described in greater detail under “Risk Factors —

Risks Related to Intellectual Property” in RIM’s Annual Information Form, which is included in RIM’s Annual Report on Form 40-F.

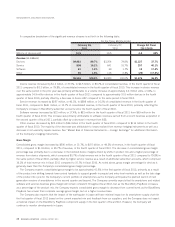

Management reviews all of the relevant facts for each claim and applies judgment in evaluating the likelihood and, if applicable, the

amount of any potential loss. Where it is considered likely for a material exposure to result and where the amount of the claim is

quantifiable, provisions for loss are made based on management’s assessment of the likely outcome. The Company does not provide

for claims that are considered unlikely to result in a significant loss, claims for which the outcome is not determinable or claims where

the amount of the loss cannot be reasonably estimated. Any settlements or awards under such claims are provided for when reasonably

determinable.

On March 7, 2008, FlashPoint Technology Inc. (“FlashPoint”) filed a patent infringement lawsuit against the Company and 14 other

defendants in the District of Delaware. The patents-in-suit include United States (“U.S.”) Patent Nos. 6,118,480, 6,177,956,

6,222,538, 6,223,190 (the “’190 Patent”), 6,249,316, 6,486,914 and 6,504,575. These patents are generally directed to digital

camera and imaging technologies. On May 31, 2008, FlashPoint dismissed its complaint as to 6 of the 7 patents-in-suit, leaving only

the “’190 Patent in the litigation against RIM. On February 6, 2009, FlashPoint filed an amended complaint adding Patent

Nos. 5,903,309, 6,278,447 (the “’447 Patent”) and 6,400,471 (the “’471 Patent”). Only the ’447 Patent and the ’471 Patent have

been asserted against RIM. The complaint seeks an injunction and monetary damages. On December 17, 2009, the Court stayed the

entire litigation pending completion of all re-examinations of the patents-in-suit.

On May 13, 2010, FlashPoint filed a complaint with the U.S. International Trade Commission (“ITC”) against the Company, as well

as three other defendants, alleging infringement of U.S. Patent Nos. 6,134,606; 6,163,816; and 6,262,769. These patents are

generally directed to digital camera and imaging technologies. The ITC set the trial for April 7-13, 2011. The initial determination is

RESEARCH IN MOTION ANNUAL REPORT 2011 35