Blackberry 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

investment horizon to value these securities and considered the underlying risk of the securities and the current market interest rate

environment. The Company has the ability and intent to hold these securities until such time that market liquidity return to normal

levels or a solution to the liquidity of the securities is determined, and does not consider the principal or interest amounts on these

securities to be materially at risk at this time. The auction rate securities are classified as long-term investments on the balance sheet

given the uncertainty as to when market liquidity for auction rate securities will return to normal.

Lehman Brothers International (Europe)

Since March 1, 2005, the Company has maintained an investment account with Lehman Brothers International (Europe) (“LBIE”). As of

September 30, 2008, the date of the last account statement received by the Company, the Company held in the account $81 million in

combined cash and aggregate principal amount of fixed-income securities issued by third parties unrelated to LBIE or any other affiliate

of Lehman Brothers Holdings Inc (“LBHI”). Due to the insolvency proceedings instituted by LBHI and its affiliates, including LBIE,

commencing on September 15, 2008, the Company’s regular access to information regarding the account has been disrupted.

Following the appointment of the Administrators to LBIE the Company has asserted a trust claim in specie (the “Trust Claim”) over the

assets held for it by LBIE for the return of those assets in accordance with the insolvency procedure in the United Kingdom. In the first

quarter of fiscal 2010, the Company received a Letter of Return (the “Letter”) from the Administrators of LBIE relating to the Trust

Claim. The Letter noted that, based on the work performed to date, the Administrators had identified certain assets belonging to the

Company within the records of LBIE and that they are continuing to investigate the records for the remaining assets included in the

Trust Claims: an additional asset was identified as belonging to the Company in the fourth quarter of fiscal 2010. In the fourth quarter

of fiscal 2010, the Company signed the “Form of Acceptance’ and “Claim Resolution Agreement’, which are the necessary steps to

have the identified assets returned. On June 8, 2010, the Company received a Claim Amount Notice from LBIE identifying amounts to

be paid out in respect to certain identified assets. On August 10, 2010, the Company received a payment net of fees in the amount of

$38 million representing monies for three of the identified assets listed in the Claim Amount Notice. The Company currently has trust

claims filed with the Administrators totalling $47 million for unreturned assets and continues to maintain it has a valid trust claim on

those assets. Based on communications with the Administrators, publicly available information published by the Administrators, as well

as the passage of time and the uncertainty associated with the Administrator not having specifically identified these funds as trust

funds, the Company recorded an other-than-temporary impairment charge to investment income in the amount of $11 million during

the third quarter of fiscal 2011.

As at February 26, 2011, the carrying value of the Company’s claim on LBIE assets is $36 million. The Company continues to work

with the Administrators for the return of the remaining assets, identified or not specifically identified, along with the past interest

accrued on these assets since LBIE began its administration proceedings. The Company will continue to take all actions it deems

appropriate to defend its rights to these holdings.

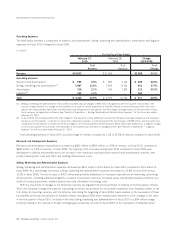

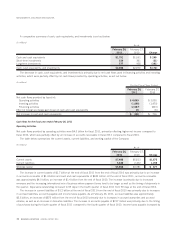

Aggregate Contractual Obligations

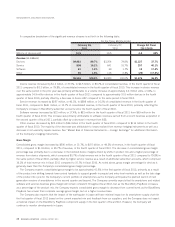

The following table sets out aggregate information about the Company’s contractual obligations and the periods in which payments are

due as at February 26, 2011:

(in millions)

Total

Less than

One Year

One to

Three Years

Four to

Five Years

Greater than

Five Years

Operating lease obligations $ 244 $ 41 $ 77 $ 55 $ 71

Purchase obligations and commitments 10,843 9,643 1,200 – –

Total $11,087 $9,684 $1,277 $ 55 $ 71

Purchase obligations and commitments amounted to approximately $10.8 billion as of February 26, 2011, with purchase orders

with contract manufacturers representing approximately $8.5 billion of the total. The Company also has commitments on account of

capital expenditures of approximately $144 million included in this total, primarily for manufacturing, facilities and information

technology, including service operations. The remaining balance consists of purchase orders or contracts with suppliers of raw

materials, as well as other goods and services utilized in the operations of the Company. The expected timing of payment of these

34 RESEARCH IN MOTION ANNUAL REPORT 2011

MANAGEMENT’S DISCUSSION AND ANALYSIS