Blackberry 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On March 18, 2011, Content Delivery Solutions, LLC filed a complaint against the Company as well as nine other defendants in the

U.S. District Court for the Western District of Texas (Austin) asserting infringement of U.S. Patent Nos. 6,058,418 and 6,393,471 which

generally relate to marketing data delivery technology. The complaint seeks an injunction and monetary damages. Proceedings are

ongoing.

On March 18, 2011, Imperium (IP) Holdings, Inc., filed a complaint against the Company as well as six other defendants in the

U.S. District Court for the Eastern District of Texas (Tyler Division) asserting infringement of U.S. Patent Nos. 6,271,884; 6,838,651;

6,838,715; 7,064,768; and 7,109,535; however, only two of these patents have been asserted against the Company (U.S. Patent

Nos. 6,271,884 and 6,838,715). The complaint seeks an injunction and monetary damages. Proceedings are ongoing.

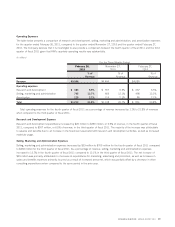

Market Risk of Financial Instruments

The Company is engaged in operating and financing activities that generate risk in three primary areas:

Foreign Exchange

The Company is exposed to foreign exchange risk as a result of transactions in currencies other than its functional currency, the

U.S. dollar. The majority of the Company’s revenues in fiscal 2011 were transacted in U.S. dollars. Portions of the revenues are

denominated in Canadian dollars, Euros and British Pounds. Purchases of raw materials are primarily transacted in U.S. dollars. Other

expenses, consisting of the majority of salaries, certain operating costs and manufacturing overhead are incurred primarily in Canadian

dollars. At February 26, 2011, approximately 59% of cash and cash equivalents, 25% of accounts receivables and 8% of accounts

payable are denominated in foreign currencies (February 27, 2010 — 38%, 22% and 7%, respectively). These foreign currencies

primarily include the Canadian dollar, Euro and British Pound. As part of its risk management strategy, the Company maintains net

monetary asset and/or liability balances in foreign currencies and engages in foreign currency hedging activities using derivative

financial instruments, including currency forward contracts and currency options. The Company does not use derivative instruments for

speculative purposes. The principal currencies hedged include the Canadian dollar, Euro and British Pound.

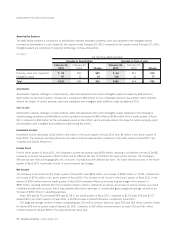

The Company enters into forward and option contracts to hedge exposures relating to foreign currency anticipated transactions.

These contracts have been designated as cash flow hedges with the effective portion of the change in fair value initially recorded in

accumulated other comprehensive income and subsequently reclassified to income when the hedged exposure affects income. Any

ineffective portion of the derivative’s gain or loss is recognized in current period income. The cash flow hedges were fully effective at

February 26, 2011. As at February 26, 2011, the net unrealized losses on these forward contracts was approximately $20 million

(February 27, 2010 — net unrealized gains of $62 million). Unrealized gains associated with these contracts were recorded in other

current assets and accumulated other comprehensive income. Unrealized losses were recorded in accrued liabilities and accumulated

other comprehensive income.

The Company enters into forward and option contracts to hedge certain monetary assets and liabilities that are exposed to foreign

currency risk. The principal currencies hedged include the Canadian dollar, Euro and British Pound. These contracts are not subject to

hedge accounting; as a result, gains or losses are recognized in income each period, generally offsetting the change in the U.S. dollar

value of the hedged asset or liability. As at February 26, 2011, net unrealized losses of $46 million were recorded in respect of this

amount (February 27, 2010 — net unrealized gains of $29 million). Unrealized gains associated with these contracts were recorded in

other current assets and selling, marketing and administration. Unrealized losses were recorded in accrued liabilities and selling,

marketing and administration.

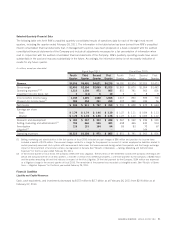

Interest Rate

Cash, cash equivalents and investments are invested in certain instruments of varying maturities. Consequently, the Company is

exposed to interest rate risk as a result of holding investments of varying maturities. The fair value of investments, as well as the

investment income derived from the investment portfolio, will fluctuate with changes in prevailing interest rates. The Company does not

currently use interest rate derivative financial instruments in its investment portfolio.

Credit and Customer Concentration

The Company has historically been dependent on an increasing number of significant telecommunication carriers and distribution

partners and on larger more complex contracts with respect to sales of the majority of its products and services. The Company

RESEARCH IN MOTION ANNUAL REPORT 2011 39