Advance Auto Parts 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-40

imported cars and light trucks. While the mix of Commercial and DIY customers varies among the four store brands, all of the

locations serve customers through similar distribution channels. The Company has begun implementation of its multi-year plan

to fully integrate the Carquest company-operated stores and overall operations into Advance Auto Parts and to eventually

integrate the availability of all of the Company's product offerings throughout the entire chain.

The Company's Advance Auto Parts operations are currently comprised of three geographic areas. Each of the Advance

Auto Parts geographic areas, in addition to Carquest and Worldpac, are individually considered operating segments which are

aggregated into one reportable segment. Effective Q1 2015, the Company's three geographic areas expanded to five areas,

inclusive of the Carquest operations, making Carquest no longer an operating segment. Included in the Company's overall store

operations are sales generated from its e-commerce platforms. The Company's e-commerce platforms, primarily consisting of

its online websites and Commercial ordering platforms, are part of its integrated operating approach of serving its Commercial

and DIY customers. Through the Company's online ordering platforms, Commercial customers can conveniently place orders

with a designated store location for delivery to their places of business or pick-up. The Company's online websites allow its

DIY customers to pick up merchandise at a conveniently located store location or have their purchases shipped directly to them.

The majority of the Company's online DIY sales are picked up at store locations.

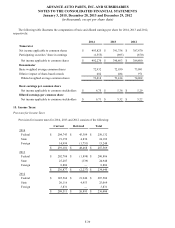

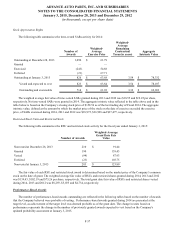

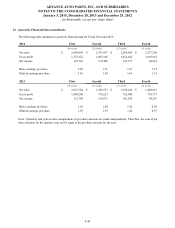

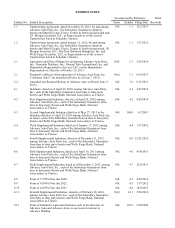

The following table summarizes financial information for each of the Company’s product groups for the years ended

January 3, 2015, December 28, 2013 and December 29, 2012, respectively.

2014 2013 2012

Percentage of Sales, by Product Group

Parts and Batteries 69% 67% 65%

Accessories 13% 14% 14%

Chemicals 8% 10% 10%

Oil 8% 9% 10%

Other 2% —% 1%

Total 100% 100% 100%

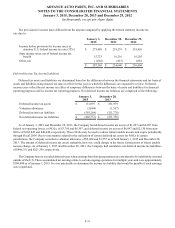

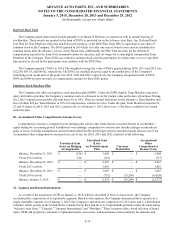

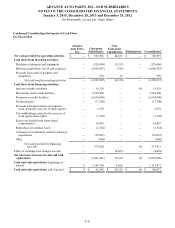

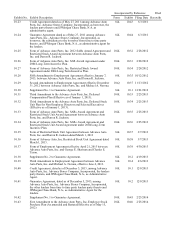

22. Condensed Consolidating Financial Statements:

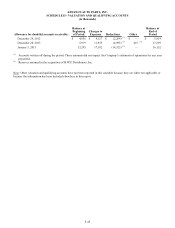

Certain 100% wholly-owned domestic subsidiaries of Advance, including its Material Subsidiaries (as defined in the 2013

Credit Agreement), serve as guarantors of Advance's senior unsecured notes ("Guarantor Subsidiaries"). The subsidiary

guarantees related to Advance's senior unsecured notes are full and unconditional and joint and several, and there are no

restrictions on the ability of Advance to obtain funds from its Guarantor Subsidiaries. Certain of Advance's wholly-owned

subsidiaries, including all of its foreign subsidiaries, do not serve as guarantors of Advance's senior unsecured notes ("Non-

Guarantor Subsidiaries"). Beginning in January 2014, the Non-Guarantor Subsidiaries, which were previously minor, no longer

qualified as minor as defined by SEC regulations. Accordingly, we present below the condensed consolidating financial

information for the Guarantor Subsidiaries and Non-Guarantor Subsidiaries. Investments in subsidiaries of the Company are

required to be presented under the equity method, even though all such subsidiaries meet the requirements to be consolidated

under GAAP.

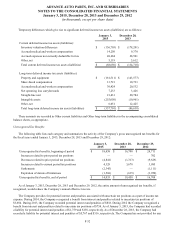

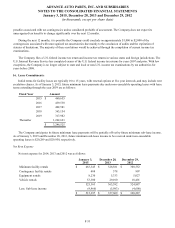

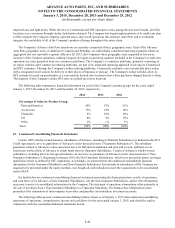

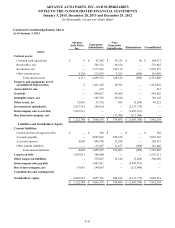

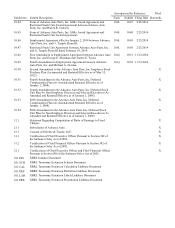

Set forth below are condensed consolidating financial statements presenting the financial position, results of operations,

and cash flows of (i) Advance, (ii) the Guarantor Subsidiaries, (iii) the Non-Guarantor Subsidiaries, and (iv) the eliminations

necessary to arrive at consolidated information for the Company. The statement of operations eliminations relate primarily to

the sale of inventory from a Non-Guarantor Subsidiary to a Guarantor Subsidiary. The balance sheet eliminations relate

primarily to the elimination of intercompany receivables and payables and subsidiary investment accounts.

The following tables present condensed consolidating balance sheets as of January 3, 2015 and condensed consolidating

statements of operations, comprehensive income and cash flows for the year ended January 3, 2015, and should be read in

conjunction with the consolidated financial statements herein.