Advance Auto Parts 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-16

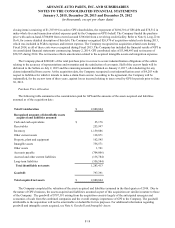

In May 2014, the FASB issued ASU 2014-09 "Revenue from Contracts with Customers." This ASU is a comprehensive

new revenue recognition model that expands disclosure requirements and requires a company to recognize revenue to depict

the transfer of goods or services to a customer at an amount that reflects the consideration it expects to receive in exchange for

those goods or services. This ASU is effective for annual reporting periods beginning after December 15, 2016 and early

adoption is not permitted. Accordingly, the Company will adopt this ASU on January 1, 2017. We are currently evaluating the

impact of the adoption of this guidance on the Company's consolidated financial condition, results of operations and cash

flows.

In April 2014, the FASB issued ASU No. 2014-08 "Presentation of Financial Statements (Topic 205) and Property, Plant,

and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of Equity",

which amends the definition of a discontinued operation in Accounting Standards Codification, or ASC, 205-20 and requires

entities to provide additional disclosures about discontinued operations as well as disposal transactions that do not meet the

discontinued operations criteria. The new guidance changes the definition of a discontinued operation and requires discontinued

operations treatment for disposals of a component or group of components that represents a strategic shift that has or will have

a major impact on an entity’s operations or financial results. The ASU is effective prospectively for all disposals (except

disposals classified as held for sale before the adoption date) or components initially classified as held for sale in periods

beginning on or after December 15, 2014; earlier adoption is permitted. The adoption of this guidance affects prospective

presentation of disposals and therefore, is not expected to have a material impact on the Company's consolidated financial

condition, results of operations or cash flows.

In July 2013, the FASB issued ASU No. 2013-11 “Presentation of an Unrecognized Tax Benefit When a Net

Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists.” Under ASU 2013-11 an entity

is required to present an unrecognized tax benefit, or a portion of an unrecognized tax benefit, in its financial statements

as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit

carryforward. If a net operating loss carryforward, a similar tax loss, or a tax credit carryforward is not available at the

reporting date, the unrecognized tax benefit should be presented in the financial statements as a liability and should not

be combined with deferred tax assets. ASU 2013-11 is effective for fiscal years, and interim periods within those years,

beginning after December 15, 2013. The adoption of this guidance affects presentation only and, therefore, had no

material impact on the Company's consolidated financial condition, results of operations or cash flows.

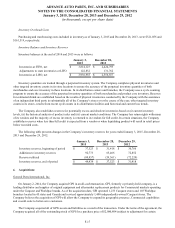

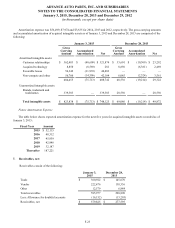

3. Inventories, net:

Merchandise Inventory

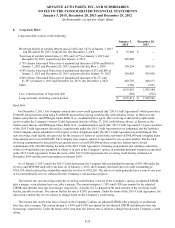

The Company used the LIFO method of accounting for approximately 88% of inventories at January 3, 2015 and 95% at

December 28, 2013. Under LIFO, the Company’s cost of sales reflects the costs of the most recently purchased inventories,

while the inventory carrying balance represents the costs for inventories purchased in 2014 and prior years. As a result of

utilizing LIFO, the Company recorded an increase to cost of sales of $8,930 in 2014 and a reduction to cost of sales of $5,572

and $24,087 in 2013 and 2012, respectively. The Company’s overall costs to acquire inventory for the same or similar products

have generally decreased historically as the Company has been able to leverage its continued growth and execution of

merchandise strategies. The increase in cost of sales for 2014 was the result of an increase in supply chain costs.

Product Cores

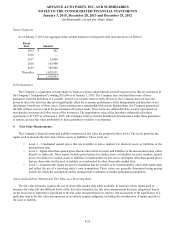

The remaining inventories are comprised of product cores, the non-consumable portion of certain parts and batteries and

the inventory of certain subsidiaries, which are valued under the first-in, first-out (“FIFO”) method. Product cores are included

as part of the Company’s merchandise costs and are either passed on to the customer or returned to the vendor. Because product

cores are not subject to frequent cost changes like the Company’s other merchandise inventory, there is no material difference

when applying either the LIFO or FIFO valuation method.