Advance Auto Parts 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

Commercial in 2014. Sales of seasonal and maintenance parts categories fluctuated more than anticipated in many of our

markets due to the cooler summer and warmer start to the winter selling season.

Acquisitions

On January 2, 2014, we acquired GPI in an all-cash transaction for $2.08 billion. GPI, formerly a privately-held company,

is a leading distributor and supplier of original equipment and aftermarket replacement products for Commercial markets

operating under the Carquest and Worldpac brands. As of the acquisition date, GPI operated 1,233 Carquest stores and 103

Worldpac branches located in 45 states and Canada and served approximately 1,400 independently-owned Carquest stores. We

believe the acquisition of GPI will allow us to expand our geographic presence, Commercial capabilities and overall scale to

better serve customers. For additional information on the GPI acquisition, refer to Note 4, "Acquisitions," in the Notes to our

Consolidated Financial Statements.

On December 31, 2012, we acquired BWP, a privately-held company that supplied, marketed and distributed automotive

aftermarket parts and products principally to Commercial customers. Prior to the acquisition, BWP operated or supplied 216

locations in the Northeastern United States. Concurrent with the closing of the acquisition, we transferred one distribution

center and BWP’s rights to distribute to 92 independently owned locations to an affiliate of GPI. The integration of BWP

stores consisted of converting or consolidating those locations into Advance Auto Parts locations. As of the end of 2014, most

of the BWP stores have been integrated into the Advance Auto Parts operations.

2014 Highlights

A high-level summary of our financial results and other highlights from our 2014 include:

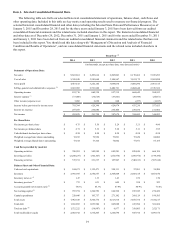

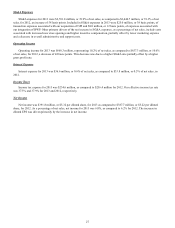

Financial

• Total sales during 2014 increased 51.6% to $9,843.9 million as compared to 2013. This increase was primarily driven

by the acquisition of GPI, a comparable store sales increase of 2.0%, $150.4 million in sales from the 53rd week and

sales from new stores opened during the past year.

• Our operating income for 2014 was $851.7 million, an increase of $191.4 million from the comparable period in 2013.

As a percentage of total sales, operating income was 8.7%, a decrease of 152 basis points, due to a lower gross profit

rate partially offset by a favorable SG&A rate.

• Our inventory balance as of January 3, 2015 increased $1,380.4 million, or 54.0%, over the prior year driven primarily

by the acquisition of GPI as well as inventory upgrades and increases from new stores and HUB stores.

• We generated operating cash flow of $709.0 million during 2014, an increase of 30.0% compared to 2013, primarily

due to an increase in net income and non-cash expenses.

Refer to the “Consolidated Results of Operations” and “Liquidity and Capital Resources” sections for further details of

our income statement and cash flow results, respectively.

Business Update

We have two essential priorities - (i) deliver results by executing under our key strategies of Superior Availability and

Service Leadership and (ii) successfully achieve the goals of the multi-year GPI integration plan. Our key strategies remain

consistent with 2014. Superior Availability is aimed at product availability and maximizing the speed, reliability and efficiency

of our supply chain. Service Leadership leverages our product availability in addition to more consistent execution of customer-

facing initiatives to strengthen our integrated operating approach of serving our customers in our stores and on-line. Through

these two key strategies and the integration of GPI, we believe we can continue to build on the initiatives discussed below to

produce favorable financial results over the long term. Sales to Commercial customers remain the largest opportunity for us to

increase our overall market share in the automotive aftermarket industry. Our Commercial sales, as a percentage of total sales,

increased to 57.0% in 2014 compared to 40.4% in 2013. This increase is primarily due to the contribution of the acquired GPI

and BWP operations which are significantly more heavily weighted in Commercial than our Advance Auto Parts stores. In

addition, our comparable store sales growth has been driven primarily by sales to Commercial customers.