Advance Auto Parts 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

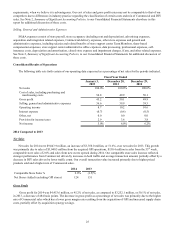

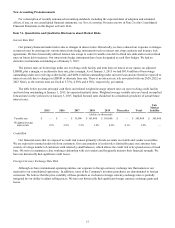

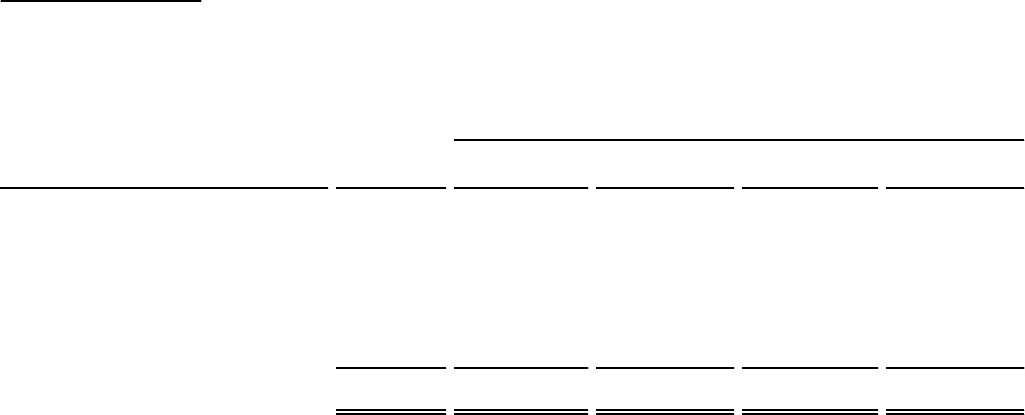

Contractual Obligations

In addition to our Notes and revolving credit facility, we utilize operating leases as another source of financing. The

amounts payable under these operating leases are included in our schedule of contractual obligations. Our future contractual

obligations related to long-term debt, operating leases and other contractual obligations as of January 3, 2015 were as follows:

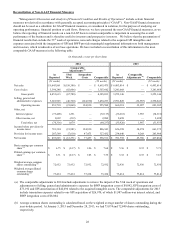

Payments Due by Period

Contractual Obligations Total

Less than

1 Year 1 - 3 Years 3 - 5 Years

More Than

5 Years

(in thousands)

Long-term debt (1) $ 1,636,893 $ 582 $ 35,000 $ 548,400 $ 1,052,911

Interest payments 447,827 62,219 138,144 130,031 117,433

Operating leases (2) 3,246,525 460,655 842,111 681,136 1,262,623

Other long-term liabilities (3) 580,069 — — — —

Purchase obligations (4) 68,685 39,241 15,788 5,432 8,224

$ 5,979,999 $ 562,697 $ 1,031,043 $ 1,364,999 $ 2,441,191

Note: For additional information refer to Note 8, Long-term Debt; Note 15, Income Taxes; Note 16, Lease Commitments; Note

17, Contingencies; and Note 18, Benefit Plans, in the Notes to Consolidated Financial Statements, included in Item 15.

Exhibits, Financial Statement Schedules, of this Annual Report on Form 10-K.

(1) Long-term debt primarily represents the principal amount of our 2020 Notes, 2022 Notes and 2023 Notes, which

become due in 2020, 2022 and 2023, respectively.

(2) We lease certain store locations, distribution centers, office space, equipment and vehicles. Our property leases

generally contain renewal and escalation clauses and other concessions. These provisions are considered in our

calculation of our minimum lease payments which are recognized as expense on a straight-line basis over the

applicable lease term. Any lease payments that are based upon an existing index or rate are included in our minimum

lease payment calculations.

(3) Includes the long-term portion other liabilities for which no contractual payment schedule exists and we expect the

payments to occur beyond 12 months from January 3, 2015. Accordingly, the related balances have not been reflected

in the “Payments Due by Period” section of the table. For additional information on the amounts included in this

balance see Note 12, Other Current and Long-term Liabilities.

(4) Purchase obligations include agreements to purchase goods or services that are enforceable, legally binding and

specify all significant terms, including fixed or minimum quantities to be purchased; fixed, minimum or variable price

provisions; and the approximate timing of the transaction. Included in the table above is the lesser of the remaining

obligation or the cancellation penalty under the agreement. Our open purchase orders related to merchandise inventory

are based on current operational needs and are fulfilled by our vendors within a short period of time. We currently do

not have minimum purchase commitments under our vendor supply agreements nor are our open purchase orders

binding agreements. Accordingly, we have excluded open purchase orders from the above table.