Advance Auto Parts 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-15

operations. Operations and associated cash flows transferred to another store in the local market are not considered eliminated

in the evaluation of discontinued operations.

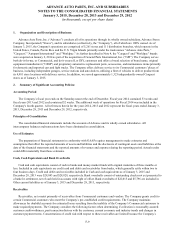

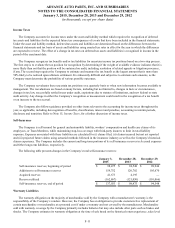

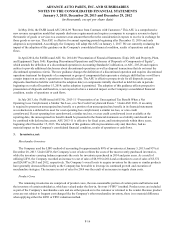

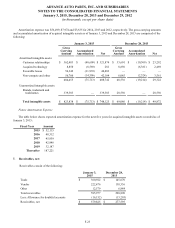

Cost of Sales and Selling, General and Administrative Expenses

The following table identifies the primary costs classified in each major expense category:

Cost of Sales SG&A

Total cost of merchandise sold including: Payroll and benefit costs for store and corporate

- Freight expenses associated with moving Team Members;

merchandise inventories from our vendors to Occupancy costs of store and corporate facilities;

our distribution center, Depreciation and amortization related to store and

- Vendor incentives, and corporate assets;

- Cash discounts on payments to vendors; Advertising;

Inventory shrinkage; Costs associated with our Commercial delivery

Defective merchandise and warranty costs; program, including payroll and benefit costs,

Costs associated with operating our distribution and transportation expenses associated with moving

network, including payroll and benefit costs, merchandise inventories from our stores and branches to

occupancy costs and depreciation; and our customer locations;

Freight and other handling costs associated with Self-insurance costs;

moving merchandise inventories through our Professional services;

supply chain Other administrative costs, such as credit card

- From our distribution centers to our store and service fees, supplies, travel and lodging;

branch locations and customers, and Closed store expense;

- From certain of our larger stores which stock a Impairment charges;

wider variety and greater supply of inventory (“HUB GPI acquisition-related expenses and integration costs;

stores”) to our stores after the customer has and

special-ordered the merchandise. BWP acquisition-related expenses and integration costs.

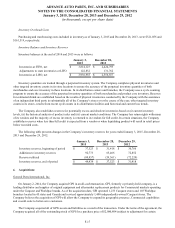

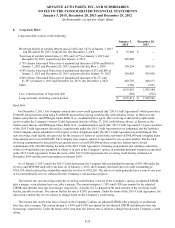

New Accounting Pronouncements

In August 2014, the Financial Accounting Standard Board, or FASB, issued Accounting Standard Update, or ASU, 2014-15

“Presentation of Financial Statements - Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity's Ability

to Continue as a Going Concern." This new standard requires management to perform interim and annual assessments of an

entity's ability to continue as a going concern within one year of the date the financial statements are issued. An entity must

provide certain disclosures if conditions or events raise substantial doubt about the entity's ability to continue as a going

concern. This ASU is effective for annual periods ending after December 15, 2016, and interim periods thereafter; earlier

adoption is permitted. The adoption of this guidance is not expected to have a material impact on the Company's consolidated

financial condition, results of operations or cash flows.

In June 2014, the FASB, issued ASU 2014-12 “Compensation - Stock Compensation (Topic 718): Accounting for Share-

Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite

Service Period." The amendments in this ASU require that a performance target that affects vesting and that could be achieved

after the requisite service period be treated as a performance condition. The amendments in this ASU are effective for annual

periods and interim periods within those annual periods beginning after December 15, 2015; earlier adoption is permitted. The

adoption of this guidance is not expected to have a material impact on the Company's consolidated financial condition, results

of operations or cash flows.