Advance Auto Parts 2014 Annual Report Download - page 60

Download and view the complete annual report

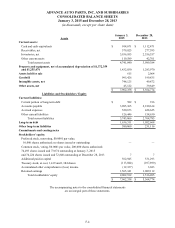

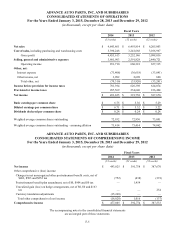

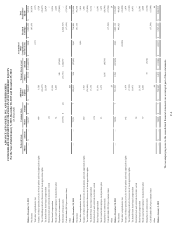

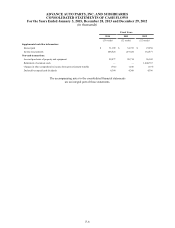

Please find page 60 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-13

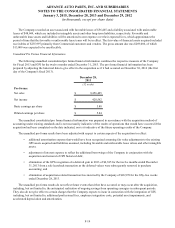

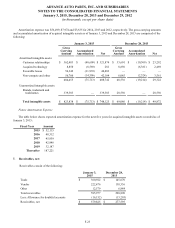

Goodwill and Other Intangible Assets

Goodwill is the excess of the purchase price over the fair value of identifiable net assets acquired in business combinations

accounted for under the purchase method. The Company tests goodwill and indefinite-lived intangible assets for impairment

annually as of the first day of the fiscal fourth quarter, or when indications of potential impairment exist. These indicators

would include a significant change in operating performance, the business climate, legal factors, competition, or a planned sale

or disposition of a significant portion of the business, among other factors. The Company reviews finite-lived intangible assets

for impairment in accordance with its policy for the valuation of long-lived assets.

Valuation of Long-Lived Assets

The Company evaluates the recoverability of its long-lived assets whenever events or changes in circumstances indicate

that the carrying amount of an asset might not be recoverable and exceeds its fair value.

Significant factors, which would trigger an impairment review, include the following:

• Significant decrease in the market price of a long-lived asset (asset group);

• Significant changes in how assets are used or are planned to be used;

• Significant adverse change in legal factors or business climate, including adverse regulatory action;

• Significant negative industry trends;

• An accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction

of a long-lived asset (asset group);

• Significant changes in technology;

• A current-period operating or cash flow loss combined with a history of operating or cash flow losses, or a projection

or forecast that demonstrates continuing losses associated with the use of a long-lived asset (asset group); or

• A current expectation that, more likely than not, a long-lived asset (asset group) will be sold or otherwise disposed of

significantly before the end of its previously estimated useful life.

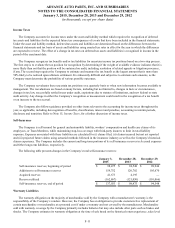

When such an event occurs, the Company estimates the undiscounted future cash flows expected to result from the use of

the long-lived asset (asset group) and its eventual disposition. These impairment evaluations involve estimates of asset useful

lives and future cash flows. If the undiscounted expected future cash flows are less than the carrying amount of the asset and

the carrying amount of the asset exceeds its fair value, an impairment loss is recognized. When an impairment loss is

recognized, the carrying amount of the asset is reduced to its estimated fair value based on quoted market prices or other

valuation techniques (e.g., discounted cash flow analysis). In 2014, the Company recognized impairment losses of $11,819 on

various store and corporate assets. The remaining fair value of these assets was not significant. There were no material

impairment losses in 2013 or 2012.

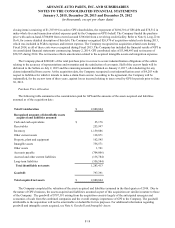

Earnings per Share

The Company uses the two-class method to calculate earnings per share. Under the two-class method, unvested share-

based payment awards that contain non-forfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are

considered participating securities and are included in the computation of earnings per share. Certain of the Company’s shares

granted to Team Members in the form of restricted stock and restricted stock units are considered participating securities.

Accordingly, earnings per share is computed by dividing net income attributable to the Company’s common shareholders

by the weighted-average common shares outstanding during the period. The two-class method is an earnings allocation formula

that determines income per share for each class of common stock and participating security according to dividends declared

and participation rights in undistributed earnings. Diluted income per common share reflects the more dilutive earnings per

share amount calculated using the treasury stock method or the two-class method.

Basic earnings per share of common stock has been computed based on the weighted-average number of common shares

outstanding during the period, which is reduced by stock held in treasury and shares of nonvested restricted stock. Diluted

earnings per share is calculated by including the effect of dilutive securities. Diluted earnings per share of common stock