Advance Auto Parts 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-17

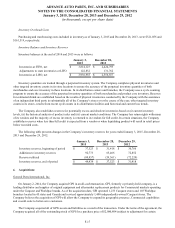

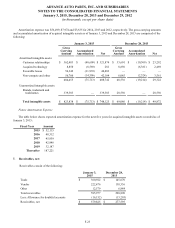

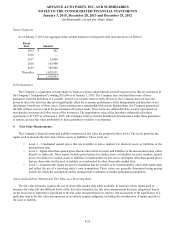

Inventory Overhead Costs

Purchasing and warehousing costs included in inventory as of January 3, 2015 and December 28, 2013, were $321,856 and

$161,519, respectively.

Inventory Balance and Inventory Reserves

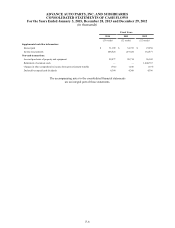

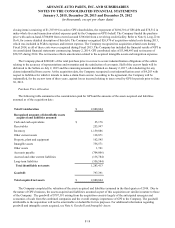

Inventory balances at the end of 2014 and 2013 were as follows:

January 3,

2015

December 28,

2013

Inventories at FIFO, net $ 3,814,123 $ 2,424,795

Adjustments to state inventories at LIFO 122,832 131,762

Inventories at LIFO, net $ 3,936,955 $ 2,556,557

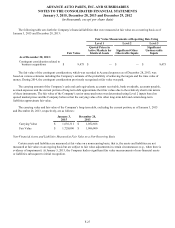

Inventory quantities are tracked through a perpetual inventory system. The Company completes physical inventories and

other targeted inventory counts in its store locations to ensure the accuracy of the perpetual inventory quantities of both

merchandise and core inventory in these locations. In its distribution centers and branches, the Company uses a cycle counting

program to ensure the accuracy of the perpetual inventory quantities of both merchandise and product core inventory. Reserves

for estimated shrink are established based on the results of physical inventories conducted by the Company with the assistance

of an independent third party in substantially all of the Company’s stores over the course of the year, other targeted inventory

counts in its stores, results from recent cycle counts in its distribution facilities and historical and current loss trends.

The Company also establishes reserves for potentially excess and obsolete inventories based on (i) current inventory

levels, (ii) the historical analysis of product sales and (iii) current market conditions. The Company has return rights with many

of its vendors and the majority of excess inventory is returned to its vendors for full credit. In certain situations, the Company

establishes reserves when less than full credit is expected from a vendor or when liquidating product will result in retail prices

below recorded costs.

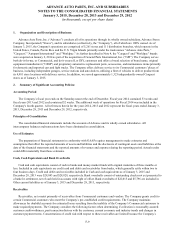

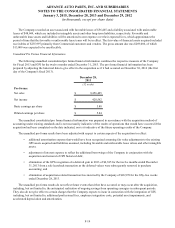

The following table presents changes in the Company’s inventory reserves for years ended January 3, 2015, December 28,

2013 and December 29, 2012:

January 3,

2015

December 28,

2013

December 29,

2012

Inventory reserves, beginning of period $ 37,523 $ 31,418 $ 30,786

Additions to inventory reserves 92,773 65,466 72,852

Reserves utilized (80,857)(59,361)(72,220)

Inventory reserves, end of period $ 49,439 $ 37,523 $ 31,418

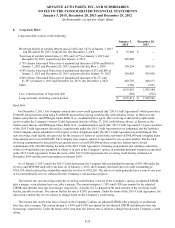

4. Acquisitions:

General Parts International, Inc.

On January 2, 2014, the Company acquired GPI in an all-cash transaction. GPI, formerly a privately-held company, is a

leading distributor and supplier of original equipment and aftermarket replacement products for Commercial markets operating

under the Carquest and Worldpac brands. As of the acquisition date, GPI operated 1,233 Carquest stores and 103 Worldpac

branches located in 45 states and Canada and serviced approximately 1,400 independently-owned Carquest stores. The

Company believes the acquisition of GPI will allow the Company to expand its geographic presence, Commercial capabilities

and overall scale to better serve customers.

The Company acquired all of GPI's assets and liabilities as a result of the transaction. Under the terms of the agreement, the

Company acquired all of the outstanding stock of GPI for a purchase price of $2,080,804 (subject to adjustment for certain