Advance Auto Parts 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-28

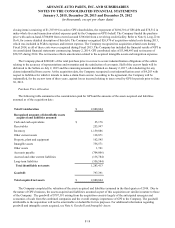

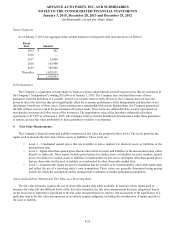

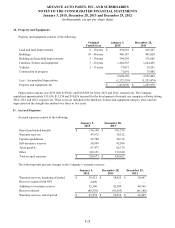

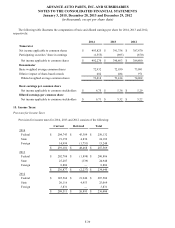

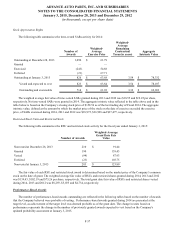

10. Property and Equipment:

Property and equipment consists of the following:

Original

Useful Lives

January 3,

2015

December 28,

2013

Land and land improvements 0 - 10 years $ 438,638 $ 418,207

Buildings 30 - 40 years 460,187 445,820

Building and leasehold improvements 3 - 30 years 394,259 336,685

Furniture, fixtures and equipment 3 - 20 years 1,402,563 1,244,456

Vehicles 2 - 13 years 37,051 18,291

Construction in progress 71,691 75,985

2,804,389 2,539,444

Less - Accumulated depreciation (1,372,359)(1,255,474)

Property and equipment, net $ 1,432,030 $ 1,283,970

Depreciation expense was $235,040, $199,821 and $185,909 for 2014, 2013 and 2012, respectively. The Company

capitalized approximately $11,436, $11,534 and $10,026 incurred for the development of internal use computer software during

2014, 2013 and 2012, respectively. These costs are included in the furniture, fixtures and equipment category above and are

depreciated on the straight-line method over three to five years.

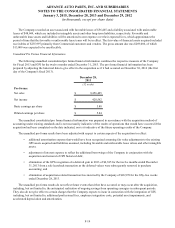

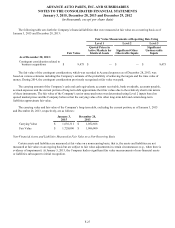

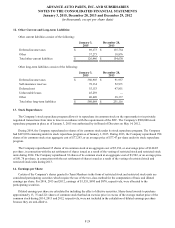

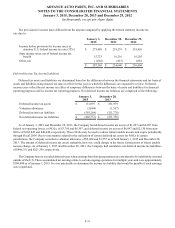

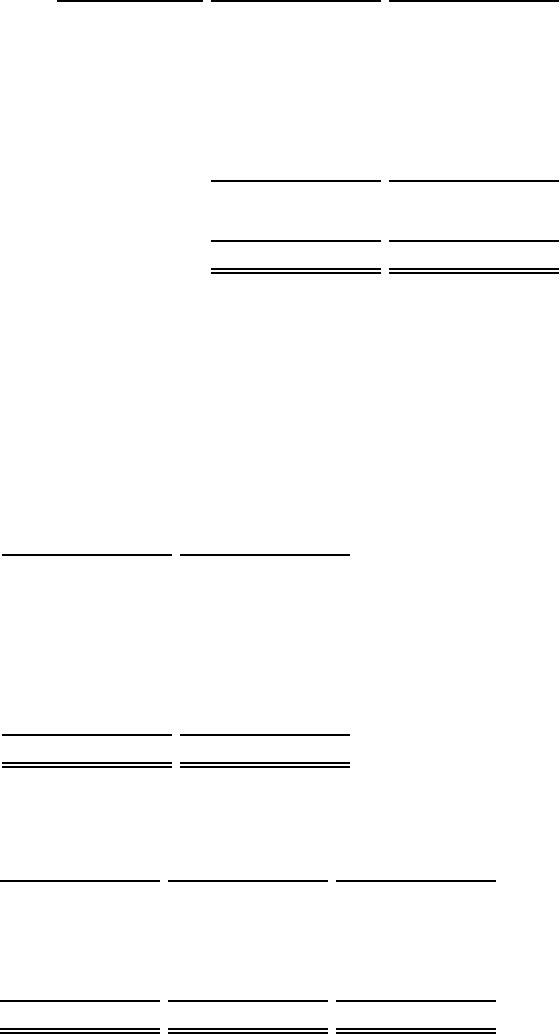

11. Accrued Expenses:

Accrued expenses consist of the following:

January 3,

2015

December 28,

2013

Payroll and related benefits $ 116,198 $ 101,576

Warranty reserves 47,972 39,512

Capital expenditures 29,780 20,714

Self-insurance reserves 58,899 45,504

Taxes payable 87,473 82,179

Other 180,351 139,140

Total accrued expenses $ 520,673 $ 428,625

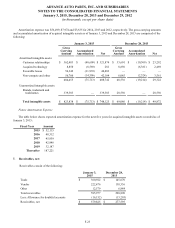

The following table presents changes in the Company’s warranty reserves:

January 3,

2015

December 28,

2013

December 29,

2012

Warranty reserves, beginning of period $ 39,512 $ 38,425 $ 38,847

Reserves acquired with GPI 4,490 — —

Additions to warranty reserves 52,306 42,380 40,766

Reserves utilized (48,336)(41,293)(41,188)

Warranty reserves, end of period $ 47,972 $ 39,512 $ 38,425