Advance Auto Parts 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-38

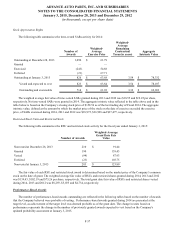

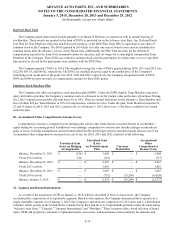

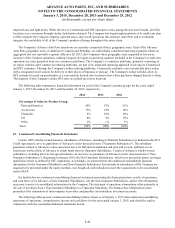

Compensation expense for performance-based awards of $6,161, $1,141, and $3,267 in 2014, 2013 and 2012, respectively,

was determined based on management’s estimate of the probable vesting outcome.

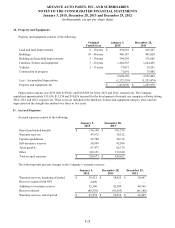

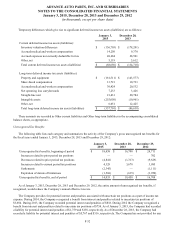

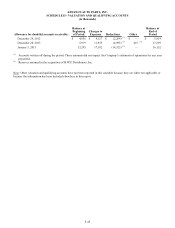

Performance-Based SARs

The following table summarizes the performance-based SARs activity for 2014:

Number of

Awards

Weighted-

Average

Exercise Price

Weighted-

Average

Remaining

Contractual

Term (in years)

Aggregate

Intrinsic Value

Outstanding at December 28, 2013 520 $ 78.21

Granted 303 141.57

Change in units based on performance (48) 90.57

Exercised (39) 35.18

Forfeited (107) 68.97

Outstanding at January 3, 2015 629 $ 112.01 5.47 $ 29,285

Vested and expected to vest 533 $ 108.17 4.97 $ 26,864

Outstanding and exercisable 92 $ 36.91 1.84 $ 11,152

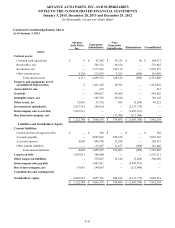

The weighted average fair value of performance-based SARs granted during 2014, 2013 and 2012 was $32.41, $23.72 and

$19.23 per share, respectively. The aggregate intrinsic value of performance-based SARs exercised during 2014, 2013 and 2012

was $3,814, $14,257 and $34,020, respectively. As of January 3, 2015, the maximum potential payout under the Company’s

currently outstanding performance-based SAR awards was 2,167 units.

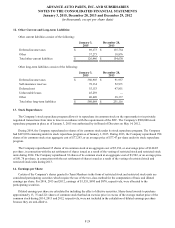

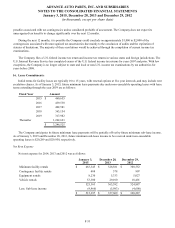

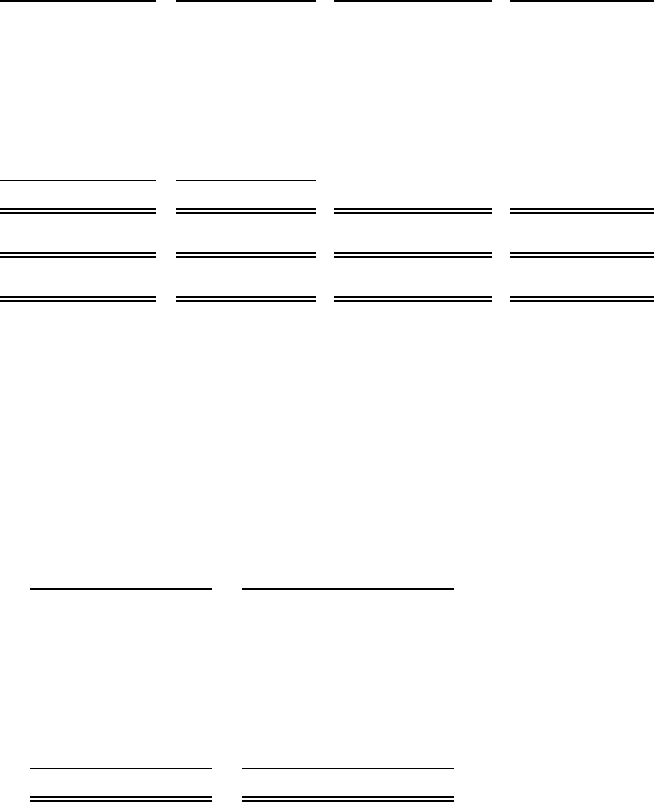

Performance-Based Restricted Stock Units

The following table summarizes the performance-based RSUs activity for 2014:

Number of Awards

Weighted-Average

Grant Date Fair Value

Nonvested at December 28, 2013 182 $ 75.36

Granted 19 123.32

Change in units based on performance 6 104.87

Vested (2) 74.43

Forfeited (10) 76.09

Nonvested at January 3, 2015 195 $ 81.98

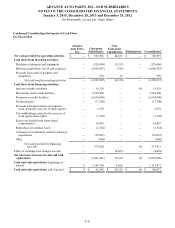

The fair value of each performance-based RSU is determined based on the market price of the Company’s common stock

on the date of grant. The weighted average fair value of performance-based RSUs granted during 2014, 2013 and 2012 was

$123.32, $77.47 and $75.20 per share, respectively. The total grant date fair value of performance-based restricted stock vested

during 2014, 2013 and 2012 was $142, $1,290 and $4,858, respectively. As of January 3, 2015, the maximum potential payout

under the Company’s currently outstanding performance-based RSUs was 462 shares.