Advance Auto Parts 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

We may not be able to successfully integrate GPI’s operations with ours; the GPI business may not achieve the expected

business results and could cause us to incur unexpected liabilities; the GPI acquisition has caused and may continue to

cause us to incur significant transaction and integration costs; our level of indebtedness could limit the cash flow

available for operations and could adversely affect our ability to service our debt or obtain additional financing; and we

may not be able to retain key GPI personnel.

Integration Issues and Business Expectations

We cannot be certain whether, and to what extent, any strategic, operational, financial or other anticipated benefits

resulting from the acquisition of GPI will be achieved. In order to obtain the anticipated benefits of the transaction, we must

integrate GPI’s operations with ours. This integration may be complex and failure to do so quickly and effectively may

negatively affect our earnings. The market price of our common stock may decline as a result of the acquisition if our

integration of GPI is unsuccessful, takes longer than expected or fails to achieve financial benefits to the extent anticipated by

financial analysts or investors, or the effect of the acquisition on our financial results is otherwise not consistent with the

expectations of financial analysts or investors.

The acquisition of GPI could cause disruptions in and create uncertainty surrounding GPI’s and our businesses, including

affecting GPI’s and our relationships with existing and future customers, wholesalers, independently-owned and jobber stores,

suppliers and employees, which could have an adverse effect on GPI’s and our businesses, financial results and operations. In

particular, GPI and Advance could lose customers or suppliers, and new customer or supplier contracts could be delayed or

decreased or otherwise adversely affected in economic value. In addition, we have diverted, and will continue to divert,

significant management resources towards the integration efforts, which could adversely affect our business and results of

operations.

In connection with our acquisition of GPI, we assumed all of the liabilities of GPI, including any actual or contingent

liabilities to which GPI is or may become subject. GPI may be or may become subject to loss contingencies, known or

unknown, which could relate to past, present, or future facts, events, circumstances or occurrences. Although the agreement

pursuant to which we acquired GPI provides us with certain indemnification provisions, potential costs relating to any such

liabilities could exceed the amount of any such indemnification or extend beyond the indemnification period.

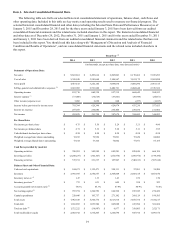

Additional Transaction and Integration Costs

In connection with the GPI acquisition, we have incurred significant one-time transaction costs and entered into new

financing agreements and issued new debt instruments. We expect to incur additional transaction and integration costs in

connection with the acquisition. Although efficiencies related to the integration of the businesses may allow us to offset

incremental transaction and integration costs over time, this net benefit may not be achieved in the near term, or at all.

Level of Indebtedness

In connection with our acquisition of GPI our level of indebtedness increased significantly. Our indebtedness could restrict

our operations and make it more difficult for us to satisfy our debt obligations. For example, our level of indebtedness could,

among other things:

• affect our liquidity by limiting our ability to obtain additional financing for working capital, limit our ability to obtain

financing for capital expenditures and acquisitions or make any available financing more costly;

• require us to dedicate all or a substantial portion of our cash flow to service our debt, which would reduce funds

available for other business purposes, such as capital expenditures, dividends or acquisitions;

• limit our flexibility in planning for or reacting to changes in the markets in which we compete;

• place us at a competitive disadvantage relative to our competitors who may have less indebtedness;

• render us more vulnerable to general adverse economic and industry conditions; and

• make it more difficult for us to satisfy our financial obligations, including those relating to the notes associated with

the acquisition of GPI.

In addition, the indenture governing the notes related to the GPI acquisition and the credit agreement governing the new

credit facilities contain financial and other restrictive covenants that limit our ability to engage in activities that may be in our

long-term best interests. Our failure to comply with those covenants could result in an event of default which, if not cured or

waived, could result in the acceleration of all of our debt, including such notes.