Advance Auto Parts 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-6

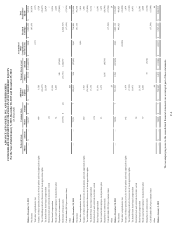

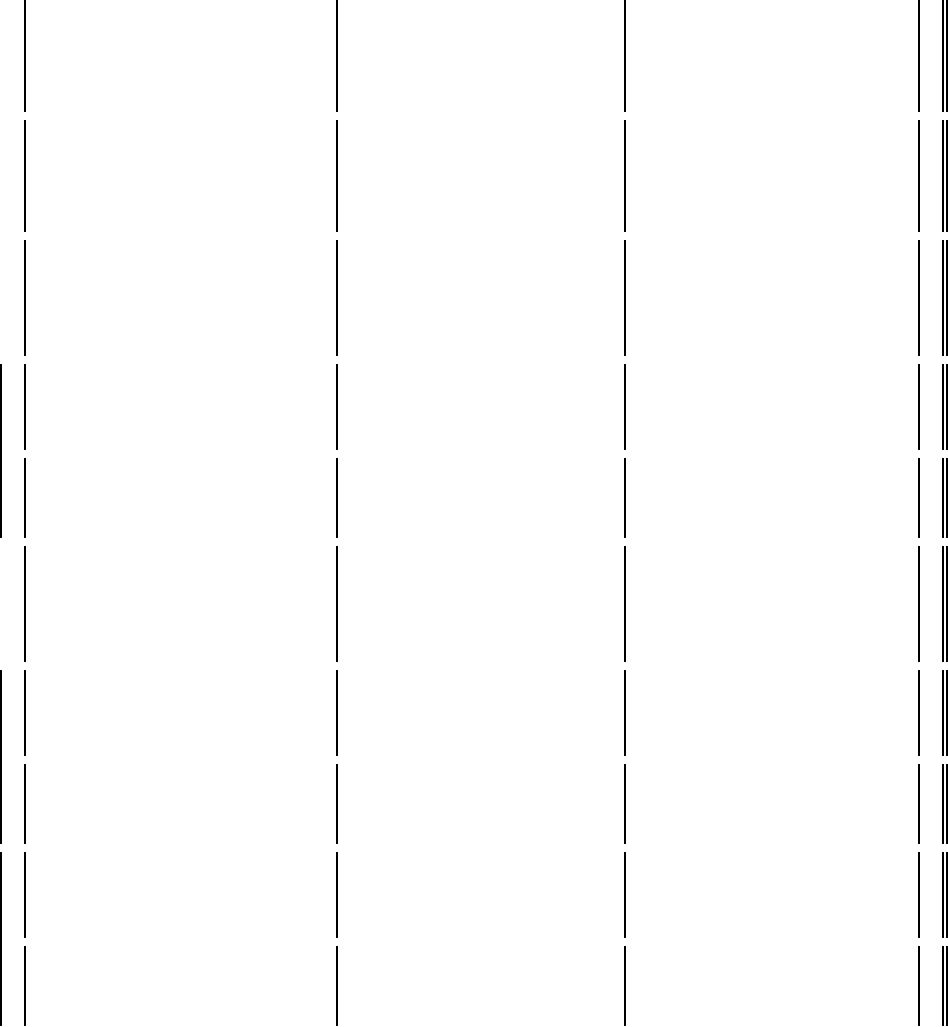

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

CONSOLIDATD STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

For the Years Ended January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands)

Preferred Stock Common Stock Additional

Paid-in

Capital

Treasury Stock, at cost

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

Total

Stockholders'

Equity

Shares Amount Shares Amount Shares Amount

Balance, December 31, 2011 — $ — 106,537 $ 11 $ 500,237 33,738 $ (1,644,767) $ 2,804 $ 1,989,629 $ 847,914

Net income 387,670 387,670

Total other comprehensive loss (137) (137)

Issuance of shares upon the exercise of stock options and stock appreciation rights 900 5,720 5,720

Tax withholdings related to the exercise of stock appreciation rights (26,677)(26,677)

Tax benefit from share-based compensation 22,924 22,924

Restricted stock and restricted stock units vested (2) —

Share-based compensation 15,236 15,236

Stock issued under employee stock purchase plan 34 2,266 2,266

Repurchase of common stock 348 (27,095) (27,095)

Retirement of treasury stock (33,738)$ (4) (33,738) 1,644,767 (1,644,763) —

Cash dividends ($0.24 per common share) (17,636) (17,636)

Other 509 509

Balance, December 29, 2012 — — 73,731 7 520,215 348 (27,095) 2,667 714,900 1,210,694

Net income 391,758 391,758

Total other comprehensive income 1,016 1,016

Issuance of shares upon the exercise of stock options and stock appreciation rights 480 1,903 1,903

Tax withholdings related to the exercise of stock appreciation rights (21,856)(21,856)

Tax benefit from share-based compensation 16,132 16,132

Restricted stock and restricted stock units vested (10) —

Share-based compensation 13,191 13,191

Stock issued under employee stock purchase plan 23 1,679 1,679

Repurchase of common stock 1,036 (80,795) (80,795)

Cash dividends ($0.24 per common share) (17,546) (17,546)

Other 29 29

Balance, December 28, 2013 — — 74,224 7 531,293 1,384 (107,890) 3,683 1,089,112 1,516,205

Net income 493,825 493,825

Total other comprehensive loss (16,020) (16,020)

Issuance of shares upon the exercise of stock options and stock appreciation rights 162 1,874 1,874

Tax withholdings related to the exercise of stock appreciation rights (7,102)(7,102)

Tax benefit from share-based compensation 10,471 10,471

Restricted stock and restricted stock units vested 68 —

Share-based compensation 21,705 21,705

Stock issued under employee stock purchase plan 39 4,660 4,660

Repurchase of common stock 35 (5,154) (5,154)

Cash dividends ($0.24 per common share) (17,596) (17,596)

Other 44 44

Balance, January 3, 2015 — $ — 74,493 $ 7 $ 562,945 1,419 $ (113,044) $ (12,337) $ 1,565,341 $ 2,002,912

The accompanying notes to the consolidated financial statements are an integral part of these statements.