Advance Auto Parts 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-20

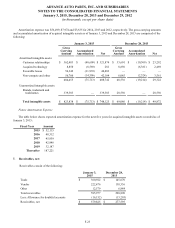

B.W.P. Distributors, Inc.

On December 31, 2012, the Company acquired B.W.P. Distributors, Inc. ("BWP") in an all-cash transaction. BWP,

formerly a privately-held company, supplied, marketed and distributed automotive aftermarket parts and products principally to

Commercial customers. Prior to the acquisition, BWP operated or supplied 216 locations in the northeastern U.S. The Company

believes this acquisition will enable the Company to continue its expansion in the competitive Northeast, which is a strategic

growth area for the Company due to the large population and overall size of the market, and to gain valuable information to

apply to its existing operations as a result of BWP's expertise in Commercial. The amount of acquired goodwill reflects this

strategic importance to the Company.

Concurrent with the closing of the acquisition, the Company transferred one distribution center and BWP's rights to

distribute to 92 independently owned locations to an affiliate of GPI. As a result, the Company began operating the 124 BWP

company-owned stores and two remaining BWP distribution centers as of the closing date. The Company has included the

financial results of BWP in its consolidated financial statements commencing December 31, 2012 (Fiscal 2013). Pro forma

results of operations related to the acquisition of BWP are not presented as BWP's results are not material to the Company's

consolidated statements of operations.

Under the terms of the agreement, the Company acquired the net assets in exchange for a purchase price of $187,109.

Following the closing of the acquisition, the Company sold certain of the acquired assets for $16,798 related to the transfer of

operations to GPI. The Company recognized $123,446 of goodwill upon the acquisition, which is expected to be deductible for

income tax purposes.

Other

The Company also acquired nine stores during 2014 with an aggregate purchase price of $5,155. The results of these stores are

not material to the Company's consolidated financial statements.

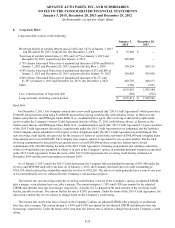

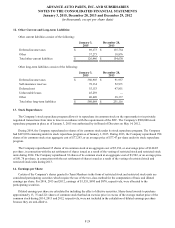

5. Exit Activities and Impairment:

Office Consolidations

In June 2014, the Company approved plans to relocate operations from its Minneapolis, Minnesota and Campbell,

California offices to other existing offices of the Company, including its offices in Newark, California, Roanoke, Virginia and

Raleigh, North Carolina, and to close its Minneapolis and Campbell offices. The Company also expects to relocate various

functions between its existing offices in Roanoke and Raleigh. The Company anticipates that the relocations and office closings

will be substantially completed by the end of 2015.

In connection with these relocations and office closings, the Company plans to relocate some employees and terminate the

employment of others. The Board of Directors of the Company approved this action in order to take advantage of synergies

following the acquisition of GPI and to capitalize on the strength of existing locations and organizational experience. The

Company estimates that it will incur restructuring costs of approximately $28,800 under these plans through the end of 2015.

Substantially all of these costs are expected to be cash expenditures. This estimate includes approximately $11,200 of employee

severance costs and $17,600 of relocation costs.

Employees receiving severance/outplacement benefits will be required to render service until they are terminated in order

to receive the benefits. Therefore, the severance/outplacement benefits will be recognized over the related service periods.

During 2014, the Company recognized $6,731 of severance/outplacement benefits under these restructuring plans and other

severance related to the acquisition of GPI. Other restructuring costs, including costs to relocate employees, will be recognized

in the period in which the liability is incurred. During 2014, the Company recognized $7,053 of relocation costs.