Advance Auto Parts 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-26

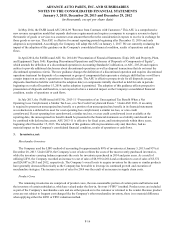

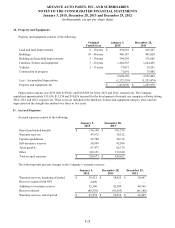

Future Payments

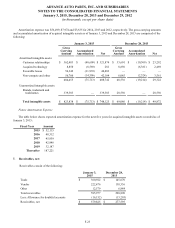

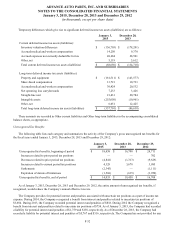

As of January 3, 2015, the aggregate future annual maturities of long-term debt instruments are as follows:

Fiscal

Year Amount

2015 $ 582

2016 —

2017 35,000

2018 163,400

2019 385,000

Thereafter 1,052,911

$ 1,636,893

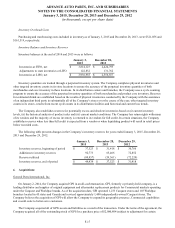

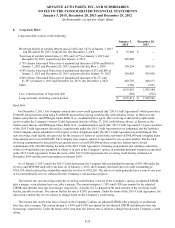

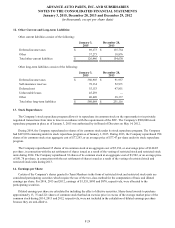

Debt Guarantees

The Company is a guarantor of loans made by banks to various independently-owned Carquest stores that are customers of

the Company ("Independents") totaling $33,606 as of January 3, 2015. The Company has concluded that some of these

guarantees meet the definition of a variable interest in a variable interest entity. However, the Company does not have the

power to direct the activities that most significantly affect the economic performance of the Independents and therefore is not

the primary beneficiary of these stores. Upon entering into a relationship with certain Independents, the Company guaranteed

the debt of those stores to aid in the procurement of business loans. These loans are collateralized by security agreements on

merchandise inventory and other assets of the borrowers. The approximate value of the inventory collateralized in these

agreements is $71,997 as of January 3, 2015. The Company believes that the likelihood of performance under these guarantees

is remote, and any fair value attributable to these guarantees would be very minimal.

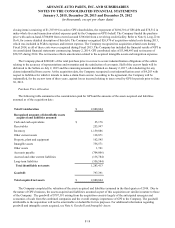

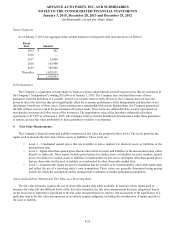

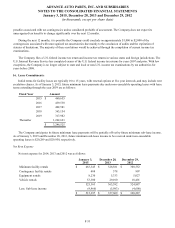

9. Fair Value Measurements:

The Company’s financial assets and liabilities measured at fair value are grouped in three levels. The levels prioritize the

inputs used to measure the fair value of these assets or liabilities. These levels are:

• Level 1 – Unadjusted quoted prices that are available in active markets for identical assets or liabilities at the

measurement date.

• Level 2 – Inputs other than quoted prices that are observable for assets and liabilities at the measurement date, either

directly or indirectly. These inputs include quoted prices for similar assets or liabilities in active markets, quoted

prices for identical or similar assets or liabilities in markets that are less active, and inputs other than quoted prices

that are observable for the asset or liability or corroborated by other observable market data.

• Level 3 – Unobservable inputs for assets or liabilities that are not able to be corroborated by observable market data

and reflect the use of a reporting entity’s own assumptions. These values are generally determined using pricing

models for which the assumptions utilize management’s estimates of market participant assumptions.

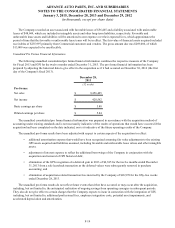

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The fair value hierarchy requires the use of observable market data when available. In instances where inputs used to

measure fair value fall into different levels of the fair value hierarchy, the fair value measurement has been categorized based

on the lowest level input that is significant to the fair value measurement in its entirety. Our assessment of the significance of a

particular item to the fair value measurement in its entirety requires judgment, including the consideration of inputs specific to

the asset or liability.