Advance Auto Parts 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-33

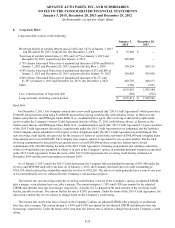

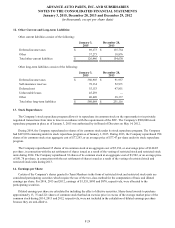

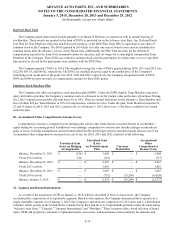

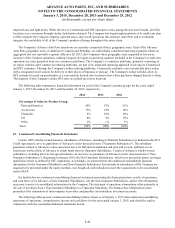

penalties associated with tax contingencies unless considered probable of assessment. The Company does not expect its

unrecognized tax benefits to change significantly over the next 12 months.

During the next 12 months, it is possible the Company could conclude on approximately $1,000 to $2,000 of the

contingencies associated with unrecognized tax uncertainties due mainly to the conclusion of audits and the expiration of

statutes of limitations. The majority of these resolutions would be achieved through the completion of current income tax

examinations.

The Company files a U.S. federal income tax return and income tax returns in various states and foreign jurisdictions. The

U.S. Internal Revenue Service has completed exams of the U.S. federal income tax returns for years 2007 and prior. With few

exceptions, the Company is no longer subject to state and local or non-U.S. income tax examinations by tax authorities for

years before 2008.

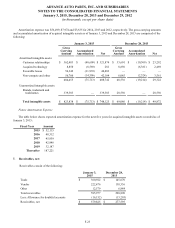

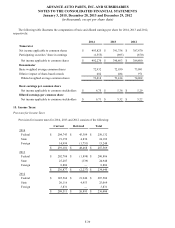

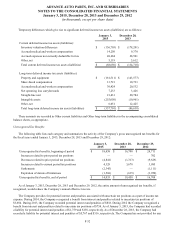

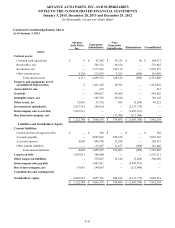

16. Lease Commitments:

Initial terms for facility leases are typically 10 to 15 years, with renewal options at five year intervals, and may include rent

escalation clauses. As of January 3, 2015, future minimum lease payments due under non-cancelable operating leases with lease

terms extending through the year 2059 are as follows:

Fiscal Year Amount

2015 $ 460,655

2016 439,530

2017 402,581

2018 363,154

2019 317,982

Thereafter 1,262,623

$ 3,246,525

The Company anticipates its future minimum lease payments will be partially off-set by future minimum sub-lease income.

As of January 3, 2015 and December 28, 2013, future minimum sub-lease income to be received under non-cancelable

operating leases is $20,289 and $29,950, respectively.

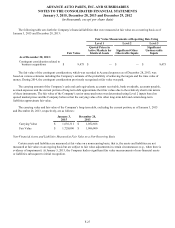

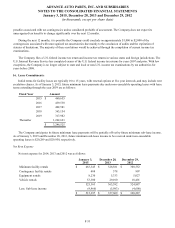

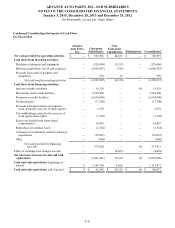

Net Rent Expense

Net rent expense for 2014, 2013 and 2012 was as follows:

January 3,

2015

December 28,

2013

December 29,

2012

Minimum facility rentals $ 463,345 $ 328,581 $ 300,552

Contingency facility rentals 488 578 907

Equipment rentals 8,230 5,333 5,027

Vehicle rentals 53,300 29,100 18,401

525,363 363,592 324,887

Less: Sub-lease income (9,966)(5,983)(4,600)

$ 515,397 $ 357,609 $ 320,287