Advance Auto Parts 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-29

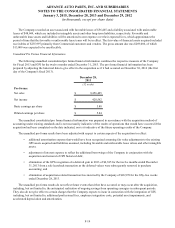

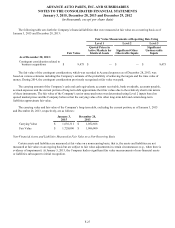

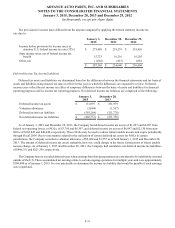

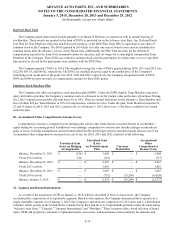

12. Other Current and Long-term Liabilities:

Other current liabilities consist of the following:

January 3,

2015

December 28,

2013

Deferred income taxes $ 89,173 $ 135,754

Other 37,273 18,876

Total other current liabilities $ 126,446 $ 154,630

Other long-term liabilities consist of the following:

January 3,

2015

December 28,

2013

Deferred income taxes $ 360,903 $ 91,957

Self-insurance reserves 78,134 52,971

Deferred rent 55,153 47,851

Unfavorable leases 45,259 —

Other 40,620 38,337

Total other long-term liabilities $ 580,069 $ 231,116

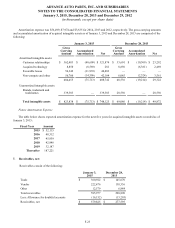

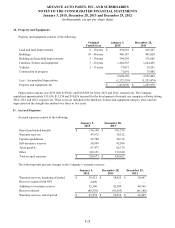

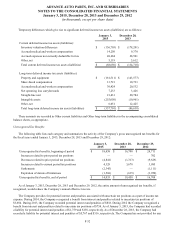

13. Stock Repurchases:

The Company’s stock repurchase program allows it to repurchase its common stock on the open market or in privately

negotiated transactions from time to time in accordance with the requirements of the SEC. The Company’s $500,000 stock

repurchase program in place as of January 3, 2015 was authorized by its Board of Directors on May 14, 2012.

During 2014, the Company repurchased no shares of its common stock under its stock repurchase program. The Company

had $415,092 remaining under its stock repurchase program as of January 3, 2015. During 2013, the Company repurchased 998

shares of its common stock at an aggregate cost of $77,293, or an average price of $77.47 per share under its stock repurchase

program.

The Company repurchased 35 shares of its common stock at an aggregate cost of $5,154, or an average price of $148.85

per share, in connection with the net settlement of shares issued as a result of the vesting of restricted stock and restricted stock

units during 2014. The Company repurchased 38 shares of its common stock at an aggregate cost of $3,502, or an average price

of $91.78 per share, in connection with the net settlement of shares issued as a result of the vesting of restricted stock and

restricted stock units during 2013.

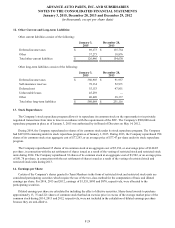

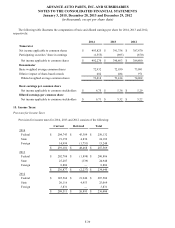

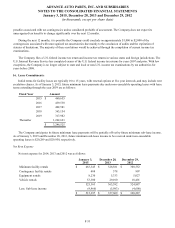

14. Earnings per Share:

Certain of the Company’s shares granted to Team Members in the form of restricted stock and restricted stock units are

considered participating securities which require the use of the two-class method for the computation of basic and diluted

earnings per share. For 2014, 2013 and 2012, earnings of $1,555, $895 and $870, respectively, were allocated to the

participating securities.

Diluted earnings per share are calculated by including the effect of dilutive securities. Share-based awards to purchase

approximately 13, 75 and 221 shares of common stock that had an exercise price in excess of the average market price of the

common stock during 2014, 2013 and 2012, respectively, were not included in the calculation of diluted earnings per share

because they are anti-dilutive.