Advance Auto Parts 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-22

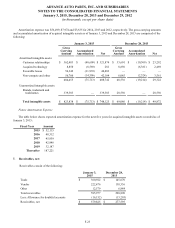

6. Goodwill and Intangible Assets:

Goodwill

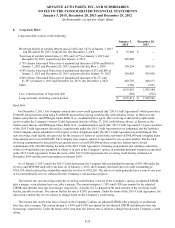

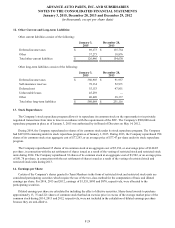

The following table reflects the carrying amount of goodwill and the changes in goodwill carrying amounts.

January 3,

2015

December 28,

2013

(53 weeks ended) (52 weeks ended)

Goodwill, beginning of period $ 199,835 $ 76,389

Acquisitions 798,043 123,446

Changes in foreign currency exchange rates (2,452)—

Goodwill, end of period $ 995,426 $ 199,835

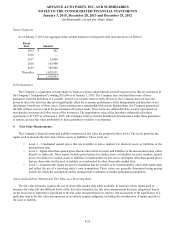

As discussed in Note 4, Acquisitions, on January 2, 2014, the Company acquired GPI in an all-cash transaction which

resulted in the addition of $797,391 of goodwill. During 2014, the Company also added $652 of goodwill associated with the

acquisition of nine stores. On December 31, 2012, the Company acquired BWP in an all-cash transaction which resulted in the

addition of $123,446 of goodwill.

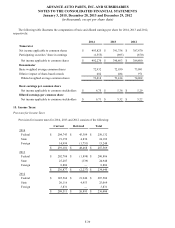

Intangible Assets Other Than Goodwill

In 2014, the Company recorded an increase to intangible assets of $757,453 related to the acquisition of GPI and nine

stores. The increase included customer relationships of $330,293 which will be amortized over 12 years, non-competes totaling

$50,695 which will be amortized over 5 years and favorable leases of $56,465 which will be amortized over the life of the

leases at a weighted average of 4.5 years. The increase also includes indefinite-lived intangibles of $320,000 from acquired

brands.

In 2013, the Company recorded a net increase to intangible assets of $29,001 related to the acquisition of BWP. The net

increase included customer relationships of $23,801 which will be amortized over 12 years and other intangible assets of

$5,200 which will be amortized over a weighted average of 3.4 years. The increases in intangible assets are presented net of the

sale of certain BWP customer relationships subsequent to the acquisition which reduced intangible assets by $2,244.