Advance Auto Parts 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

New Accounting Pronouncements

For a description of recently announced accounting standards, including the expected dates of adoption and estimated

effects, if any, on our consolidated financial statements, see New Accounting Pronouncements in Note 2 to the Consolidated

Financial Statements in this Report on Form 10-K.

Item 7A. Quantitative and Qualitative Disclosures about Market Risks.

Interest Rate Risk

Our primary financial market risk is due to changes in interest rates. Historically, we have reduced our exposure to changes

in interest rates by entering into various interest rate hedge instruments such as interest rate swap contracts and treasury lock

agreements. We have historically utilized interest rate swaps to convert variable rate debt to fixed rate debt and to lock in fixed

rates on future debt issuances. Our interest rate hedge instruments have been designated as cash flow hedges. We had no

derivative instruments outstanding as of January 3, 2015.

The interest rates on borrowings under our revolving credit facility and term loan are based, at our option, on adjusted

LIBOR, plus a margin, or an alternate base rate, plus a margin. As of January 3, 2015 we had $93.4 million of borrowings

outstanding under our revolving credit facility and $490.0 million outstanding under our term loan and are therefore exposed to

interest rate risk due to changes in LIBOR or alternate base rate. There is no interest rate risk associated with our 2020, 2022 or

2023 Notes, as the interest rates are fixed at 5.75%, 4.50% and 4.50%, respectively, per annum.

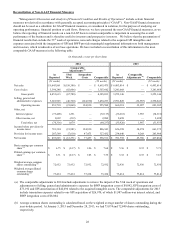

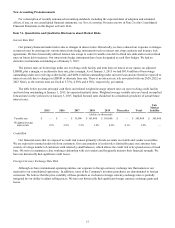

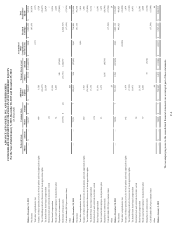

The table below presents principal cash flows and related weighted average interest rates on our revolving credit facility

and term loan outstanding at January 3, 2015, by expected maturity dates. Weighted average variable rates are based on implied

forward rates in the yield curve at January 3, 2015. Implied forward rates should not be considered a predictor of actual future

interest rates.

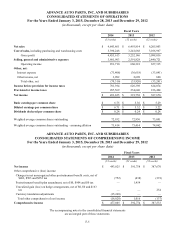

2015 2016 2017 2018 2019 Thereafter Total

Fair

Market

Liability

(dollars in thousands)

Variable rate $ — $ — $ 35,000 $ 163,400 $ 385,000 $ — $ 583,400 $ 583,400

Weighted average

interest rate 1.9% 2.8% 3.5% 3.8% 4.0% 4.1% 3.0% —

Credit Risk

Our financial assets that are exposed to credit risk consist primarily of trade accounts receivable and vendor receivables.

We are exposed to normal credit risk from customers. Our concentration of credit risk is limited because our customer base

consists of a large number of customers with relatively small balances, which allows the credit risk to be spread across a broad

base. We strive to maintain a close working relationship with our vendors and frequently monitor their financial strength. We

have not historically had significant credit losses.

Foreign Currency Exchange Rate Risk

Although we have international operating entities, our exposure to foreign currency exchange rate fluctuations is not

material to our consolidated operations. In addition, some of the Company's inventory purchases are denominated in foreign

currencies. We believe that the price volatility of these products as it relates to foreign currency exchange rates is partially

mitigated by our ability to adjust selling prices. We have not historically had significant foreign currency exchange gains and

losses.