Advance Auto Parts 2014 Annual Report Download - page 59

Download and view the complete annual report

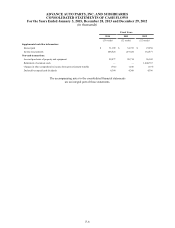

Please find page 59 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-12

and cost of the respective product sold. To the extent vendors provide upfront allowances in lieu of accepting the obligation for

warranty claims and the allowance is in excess of the related warranty expense, the excess is recorded as a reduction to cost of

sales.

Revenue Recognition

The Company recognizes revenue at the time the sale is made, at which time the Company’s walk-in customers take

immediate possession of the merchandise or same-day delivery is made to the Company’s commercial delivery customers,

which include certain independently-owned store locations. For e-commerce sales, revenue is recognized either at the time of

pick-up at one of the Company’s store locations or at the time of shipment depending on the customer’s order designation.

Sales are recorded net of discounts and rebates, sales taxes and estimated returns and allowances. The Company estimates the

reduction to sales and cost of sales for returns based on current sales levels and the Company’s historical return experience. The

Company’s reserve for sales returns and allowances was not material as of January 3, 2015 and December 28, 2013.

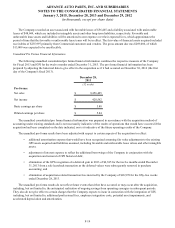

Share-Based Payments

The Company provides share-based compensation to its Team Members and Board of Directors. The Company is required

to exercise judgment and make estimates when determining the (i) fair value of each award granted and (ii) projected number

of awards expected to vest. The Company calculates the fair value of all share-based awards at the date of grant and uses the

straight-line method to amortize this fair value as compensation cost over the requisite service period.

Derivative Instruments and Hedging Activities

The Company’s accounting policy for derivative financial instruments is based on whether the instruments meet the criteria

for designation as cash flow or fair value hedges. The criteria for designating a derivative as a hedge include the assessment of

the instrument’s effectiveness in risk reduction, matching of the derivative instrument to its underlying transaction and the

probability that the underlying transaction will occur. For derivatives with cash flow hedge designation, the Company would

recognize the after-tax gain or loss from the effective portion of the hedge as a component of Accumulated other income (loss)

and reclassify it into earnings in the same period or periods in which the hedged transaction affected earnings, and within the

same income statement line item as the impact of the hedged transaction. For derivatives with fair value hedge accounting

designation, the Company would recognize gains or losses from the change in the fair value of these derivatives, as well as the

offsetting change in the fair value of the underlying hedged item, in earnings. Previously, the Company has utilized treasury

rate locks designated as cash flow hedges to lock interest rates in anticipation of debt issuances. The Company had no

derivative instruments outstanding as of January 3, 2015 and December 28, 2013.

Foreign Currency Translation

The assets and liabilities of the Company's Canadian operations are translated into U.S. dollars at current exchange rates,

and revenues, expenses and cash flows are translated at average exchange rates for the fiscal year. Resulting translation

adjustments are reflected as a separate component in the Consolidated Statements of Comprehensive Income. Gains and losses

from foreign currency transactions, which are included in Other income, net, have not been significant for any of the periods

presented.

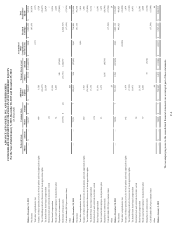

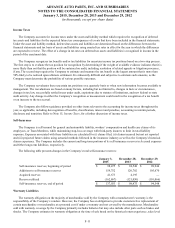

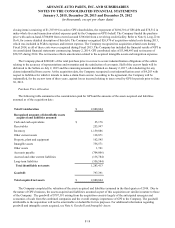

Accumulated Other Comprehensive Income (Loss)

Comprehensive income (loss) is a measure that reports all changes in equity resulting from transactions and other economic

events during the period. The changes in accumulated other comprehensive income refer to revenues, expenses, gains, and

losses that are included in other comprehensive income but excluded from net income.

The Company’s Accumulated other comprehensive income (loss) is comprised of foreign currency translation gains

(losses), the net unrealized gain associated with the Company's postretirement benefit plan and the unamortized portion of the

previously recorded unrecognized gains on interest rate swaps and forward treasury rate locks.