Advance Auto Parts 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-27

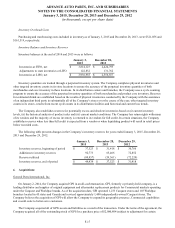

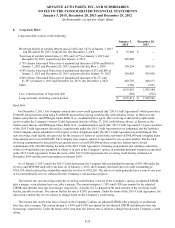

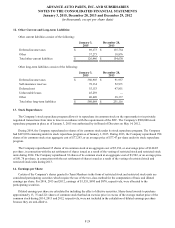

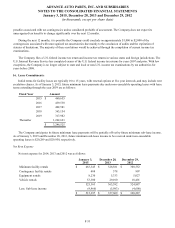

The following table sets forth the Company’s financial liabilities that were measured at fair value on a recurring basis as of

January 3, 2015 and December 28, 2013:

Fair Value Measurements at Reporting Date Using

Level 1 Level 2 Level 3

Fair Value

Quoted Prices in

Active Markets for

Identical Assets

Significant Other

Observable Inputs

Significant

Unobservable

Inputs

As of December 28, 2013:

Contingent consideration related to

business acquisitions $ 9,475 $ — $ — $ 9,475

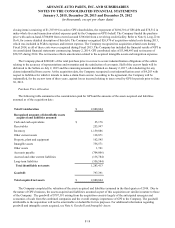

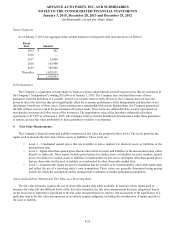

The fair value of the contingent consideration, which was recorded in Accrued expenses as of December 28, 2013, was

based on various estimates including the Company’s estimate of the probability of achieving the targets and the time value of

money. During 2014, the contingent consideration previously recognized at fair value was paid.

The carrying amount of the Company’s cash and cash equivalents, accounts receivable, bank overdrafts, accounts payable,

accrued expenses and the current portion of long term debt approximate their fair values due to the relatively short term nature

of these instruments. The fair value of the Company’s senior unsecured notes was determined using Level 2 inputs based on

quoted market prices and the Company believes that the carrying value of its other long-term debt and certain long-term

liabilities approximate fair value.

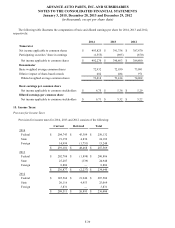

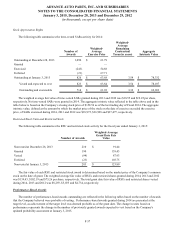

The carrying value and fair value of the Company’s long-term debt, excluding the current portion, as of January 3, 2015

and December 28, 2013, respectively, are as follows:

January 3,

2015

December 28,

2013

Carrying Value $ 1,636,311 $ 1,052,668

Fair Value $ 1,728,000 $ 1,086,000

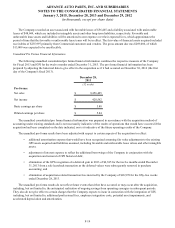

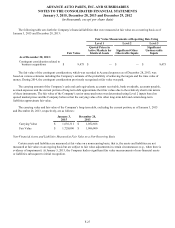

Non-Financial Assets and Liabilities Measured at Fair Value on a Non-Recurring Basis

Certain assets and liabilities are measured at fair value on a nonrecurring basis; that is, the assets and liabilities are not

measured at fair value on an ongoing basis but are subject to fair value adjustments in certain circumstances (e.g., when there is

evidence of impairment). At January 3, 2015, the Company had no significant fair value measurements of non-financial assets

or liabilities subsequent to initial recognition.