Advance Auto Parts 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

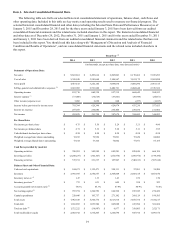

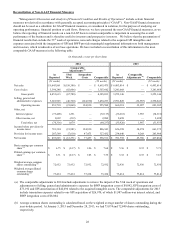

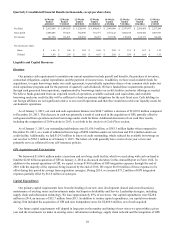

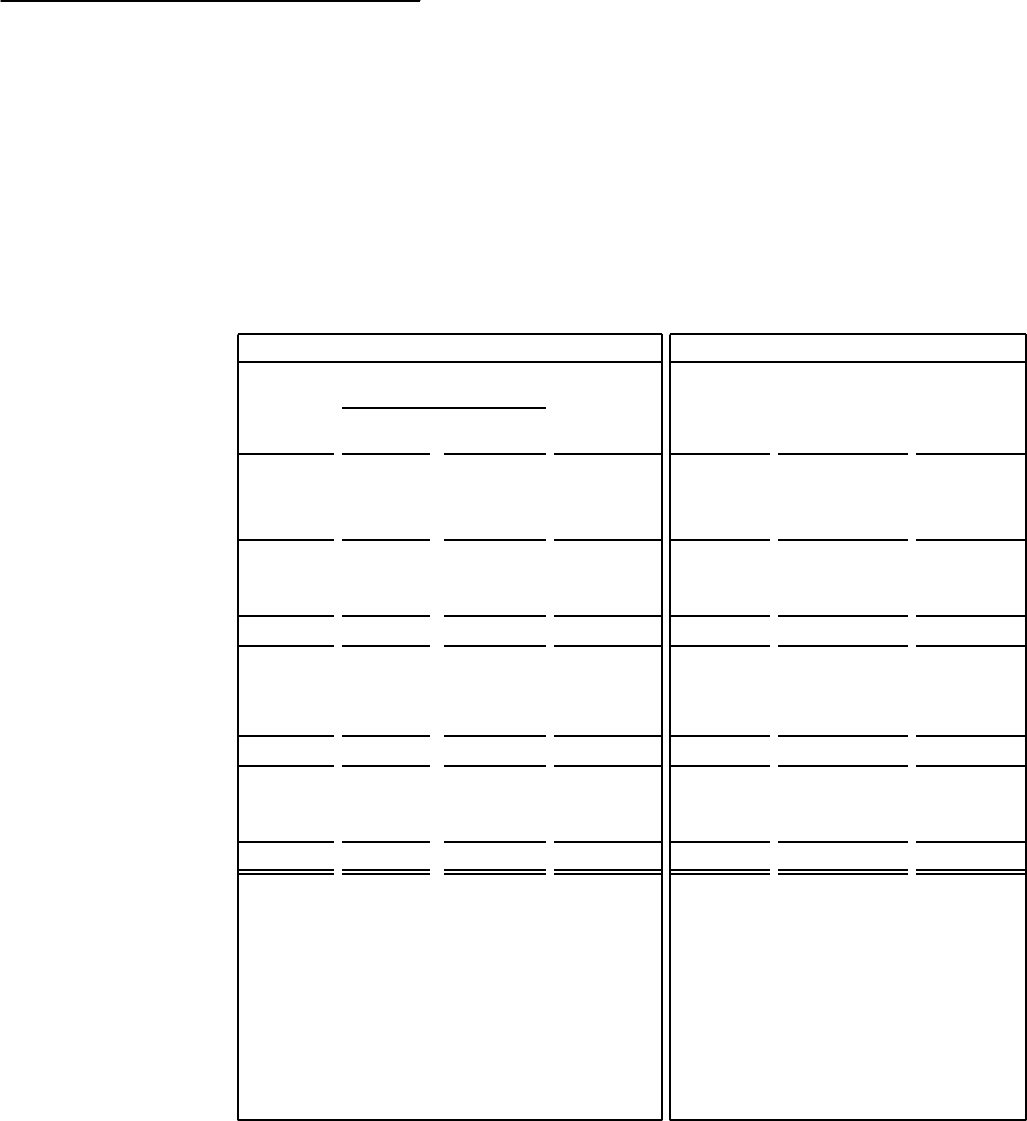

Reconciliation of Non-GAAP Financial Measures

"Management’s Discussion and Analysis of Financial Condition and Results of Operations" include certain financial

measures not derived in accordance with generally accepted accounting principles (“GAAP”). Non-GAAP financial measures

should not be used as a substitute for GAAP financial measures, or considered in isolation, for the purpose of analyzing our

operating performance, financial position or cash flows. However, we have presented the non-GAAP financial measures, as we

believe the reporting of financial results on a non-GAAP basis to remain comparable is important in assessing the overall

performance of the business and is therefore useful to investors and prospective investors. We believe that the presentation of

financial results that exclude the 53rd week of operations, non-cash charges related to the acquired GPI intangibles and

expenses associated with the integration of GPI and BWP provide meaningful supplemental information to both management

and investors, which is indicative of our base operations. We have included a reconciliation of this information to the most

comparable GAAP measures in the following table.

(in thousands, except per share data)

2014 2013

Comparable

Adjustments (a)

As

Reported

53rd

Week

Integration

Costs Comparable

As

Reported

Comparable

Adjustments (a) Comparable

(53 weeks) (52 weeks) (52 weeks) (52 weeks)

Net sales $ 9,843,861 $ (150,386) $ — $ 9,693,475 $ 6,493,814 $ — $ 6,493,814

Cost of sales 5,390,248 (82,606) — 5,307,642 3,241,668 — 3,241,668

Gross profit 4,453,613 (67,780) — 4,385,833 3,252,146 — 3,252,146

Selling, general and

administrative expenses 3,601,903 (46,720) (124,930) 3,430,253 2,591,828 (32,987) 2,558,841

Operating income 851,710 (21,060) 124,930 955,580 660,318 32,987 693,305

Other, net:

Interest expense (73,408) 1,291 — (72,117) (36,618) 1,987 (34,631)

Other income, net 3,092 (212) — 2,880 2,698 — 2,698

Total other, net (70,316) 1,079 — (69,237) (33,920) 1,987 (31,933)

Income before provision for

income taxes 781,394 (19,981) 124,930 886,343 626,398 34,974 661,372

Provision for income taxes 287,569 (7,610) 47,473 327,432 234,640 9,268 243,908

Net income $ 493,825 $ (12,371) $ 77,457 $ 558,911 $ 391,758 $ 25,706 $ 417,464

Basic earnings per common

share (b) $ 6.75 $ (0.17) $ 1.06 $ 7.64 $ 5.36 $ 0.35 $ 5.71

Diluted earnings per common

share (b) $ 6.71 $ (0.17) $ 1.05 $ 7.59 $ 5.32 $ 0.35 $ 5.67

Weighed average common

shares outstanding (b) 72,932 72,932 72,932 72,932 72,930 72,930 72,930

Weighted average diluted

common shares

outstanding (b) 73,414 73,414 73,414 73,414 73,414 73,414 73,414

(a) The comparable adjustments to 2014 include adjustments to remove the impact of the 53rd week of operations and

adjustments to Selling, general and administrative expenses for BWP integration costs of $9,042, GPI integration costs of

$73,192 and GPI amortization of $42,696 related to the acquired intangible assets. The comparable adjustments for 2013

include transaction expenses related to our GPI acquisition of $26,970, of which $1,987 million was interest related, and

BWP integration costs of $8,004.

(b) Average common shares outstanding is calculated based on the weighted average number of shares outstanding during the

year-to-date period. At January 3, 2015 and December 28, 2013, we had 73,074 and 72,840 shares outstanding,

respectively.