Advance Auto Parts 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-10

customer base consists of a large number of small customers, spreading the credit risk across a broad base. The Company also

controls this credit risk through credit approvals, credit limits and accounts receivable and credit monitoring procedures.

The Company’s vendor receivables are established as it receives concessions from its vendors through a variety of

programs and arrangements, including allowances for new stores and warranties, volume purchase rebates and co-operative

advertising. Amounts receivable from vendors also include amounts due to the Company for changeover merchandise and

product returns. The Company regularly reviews vendor receivables for collectibility and assesses the need for a reserve for

uncollectible amounts based on an evaluation of the vendors’ financial positions and corresponding abilities to meet financial

obligations. The Company’s allowance for doubtful accounts related to vendor receivables is not significant.

Inventory

Inventory amounts are stated at the lower of cost or market. The cost of the Company’s merchandise inventory is primarily

determined using the last-in, first-out (“LIFO”) method. Under the LIFO method, the Company’s cost of sales reflects the costs

of the most recently purchased inventories, while the inventory carrying balance represents the costs relating to prices paid in

prior years.

Vendor Incentives

The Company receives incentives in the form of reductions to amounts owed and/or payments from vendors related to

cooperative advertising allowances, volume rebates and other promotional considerations. Many of these incentives are under

long-term agreements in excess of one year, while others are negotiated on an annual basis or less (short-term). Cooperative

advertising allowances provided as a reimbursement of specific, incremental and identifiable costs incurred to promote a

vendor’s products are included as an offset to selling, general and administrative expenses, or SG&A, when the cost is incurred.

Volume rebates and cooperative advertising allowances not meeting the requirements for offset in SG&A are recorded initially

as a reduction to inventory as they are earned based on inventory purchases. These deferred amounts are included as a

reduction to cost of sales as the inventory is sold. Total deferred vendor incentives included as a reduction of Inventory was

$179,785 and $111,304 as of January 3, 2015 and December 28, 2013, respectively.

Similarly, the Company recognizes other promotional incentives earned under long-term agreements not specifically

related to volume of purchases as a reduction to cost of sales. However, these incentives are not deferred as a reduction of

inventory and are recognized based on the cumulative net purchases as a percentage of total estimated net purchases over the

life of the agreement. Short-term incentives (terms less than one year) are generally recognized as a reduction to cost of sales

over the duration of any short-term agreements.

Amounts received or receivable from vendors that are not yet earned are reflected as deferred revenue in the accompanying

consolidated balance sheets. Management’s estimate of the portion of deferred revenue that will be realized within one year of

the balance sheet date has been included in Other current liabilities in the accompanying consolidated balance sheets. Earned

amounts that are receivable from vendors are included in Receivables and Other assets on the accompanying consolidated

balance sheets.

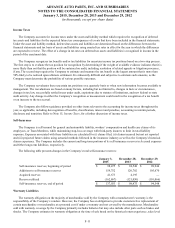

Advertising Costs

The Company expenses advertising costs as incurred. Advertising expense, net of vendor promotional funds, was $96,463,

$69,116 and $83,871 in 2014, 2013 and 2012, respectively. Vendor promotional funds, which reduced advertising expense,

amounted to $21,814 and $18,622 and $11,445 in 2014, 2013 and 2012, respectively.

Preopening Expenses

Preopening expenses, which consist primarily of payroll and occupancy costs related to the opening of new stores, are

expensed as incurred.