Advance Auto Parts 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

In evaluating our income tax positions, we record a reserve when a tax benefit cannot be recognized and measured in

accordance with the authoritative guidance on uncertain tax positions. These tax reserves are adjusted in the period actual

developments give rise to such change. Those developments could be, but are not limited to: settlement of tax audits, expiration

of the statute of limitations, the evolution of tax law, codes, regulations and court cases, along with varying applications of tax

policy and administration within those jurisdictions.

Management is required to make assumptions and apply judgment to estimate exposures associated with our various filing

positions. Although Management believes that the judgments and estimates are reasonable, actual results could differ and we

may be exposed to gains or losses that could be material. To the extent that actual results differ from our estimates, the effective

tax rate in any particular period could be materially affected. Favorable tax developments would be recognized as a reduction in

our effective tax rate in the period of resolution. Unfavorable tax developments would require an increase in our effective tax

rate and a possible use of cash in the period of resolution. A 10% change in the tax reserves at January 3, 2015 would have

affected net income by approximately $1.6 million for the fiscal year ended January 3, 2015.

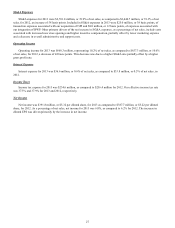

Inventory Reserves

Our inventory reserves consist of reserves for projected losses related to shrink and for potentially excess and obsolete

inventory. An increase to our inventory reserves is recorded as an increase to our cost of sales. Conversely, a decrease to our

inventory reserves is recorded as a decrease to our cost of sales. Our inventory reserves for 2014, 2013 and 2012 were $49.4

million, $37.5 million and $31.4 million, respectively. The increase in our inventory reserves in 2014 was primarily reflective

of the significant growth in our inventory due to the acquisition of GPI. The reported inventory reserves properly exclude any

adjustments made to establish the fair value of GPI's opening inventory balance.

Shrink may occur due to theft, loss or inaccurate records for the receipt of merchandise, among other things. We establish

reserves for estimated store shrink at a point in time based on results of physical inventories conducted by independent third

parties in substantially all our stores and branches over the course of the year, results from other targeted inventory counts in

our stores and historical and current loss trends. In our distribution facilities, we perform cycle counts throughout the year to

measure actual shrink and to estimate reserve requirements. We believe we have sufficient current and historical knowledge to

record reasonable estimates for our shrink reserve and that any differences in our shrink rate in the future would not have a

material impact on our shrink reserve.

Our shrink rate has fluctuated less than 20 basis points over the last two years. Historically, we have not experienced

material adjustments to our shrink reserve. Furthermore, we have consistently completed a similar number of physical

inventories at comparable times throughout the year.

Our inventory consists primarily of parts, batteries, accessories and other products used on vehicles that have reasonably

long shelf lives. Although the risk of obsolescence is minimal, we also consider whether we may have excess inventory based

on our current approach for effectively managing slower moving inventory. We strive to optimize the life cycle of our inventory

to ensure our product availability reflects customer demand. We have return rights with many of our vendors and the majority

of excess inventory is returned to our vendors for full credit. We establish reserves for potentially excess and obsolete

inventories based on (i) current inventory levels, (ii) the historical analysis of product sales and (iii) current market conditions.

In certain situations, we establish reserves when less than full credit is expected from a vendor or when liquidating product will

result in retail prices below recorded costs.

Future changes by vendors in their policies or willingness to accept returns of excess inventory, changes in our inventory

management approach for excess and obsolete inventory or failure by us to effectively manage the life cycle of our inventory

could require us to revise our estimates of required reserves and result in a negative impact on our consolidated statement of

operations. A 10% difference in actual inventory reserves at January 3, 2015 would have affected net income by approximately

$3.1 million for the fiscal year ended January 3, 2015.

Self-Insurance Reserves

We are self-insured for general and automobile liability, workers’ compensation and the health care claims of our Team

Members, although we maintain stop-loss coverage with third-party insurers to limit our total liability exposure. Our self-

insurance reserves for 2014, 2013 and 2012 were $137.0 million, $98.5 million and $94.5 million, respectively. When

excluding $41.7 million of reserves from our acquisition of GPI in 2014, our self-insurance reserves have remained relatively

flat over the last three years due to favorable claims development partially offset by the impact of our continued growth,

including an increase in stores, Team Members and Commercial delivery vehicles.